HLBank Research Highlights

Trading Idea: DRBHCOM – Rerating on the cards; A positive triangle breakout

HLInvest

Publish date: Thu, 09 Nov 2017, 09:19 AM

- Reaping the synergy. The recent conclusion of FSP agreement with Geely as Proton’s new strategic partner (and disposal of Lotus) coupled with the appointment of Li Chunrong as Proton’s new CEO (a veteran in the automotive industry with 30 years of experience working with major international brands including Honda, Kia, Dongfeng and Geely), marked a significant milestone for DRBHCOM for its earnings turnaround, after being dragged by Proton (including Lotus) since its acquisition back in 2012. Moreover, the successful injection of KLAS into POS since Oct 2016 has seen DRBHCOM consolidating POS positive earnings. POS is expected to leverage on the booming e-commerce in Malaysia, given Alibaba’s setting up of regional hub in KLIA.

- Pending a bullish downtrend line breakout. Despite the weak near term earnings outlook on the back of challenging business conditions for Proton, we opine that the market continues to unjustifiably ignore the value of other profitable businesses and assets embedded within DRBHCOM. HLIB institutional research maintains a BUY rating for DRBHCOM with TP of RM2.15, based on holding company discount rate of 30% to SOP.

- Overall, we see Proton-related risk factors gradually diminishing, and with support from Geely, DRBHCOM now has a realistic chance of reclaiming past glories, reaping the competitive products and technologies, advanced production and manufacturing techniques, raise product quality, as well as expediting its route into growing ASEAN markets.

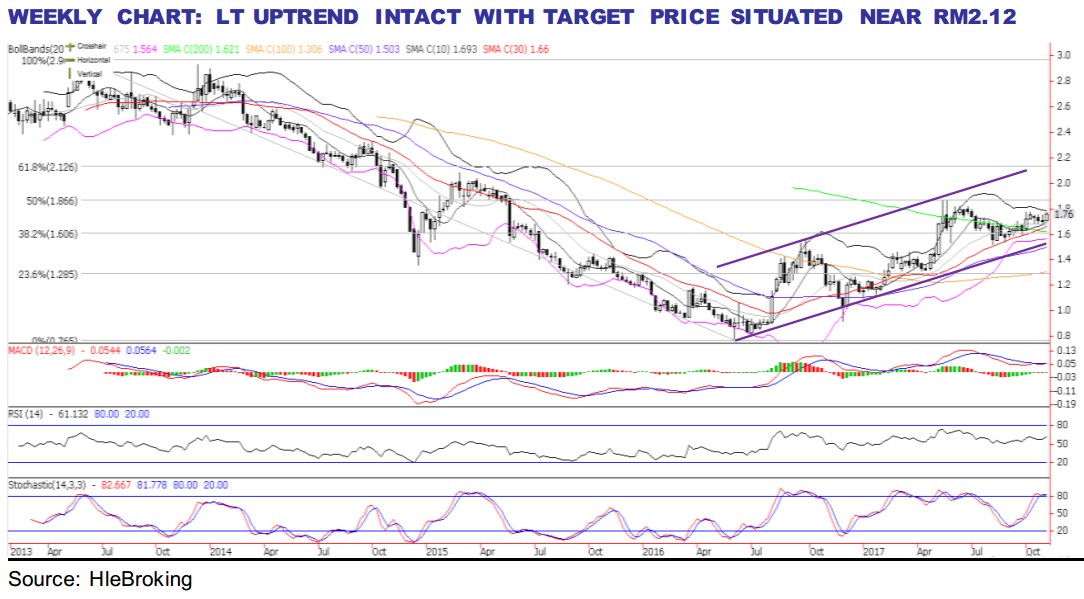

- Ripe for picking. Share prices have been trending sideways since Oct but yesterday’s triangle formations breakout, accompanied by high volume of 3.94m (1.9x higher than 1M average of 2.06m) could potentially kick start a new upswing soon, supported by positive daily and weekly technicals.

- A successful breakout above immediate neckline resistance of RM1.77 (10 & 11 Oct high) will lift prices higher towards 52-week high of RM1.86 (25 May high) and RM2.00 psychological barrier, before our LT objective at RM2.12 (61.8% FR). On the flip side, key supports are situated at RM1.72 (20-d SMA) and RM1.66 (support trendline). However, failure to hold near RM1.66 levels may weaken share prices lower towards RM1.55-1.60 zones. Cut loss at RM1.63.

Source: Hong Leong Investment Bank Research - 9 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments