Traders Brief - KLCI Could be Due for Technical Rebound

HLInvest

Publish date: Wed, 27 Jun 2018, 11:24 AM

MARKET REVIEW

Tracking the negative performances on overnight Wall Street led by technology stocks due to escalating trade worries has led most of the key regional benchmark indices lower. However, the selling pressure was fairly muted as most of the key indices managed to close off sessions’ lows. The Hang Seng Index and Shanghai Composite Index declined 0.28% and 0.51%, respectively, while Nikkei 225 rose marginally by 0.02%.

On the local front, the FBM KLCI extended the decline move, closing 0.13% lower to 1,675.86 pts. Market breadth remained negative with 547 decliners vs 264 gainers, accompanied by overall trade volumes of 1.88bn, worth RM1.93bn. Nevertheless, selected consumer and export-oriented stocks such as Dutch Lady (+1.3%), Nestle (+0.3%), Kossan (+1.1%) and PIE (+6.2%) managed to trend higher.

Wall Street rebounded mildly led by technology and energy shares after a sharp dive on Monday. However, investors remained cautious in their trading activities amid prolong trade worries. The Dow and S&P500 rose 0.12% and 0.22%, respectively.

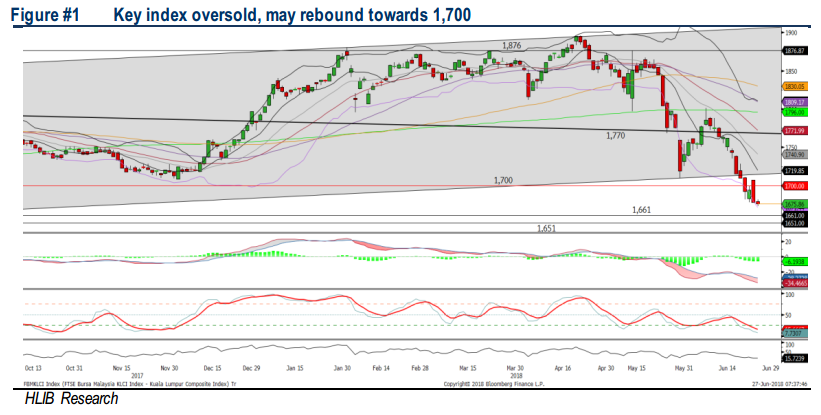

TECHNICAL OUTLOOK: KLCI

The FBM KLCI stayed negative yesterday and the MACD indicator remained in the negative territory. However, the RSI and Stochastic oscillators are suggesting that the key index is oversold. We believe the key index may be due for a technical rebound, with the upside capped along 1,707-1,725. Meanwhile, support will be located around 1,651-1,666.

We believe that stocks on the local front could be grossly oversold and may perform a technical rebound over the near term, in line with the 1H18 window dressing activities. Meanwhile, we believe the downside risk may persist with the ongoing trade spats between US and its trading partners.

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded mildly, but is hovering near the SMA200 level. The MACD Indicator continues to trend lower, but both the RSI and Stochastic oscillators are oversold. We may anticipate that the Dow could be due for a technical rebound, to retest the 24,500 level. On the flip side, should the Dow violate below the psychological level of 24,000, next support will be located around 23,500.

Despite the mild rebound on Wall Street, investors are likely to stay on the sidelines as the trade spats episode between the US and its trading partners remain a concern. Although traders may take a cautious stance over the near term on broader market, we opine that energy shares should be actively traded as WTI crude oil prices have surged above US$70 level.

Source: Hong Leong Investment Bank Research - 27 Jun 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024