WTI - Positive Bias Amid Declining US Inventory and Potential Supply Disruptions From Iran’s Sanction

HLInvest

Publish date: Thu, 23 Aug 2018, 09:17 AM

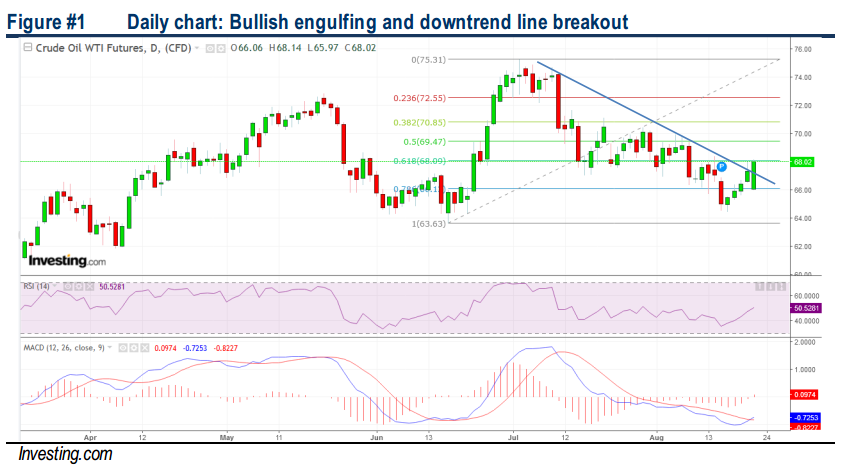

After tumbling 14.5% from 44M high of USD75.3 (3 July) to a low of USD64.4 (16 Aug) amid concerns over higher OPEC crude production by end 2018, an easing greenback, sliding US crude stockpiles and potential supply disruptions from Iran’s sanction saw prices recovered towards US$68 levels. Upside bias towards USD70-72 zones amid bullish downtrend line breakout.

WTI rallied over 3% after big drop in US stockpiles. Oil prices surged more than 3% overnight after the US Energy Information Administration (EIA) showed a larger than-anticipated drop in crude inventories as the nation's imports fell and refineries continued to run near full capacity. Crude oil also found support amid the recent decline in dollar, in response to US President Trump's comment that he was "not thrilled" by the Federal Reserve's interest rate increases. Meanwhile, the prospect of a drop in oil exports from Iran, the third-largest producer in the Organization of the Petroleum Exporting Countries, in response to new US sanctions is also supporting the market.

Upward potential towards USD70-72 following the bullish downtrend line breakout. After slipping 14.5% from the recent high of USD75.3 (3 July) to a low of USD64.4 (16 Aug) amid concerns over higher OPEC crude production by end 2018, an easing greenback, sliding US crude stockpiles and potential supply disruptions from Iran’s sanction saw prices recovered towards USD68 levels. Upside bias towards USD70-72 zones amid bullish downtrend line breakout and bullish engulfing pattern, supported by bottoming up indicators. On the flipside, failure to defend USD66.3 (76.4% FR) will witness further retracements towards lower supports at USD64.4 (16 Aug low) and USD63.6 (18 June low).

Source: Hong Leong Investment Bank Research - 23 Aug 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024