HLBank Research Highlights

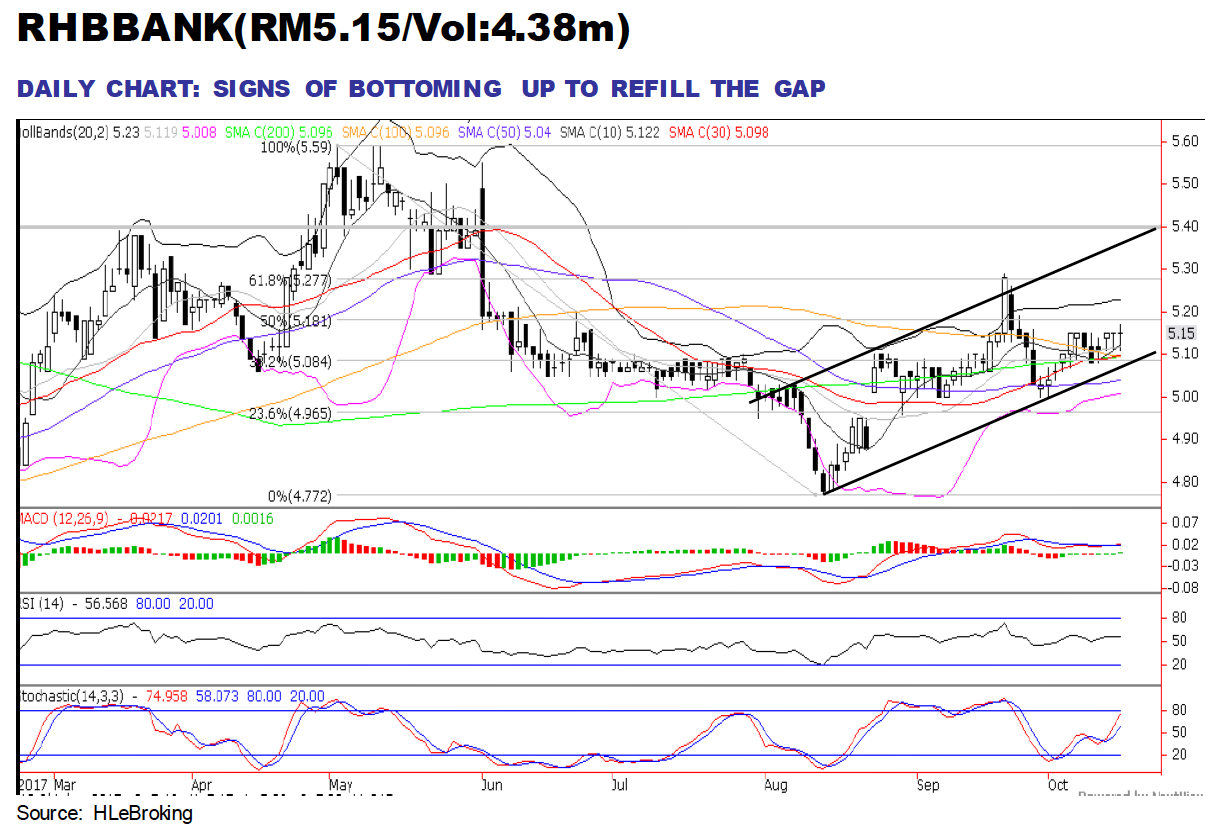

Trading idea: RHBBANK: Cheap valuations anchored by a strong earnings CAGR of 14% for FY17-19; Signs of bottoming up

HLInvest

Publish date: Tue, 17 Oct 2017, 12:32 PM

- Values resurface after recent selldown. RHBBANK’s share price rose to 52-week high of RM5.59 (3 May) amid rumours of merger talks between RHBBANK (HLIB institutional TP: RM5.50) and AMBANK to create the 4th largest banking group in Malaysia. However, after the termination of RHBBANK-AMBANK merger talks amid disagreement in reaching pricing and synergies, the stock tumbled to a low of RM4.77 (11 Aug) before staging a technical rebound to close at RM5.15 yesterday.

- Currently, we see attractive proposition in RHBBANK due to its compelling valuations at 0.95 P/BV (31% lower than peers’ 1.37x P/B) and 9x FY18 P/E (24% discount against its peers’ 11.8x), supported by a strong 14% earnings CAGR for FY17-19.

- The next banking M&A leader? Despite the scrapped deal, RHBBANK continues to ride on business recovery and will pursue organically the benefits from the implementation of its IGNITE 17 transformation program. Should the asset quality issue is addressed in upcoming 3Q17 results, it may represent a re-rating catalyst for RHB.

- In addition, given the strong backing from EPF (~41%), we do not discount the possibility that RHBBANK to emerge again as an anchor in the next wave of banking M&A to enlarge market dominance. Moreover, current valuations for Malaysian banks are below their average book value, making M&A attractive for now than ever.

- Signs of bottoming up. The stock has been gyrating within its upward channel. The recent bounce near the 38.2% FR (RM5.08) as well as the lower-channel line from RM4.77 could potentially suggest that the stock could stage a follow-through rally towards RM5.29 (21 Sep high) and its upper-channel line at RM5.40. Once this pattern ends, we expect prices to breakout to the upside above to retest 52-week high at RM5.59. On the flip side, failure to hold near RM5.08 levels may weaken share prices lower towards RM4.96 (23.6% FR). Cut loss at RM4.93.

Source: Hong Leong Investment Bank Research - 17 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments