HLBank Research Highlights

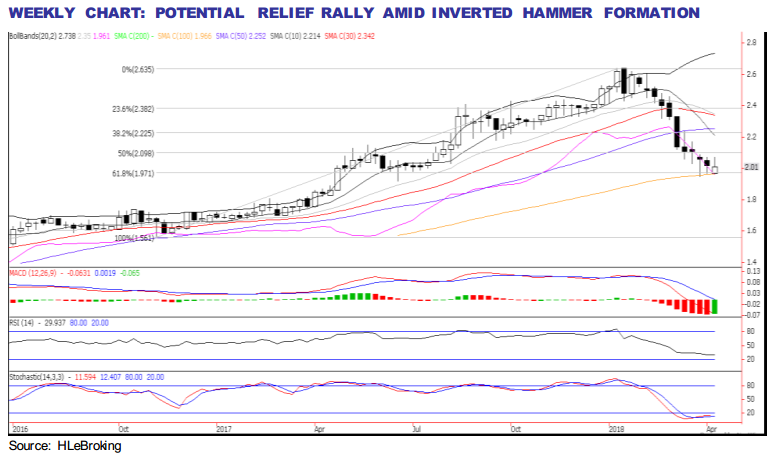

Trading idea: SUNCON – Strong and steady wins the race; Steeply oversold with potential relief rally target at RM2.13-2.28 zones

HLInvest

Publish date: Tue, 10 Apr 2018, 09:59 AM

- HLIB Research has a BUY rating on SUNCON with target price of RM2.85 (based on a 19.2x FY19 EPS), or 41.8% upside. Suncon offers integrated construction services and has precast concrete business in Singapore. The group is an integrated construction player with commendable execution capability, putting it in a prime spot to ride on the robust construction upcycle.

- Record high orderbook. For FY18, Suncon managed to secure RM730m contract YTD and should be on track to meet its target of RM2- 2.5bn. With the strong job wins, Suncon’s orderbook now stands over RM6.7bn, implying a strong cover of over 3x on FY17 revenue.

- Valuation is undemanding at 13.5x FY19 P/E (16% and 5% lower than IJM and Gamuda), supported by its superior ROE of 28% which is more than double of its peer’s average as well as recurring orders from its parent company and key GLC clients. Ex-cash of 27sen/share, valuation is even more compelling at 11.7x.

- Poised for potential relief rally. In wake of a “risk off” selldown on the small caps, construction and property stocks due to Trump’s tariff tantrums and the impending GE14, Suncon’s share prices slid 23.9% from all-time high of RM2.64 (15 Jan) to end at RM2.01 (-19.9% YTD) yesterday. However, we see potential downtrend reversal owing to the inverted hammer formation (weekly chart), supported by its strong earnings CAGR of 18% and undemanding valuation. Key supports are RM1.95 (29 Mar low) and RM1. 90 zones. A successful breakout above RM2.10 (50% FR) will spur prices higher towards RM2.22 (50% FR) before reaching our LT target at RM2.38 (23.6% FR). Failure to hold near RM1.90 may weaken share prices lower towards RM1. 82 (76.4% FR) levels. Cut loss at RM1.88.

Source: Hong Leong Investment Bank Research - 10 Apr 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-30

SUNCON2024-07-30

SUNCON2024-07-30

SUNCON2024-07-30

SUNCON2024-07-30

SUNCON2024-07-30

SUNCON2024-07-29

SUNCON2024-07-29

SUNCON2024-07-29

SUNCON2024-07-26

SUNCON2024-07-26

SUNCON2024-07-25

SUNCON2024-07-24

SUNCON2024-07-24

SUNCON2024-07-24

SUNCON2024-07-23

SUNCON2024-07-23

SUNCON2024-07-23

SUNCON2024-07-23

SUNCON2024-07-23

SUNCON2024-07-23

SUNCON2024-07-22

SUNCON2024-07-22

SUNCON2024-07-22

SUNCON2024-07-22

SUNCON2024-07-22

SUNCON2024-07-22

SUNCON2024-07-22

SUNCONMore articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments