HLBank Research Highlights

Trading Idea: Inari - Poised to rewrite all time high amid flag breakout

HLInvest

Publish date: Tue, 14 Jul 2015, 11:20 AM

- Brighter days ahead. INARI is on a multi-year expansion driven by strong radio frequency (RF) demand on the back of rising 4G network adoption and exponential mobile data growth.

- We like Inari for its exciting growth prospects, scalability of its business and improving franchise with a strong MNC customer base, Avago. At RM3.47, INARI is trading at 13x FY17E P/E, supported by EPS CAGR of 27% over FY14-17 and a decent 3.1% net dividend yield. Potential re-rating catalysts include: 1. Technological advancement and creation of new electronics applications in wireless communications/ mobility/IoT (M2M) /LTE; 2. Business diversifications into optoelectronics and T&M; 3. Favorable FOREX; and 4. Continuous effective operational strategy.

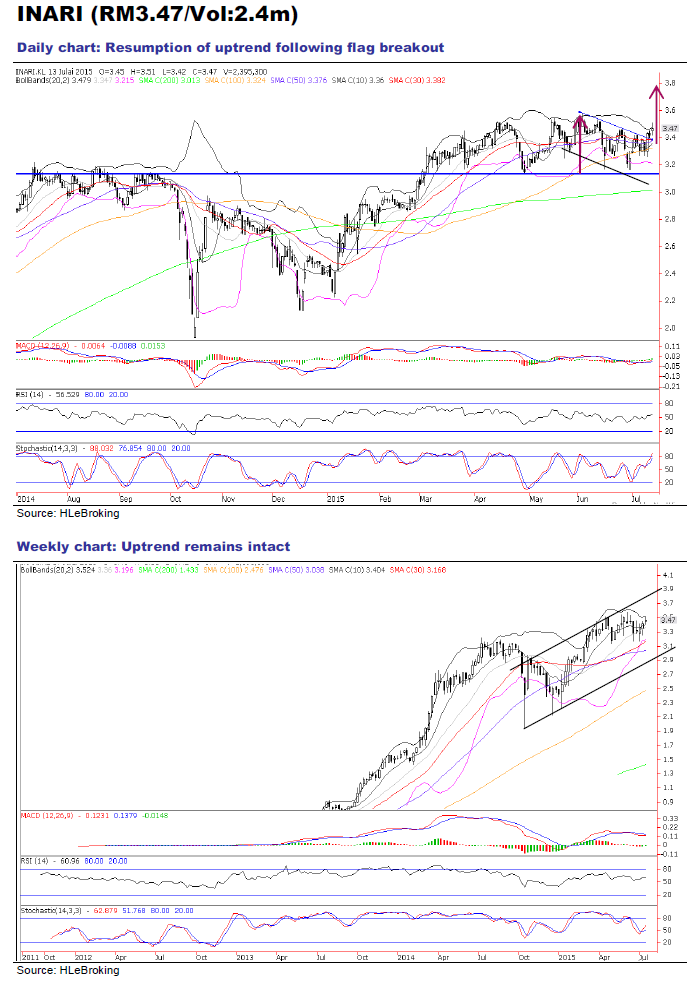

- Poised to rewrite all time high of RM3.58 following a flag breakout. After hitting all time high of RM3.58 on 3 June, share price retraced 11.5% to a low of RM3.17 on 30 June before gradually trending upwards to end at RM3.47 yesterday. Chart-wise, we believe that share prices have formed a continuation bullish “Flag” pattern, supported by bottoming up of grossly oversold daily and weekly oscillators (RSI, Slow Stochastics and MACD).

- Immediate upside target is RM3.58. A decisive breakout above RM3.58 will spur prices higher to RM3.82 (flag breakout objective) and our long term target price at RM3.90 (upper channel in weekly chart). Immediate supports are located at RM3.38 (50-d SMA) and RM3.22 (daily lower Bollinger band). Cut loss at RM3.16.

- A better trading exposure is through INARI-WB (Expiry: 17 Feb 2020; Premium: -1.2%; gearing: 2.43x; 1-month average volume: 1.39m) compared with INARI-WA (Expiry: 6 Apr 2018; Premium: -1.5%; gearing: 1.12x; 1-month average volume: 10k), as INARI-WB has a longer expiry and liquidity coupled with higher gearing.

Source: Hong Leong Investment Bank Research - 14 Jul 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-31

INARI2024-07-31

INARI2024-07-31

INARI2024-07-31

INARI2024-07-30

INARI2024-07-30

INARI2024-07-30

INARI2024-07-30

INARI2024-07-30

INARI2024-07-30

INARI2024-07-29

INARI2024-07-29

INARI2024-07-29

INARI2024-07-26

INARI2024-07-26

INARI2024-07-26

INARI2024-07-26

INARI2024-07-26

INARI2024-07-25

INARI2024-07-25

INARI2024-07-25

INARI2024-07-24

INARI2024-07-24

INARI2024-07-23

INARI2024-07-23

INARI2024-07-22

INARI2024-07-22

INARI2024-07-22

INARI2024-07-22

INARIMore articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments