Traders Brief - Lack of Fresh Catalyst and KLCI’s Upside Limited

HLInvest

Publish date: Thu, 23 Aug 2018, 09:19 AM

MARKET REVIEW

Asia key benchmark indices trended mixed as investors focused on the upcoming trade discussion between the US and China as well as the US political developments, whereby President Trump’s former personal lawyer pleaded guilty to 8 counts in federal court. The Nikkei 225 and Hang Seng Index rose 0.64% and 0.63%, respectively, while Shanghai Composite Index ended lower by 0.70%.

The FBM KLCI was fairly positive on the optimism of the upcoming trade talks between US China, which led to buying support amongst KLCI members. Market breadth, however was negative (549 decliners vs 378 gainers) led by construction stocks following the cancellation of ECRL as mentioned by PM Tun Mahathir.

Wall Street traded mixed as investors digested the political uncertainty in Washington as two former members of President Trump’s inner circle faced legal repercussions, which may led to a bumpy road for the president ahead of the midterm elections. The Dow slid 0.34%, but Nasdaq gained 0.38% and S&P500 ended flattish.

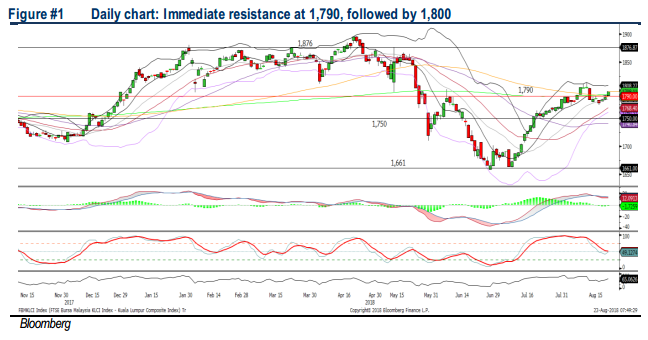

TECHNICAL OUTLOOK: KLCI

The FBM KLCI extended its rebound above the 1,790 level and hovering above the SMA200. The MACD Histogram is recovering, while the momentum oscillators are turning more positive. With the technical are staging a good recovery, we expect the upward momentum to remain intact and the key index could be revisiting resistance around 1,800-1,810. Meanwhile, support will be located around 1,774 and 1,760.

On the local front, we expect market participant to extend profit taking activities on the broader market amid lack of fresh catalyst. Also, with the cancellation of ECRL project, trading tone on the construction sector will remain weak. Nevertheless, oil and gas stocks could see potential buying support amid a jump in crude oil prices yesterday.

TECHNICAL OUTLOOK: DOW JONES

The Dow has formed a pullback candle after forming a shooting star candle on Tuesday. The MACD Indicator is still suggesting that the uptrend is intact. However, momentum oscillators are mixed as RSI is hovering above 50, but Stochastic is slightly overbought. As the technical signals are mixed, we expect the Dow to consolidate over the near term within the range of 25,500-26,000. Further support will be located around 25,000.

With the renewed political concerns in the US, it may increase the volatility in the stock markets over the near term. However, we think the recent ongoing corporate earnings will be able to reduce the downside risk and Wall Street could sustain its upward momentum.

Source: Hong Leong Investment Bank Research - 23 Aug 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024