Traders Brief - FBM KLCI to Stay Firm Amid Positive Wall Street

HLInvest

Publish date: Wed, 18 Jul 2018, 09:07 AM

MARKET REVIEW

Asian stock markets (exclude Japan Nikkei 235: +0.44%) were broadly lower amid the sell down in energy shares following the overnight crude oil price tumble; the Hang Seng Index and Shanghai Composite Index declined 1.25% and 0.55%, respectively.

Stocks on the local bourse were generally more positive towards the end, despite a lackluster start after the opening bell. The FBM KLCI was pushed higher by 0.61% near the end of the trading session led by banking heavyweights. Market breadth was positive with 473 gainers vs 376 losers, accompanied by overall trading volumes of 2.34bn (worth RM2.14bn). Selected stocks within the FBM ACE index were positive; MPAY, KRONO and AEMULUS added 4 sen, 2 sen and 1 sen, respectively.

Although Wall Street started in the negative territory, sentiments managed to turn positive led by technology stocks such as Amazon (charged towards fresh highs) and Netflix; the latter managed to pare down losses after announcing weaker-than-expected earnings. The Dow gained 0.22%, while S&P500 and Nasdaq rose 0.40% and 0.63%, respectively.

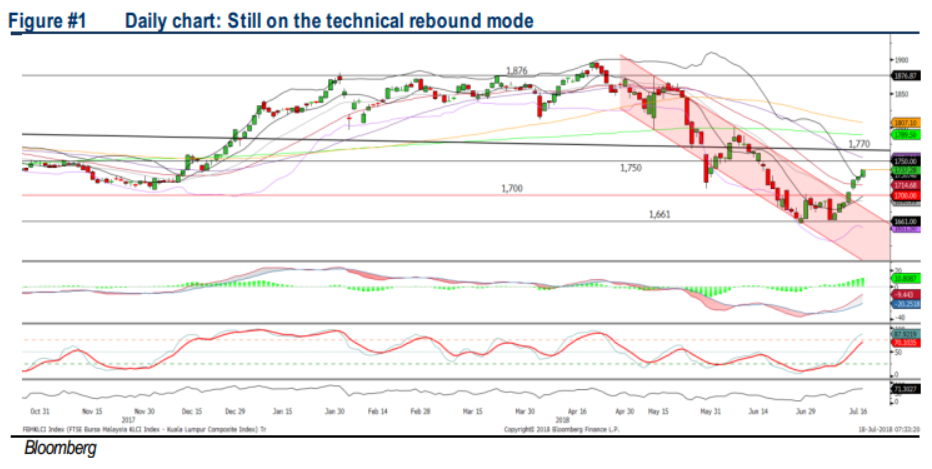

TECHNICAL OUTLOOK: KLCI

The FBM KLCI managed to rebound for another day, marking the 7th day of winning streak. The MACD Indicator is approaching zero, but both the RSI and Stochastic oscillators are nearing the overbought region. We believe the key index may be capped along 1,740-1,750 resistance, while the support will be located around 1,700-1,720.

Tracking the positive tone on Wall Street, we may expect the FBM KLCI to trend mildly higher towards the resistance zone of 1,740-1,750. Meanwhile, selected sector such as construction and technology could also see further trading activities with cautiously optimistic view on construction mega projects after the LRT3 newsflow last week and the weaker ringgit outlook, respectively.

TECHNICAL OUTLOOK: DOW JONES

The Dow has experienced a symmetrical triangle breakout yesterday and the MACD Line is hovering above zero; suggesting that the uptrend is intact. However, the Stochastic is overbought. Hence, the Dow may revisit 25,500 and could face with selling pressure along the resistance level. Meanwhile, the support will be pegged around 24,500-25,000.

In the US, we believe the uptrend move above the 25,000 may sustain as the Fed chairman remained optimistic on the economy outlook as the unemployment rate is trending lower and market participants are expecting another two rate hike in 2018. Nevertheless, trading tone in the US will depend on the on-going reporting season and trade development newsflow that may surface over the near term.

Source: Hong Leong Investment Bank Research - 18 Jul 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024