Rohas Tecnic Bhd - Anticipate a strong FY17-20 EPS CAGR of 21%; Potential downtrend reversal amid hammer pattern

HLInvest

Publish date: Mon, 16 Jul 2018, 09:42 AM

As the existing core business are not affected by change in government, we believe ROHAS’s rout (-24% YTD and 28% off historical peak on 9 Jan) as overdone. Besides, values emerge amid undemanding 9.6x FY19 P/E (26% lower than 1Y historical P/E of 13x), supported by a strong EPCC orderbook of RM680m and 21% EPS CAGR for FY17-20, riding on the tower boom and infrastructure heat in the ASEAN region. Potential downtrend reversal amid hammer formation.

50% of orderbook replenishment target in hand. Rohas’ recent 2nd EPCC job win of RM38m on 9 July brought the YTD sum to ~RM290m and a total EPCC orderbook of ~RM680m (translated to a healthy cover of 5.2x on FY17 EPCC revenue). This is expected to provide a strong boost to Rohas' earnings growth for the next two years. The company is targeting for orderbook replenishment of RM500m this year with bulk of the new jobs from Bangladesh as HGPT is one of the top three EPCC companies in the country's power transmission sector.

Opportunities mushrooming within ASEAN region. We like Rohas for its exposure to ASEAN, which is one of the fastest growing economic regions in the world. Infrastructure investment needs are expected to be robust in the foreseeable future and this will generate steady demand for its products. HLIB institutional research pegged a RM1.74 TP, providing another 46% upside.

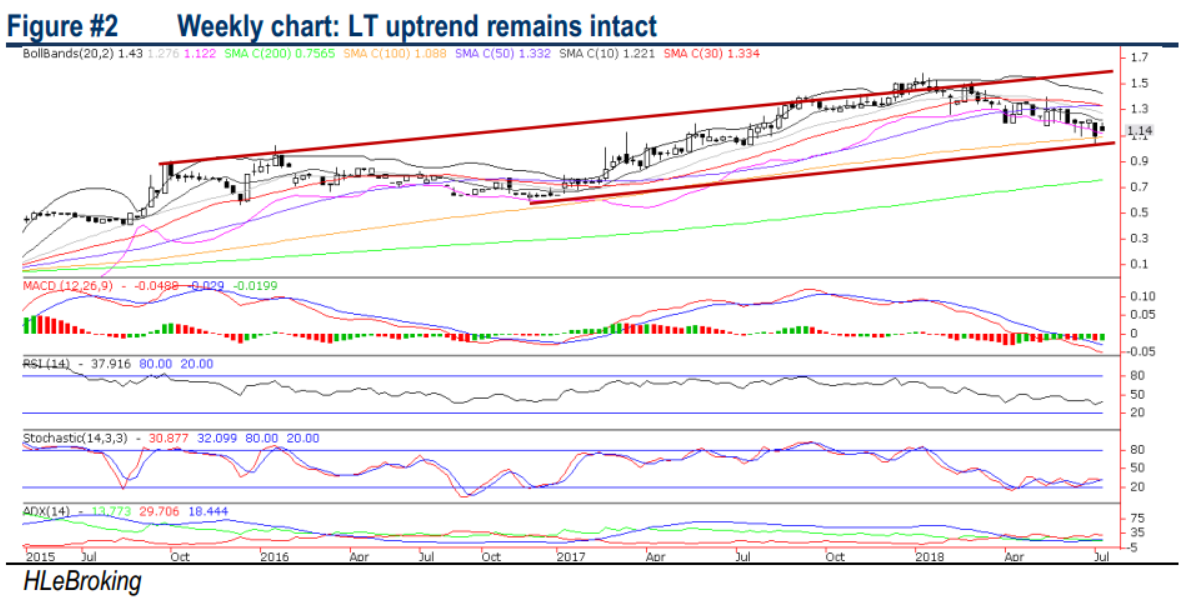

Potential downtrend reversal amid hammer pattern. After a 41% slump in share prices from historical high of RM1.58 (9 Jan) to a low of RM1.02 (6 July), ROHAS has formed a hammer pattern on 6 July before closing at RM1.14 on 13 July. We see limited downside risks with a floor near RM1.09 (100W-SMA) and RM1.03 (weekly support trendline), supported by bottoming up indicators and its strong fundamental prospects. On the flip side, a successful breakout above RM1.21 (downtrend resistance) will spur prices higher towards RM1.30 (50% FR) before reaching our LT target at RM1.45 (76.4% FR). Cut loss at RM1.02.

Source: Hong Leong Investment Bank Research - 16 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024