West Texas Intermediate - Cautious Ahead of OPEC Meeting; Extended Consolidation

HLInvest

Publish date: Tue, 19 Jun 2018, 05:00 PM

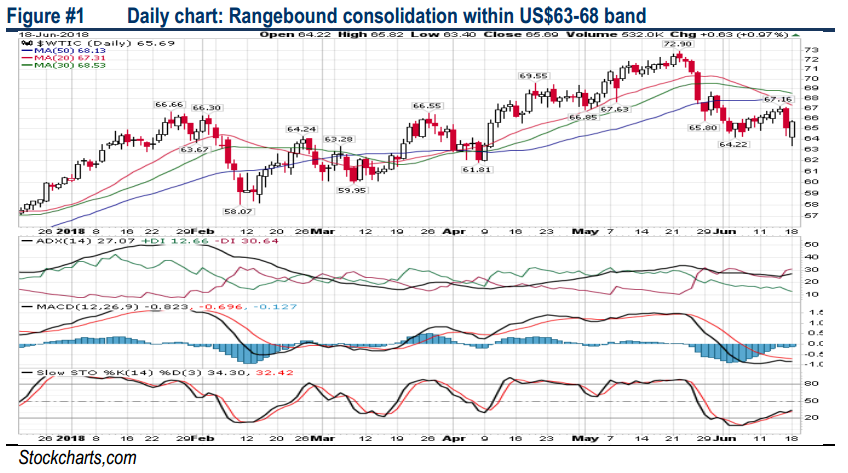

After sliding 12.9% from 2-year high of USD72.8 to a low of USD63.4 amid growing concerns over higher OPEC crude production, escalating trade wars and rising inventories. Volatility will prevail until more clarity post OPEC meeting on 22 June. Technically, the negatives are likely to be priced in and prices are likely to remain rangebound within USD63-68.5 band in the near term.

WTI rebounded 3.6% from 2-month low at USD63.4. Following a slump from US$72.8 to intraday low of US$63.4 (18 June), WTI staged a 1.3% technical rebound to US$65.7 ahead of the OPEC meeting as traders cheered news that the OPEC might consider an output hike (500k-600k bpd) well below the consensus targets of 1.0-1.5m bpd uptick in production.

All eyes on OPEC meeting on 22 June. The OPEC and non-OPEC producers led by Russia have been curbing output by about 1.8m barrels per day (bpd) since Jan 2017 (set to expire end 2018) to prop up oil prices and reduce high global oil stocks. Prior to the OPEC meeting on 22 June, concerns that Saudi Arabia and Russia could boost output (as much as 1m-1.5m bpd) to meet the shortfall in supply from Iran and Venezuela. Overall, sentiment remains cautious ahead of the outcome as OPEC attempts to placate opposing demands from its members and Russia. Saudi and Russia favours an output hike, while other OPEC members including Iraq and Iran believe production should be maintained as oil prices still need to be supported to alleviate fears of a significant slowdown in rebalancing in oil markets, given the recent fears of escalating trade wars may further trigger global economic slowdown.

Escalating trade spats further dampen sentiment. Besides uncertainty on the production output, WTI prices were trading south bound following heightened U.S.- China trade tensions as Trump imposed a series of tariffs with most of its major trading partners, including China. U.S. President Donald Trump last week pushed ahead with hefty tariffs on US$50bn of Chinese imports, starting on 6 July 6. Subsequently, China (the biggest buyer of US crude oil) said it would retaliate by slapping duties on American export products, including crude oil.

Must Swiftly Reclaim Support Trendline Near US$68 to Arrest Further Downturn. After registering a three black crows since hitting a 2-year high of US72.8 on 22 May, WTI slid to a low of US$63.4 on 18 June before ending at US$65.3. Technically, there are mild signs of bottoming up in the daily chart, supported by the formation of positive white candlestick.

On the upside, a successful assault above US$67.2 (14 June) will lift prices higher towards US68.5-70.5 levels. Failure to defend US$63.4 will witness further selldown towards US$61.8 (8 Apr low).

Source: Hong Leong Investment Bank Research - 19 Jun 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024