HLBank Research Highlights

Trading idea: KGB: Riding on the strong semicon capex wave; Poised for a positive triangle breakout

HLInvest

Publish date: Mon, 23 Oct 2017, 06:28 PM

- A leading Ultra-High Purity (UHP) Gas and Chemical Delivery Solutions Provider. KGB is an integrated engineering solutions provider specializing in ultra-high purity (UHP) gas and chemical delivery systems, mechanical process engineering, mechanical systems and electrical systems. The Group provides end-to-end engineering solutions ranging from system design to fabrication and installation of equipment to testing and maintenance. As at end June, the group outstanding orderbook stood at RM205m.

- Established since 2000, KGB serves customers in the high technology industry across different sectors such as Industrial Gases, Wafer Fabrication, Solar Energy, TFT-LCT, Bioscience and LED. KGB has also expanded its industry focus to include the F&B, pharmaceutical, healthcare and the O&G sectors. As at 1HFY17, Malaysia contributed 50% to the revenue, followed by China (17.5%), Singapore (14.1%), Taiwan (13.8%) and others (4.6%). In terms of product segments, the UHP contributed 44% to revenue, followed by general contracting (40%), process engineering (16%) and industrial gas (0.3%). Over the longer term, the newly established Industrial Gases division is set to improve further in FY18 (likely to contribute ~1% to revenue), given the recently secured long-term 10-year contract with a major photovoltaic manufacturer.

-

Strong semiconductor spending. KGB aims to capture a share of the growing semiconductor capex spending, especially in Taiwan and China, who are amongst the top three largest spending countries on fab equipment. According to the SEMI, global capex spending in the semiconductor industry for fab construction and fab equipment is expected to hit a record high of USD57bn in 2017 and USD64bn in 2018. A large part of that growth is expected to come from China’s anticipated increase in its overall fab spending (construction and equipment together) by 54% in 2017 and 60% in 2018.

-

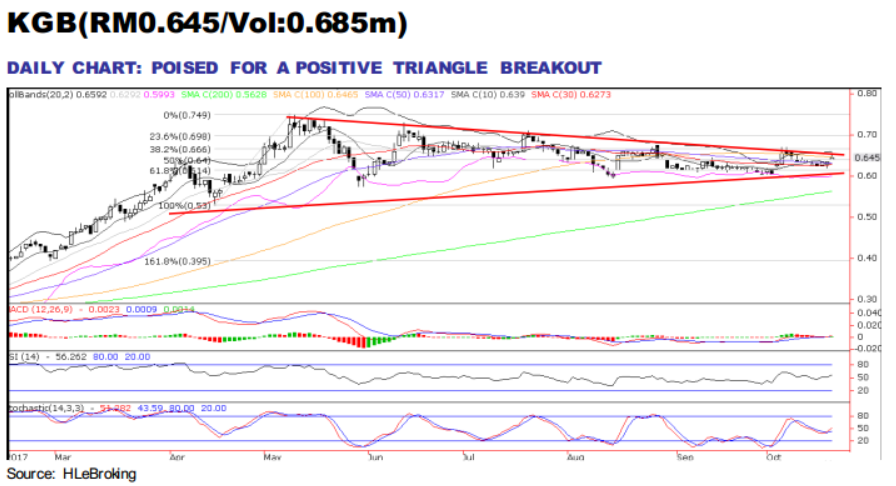

Poised for a positive triangle breakout. Ex-cash of 9.1sen, KGB is currently trading at 14.6x FY16 P/E (in line with 5-year average 17x). The stock has retraced from 52-week high of RM0.75 (11 May) to a low of RM0.575 (30 May) before consolidating upwards to end at RM0.645 last Friday. We believe the stock is ripe for a triangle breakout (daily chart) and flag breakout (weekly chart) soon, as indicators are hooking up.

- A decisive breach above RM0.665 (downtrend line) is likely to spur prices higher towards RM0.70 (23.6% FR) and our long term objective of RM0.75. Key supports are RM0.63 (50-d SMA) and 0.61 (uptrend line). Cut loss at RM0.595.

Source: Hong Leong Investment Bank Research - 23 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments