Traders Brief - Steadier Move in Market, Rebound in Store

HLInvest

Publish date: Fri, 06 Jul 2018, 09:16 AM

MARKET REVIEW

Key regional benchmark indices closed mostly lower as investors were cautious ahead of the first wave of tariffs that will be taking effect. To recap, Trump administration has imposed a 25% tariff on USD34bn on Chinese goods. The Nikkei 225 and Shanghai Composite Index declined 0.78% and 0.91% respectively, while Hang Seng Index fell 0.21%.

Trading sentiment on the local front is mixed as the FBM KLCI was fluctuating between the positive and negative region throughout the session; the key index rose marginally higher by 0.13% to end at 1,690.65 pts. Market breadth, however was slightly negative with 452 losers vs 405 gainers. Meanwhile, market volume stood at 2.17bn and total market value was RM1.45bn as traders was focusing on penny stocks and warrants.

Despite the Fed’s signal to end monetary stimulation and concern over the impact of tariffs on business investments and economic growth, Wall Street managed to rebound positively stimulated by an offer from the US to withhold imposing tax on car imports from European Union if the EU eliminates its duties. The Dow and S&P500 rose 0.75% and 0.86%, respectively on Thursday.

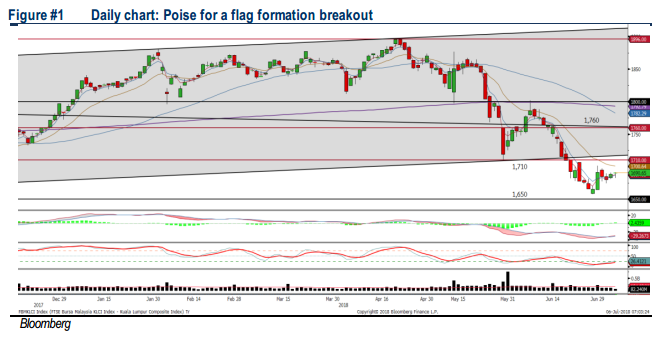

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has extended its sideways move for another session on a positive bias move. The MACD Indicator continues to recover below zero, while RSI and Stochastic oscillators are moving nearer towards 50. Hence, we believe the recent technical rebound on FBM KLCI may extend further towards 1,700-1,725, support will be located around 1,640-1,650.

We opine that the downside on our local market is limited and could be due for a good rebound as foreign selling activities have dwindled over the past few trading days. Also, with the softer tone from Trump’s administration on the trade spats, we believe most of the negative factors have already been priced in, at least for the near term.

TECHNICAL OUTLOOK: DOW JONES

Although the Dow is threading marginally below the SMA200, it is hovering within the symmetrical triangle, supported by the uptrend line. The MACD Histogram is recovering, while the Stochastic is oversold. We think the Dow may set for a rebound towards 24,500, while the support will be anchored around 24,000, followed by 23,500.

In view of the fading tension of the trade spat between US-China, we believe more upside could be noticed on Wall Street, especially on the tech-heavy Nasdaq index. Nevertheless, should any negative news on trade tension resurfaces, it may dampen the global sentiment.

TECHNICAL TRACKER: CLOSED POSITION

Yesterday, we had squared off our Technical Tracker stock pick, TM at RM3.56 or R2 (+14.5% gain).

Source: Hong Leong Investment Bank Research - 6 Jul 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024