Traders Brief - Milder foreign outflows to support the rebound

HLInvest

Publish date: Thu, 05 Jul 2018, 10:03 AM

MARKET REVIEW

Asian stock markets trended in the negative territory with the ongoing trade tensions and investors stayed cautious ahead of Friday, where Trump’s administration will be imposing the 25% tariffs on US$34bn China products. Also, a Chinese court has banned Micron from selling chip products in China, which has dampened the tech sentiment. The Nikkei 225 fell 0.31%, while Hang Seng Index and Shanghai Composite Index declined 1.06% and 0.94%, respectively.

Meanwhile, stocks on the local bourse bucked the regional indices and sentiment was recovering with FBM KLCI rising 0.83% to 1,688.56 pts. Market breadth turned positive as advancers led decliners by a ratio of 5-to-3. Market volumes stood at 2.04bn (worth RM1.63bn). Also, the broad recovery was noted in selected oversold sectors such as construction and industrial products.

European stocks closed mostly lower led by technology stocks after US Micron was banned selling chips in China late Tuesday, the intensified trade friction has led to a selloff in global tech shares. The FTSE 100 and DAX index fell 0.27% and 0.26%, respectively, while CAC Index rose marginally by 0.07%. Meanwhile, Wall Street was closed for the Independence Day holiday.

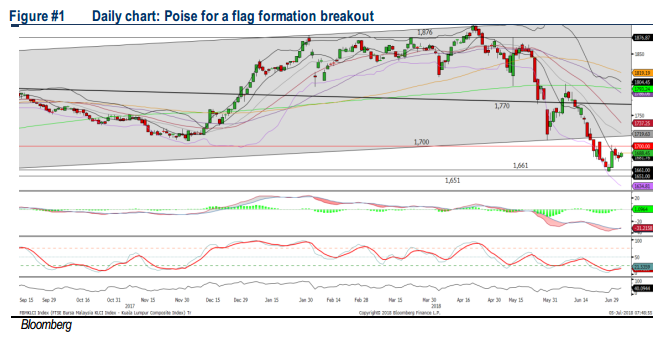

TECHNICAL OUTLOOK: KLCI

After the technical rebound from the recent low of 1,657.78 pts on 28th Jun, the FBM KLCI managed to trend sideways over the past three trading days, forming a flag formation. The MACD Indicator has issued a “buy” signal, while the RSI and Stochastic oscillators are recovering from the oversold position. The upside resistance will be pegged around 1,700- 1,725. Meanwhile, the support will be located around 1,640-1,650.

On the local front, we think the recovery in broader market is likely to sustain as most of the oversold sectors are showing signs of rebound. Also, we have noticed milder foreign outflows over the past two trading days, which is a healthy sign for supporting the recovering trend.

TECHNICAL OUTLOOK: DOW JONES

The Dow could be due for technical rebound as the key index is hovering near the immediate support of 24,000 and the upward trendline as well as the oversold signal on Stochastic oscillators. The resistance will be envisaged around 24,500, while the support will be anchored around 24,000, followed by 23,500.

In the US, traders are likely to maintain its cautious trading tone amid the prolong trade spats episode. Nevertheless, we believe that the recent trade development could have priced into the stock markets and remain cautiously optimistic on the overall market sentiment that the oversold Dow could be due for a technical rebound over the near term.

Source: Hong Leong Investment Bank Research - 5 Jul 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024