Traders Brief - Sentiment to Remain Edgy Ahead of the Long Break

HLInvest

Publish date: Fri, 07 Sep 2018, 09:43 AM

MARKET REVIEW

Asian markets ended lower as sentiment was dampened by tech selloff in Wall Street overnight, lingering worries over EMs equities and currencies markets rout as well as the looming imposition of new U.S. tariffs of 25% on USD200bn imported goods from China, which could come as early as this week after the conclusion of a public consultation period today.

After sliding 17.3 pts on 5 Sep, KLCI staged a 7.1-pt technical rebound to a high of 1802.6. However, early gains were pared down to 3.1 pts at 1798.6 with investor confidence shaken by turmoil in emerging markets and jitters over a potentially severe escalation in the US-China trade war. Trading volume reduced 35% to RM1.9bn as selling pressures tapered off but market breadth remained negative with 297 gainers against 553 losers. Foreigners continued to dump local shares, albeit at a slow pace of RM210m compared with RM370m on 5 Sep.

Dow lost as much as 95 pts before ending up 21 pts at 25996 as investors await the outcome of the US-Canada trade talks and the looming imposition of new U.S. tariffs of 25% on USD200bn imported goods from China. Sentiment was also dampened by a 3rd day fall in the Nasdaq (after hitting all-time high on 31 Aug) amid broad-based profit taking as social media stocks get slammed on regulatory concerns while chips stocks tumbled amid potential weakness in demand on escalating trade wars.

TECHNICAL OUTLOOK: KLCI

After breaching the support trendline near 1811 on 4 Sep, KLCI fell to a low of 1794.8 before ending at 1798.6 yesterday, marginally above the 1795 (200d SMA) level. Unless KLCI can swiftly reclaim 200d SMA, we see more downside risks as indicators are on negative bias mode. A fall below 1795 will witness further retracements towards 1773-1787 zones while the upside will be limited around 1800-1810 levels.

Ahead of the long holidays (Bursa Malaysia will be closed on 10 & 11 Sep due to Agong’s Birthday and Awal Muharram), sentiment on the local bourse will remain edgy. Hence, further technical rebound from yesterday is likely to be capped near 1800-1810 levels amid fears over escalation on global trade conflicts and contagion from weak currencies in emerging markets.

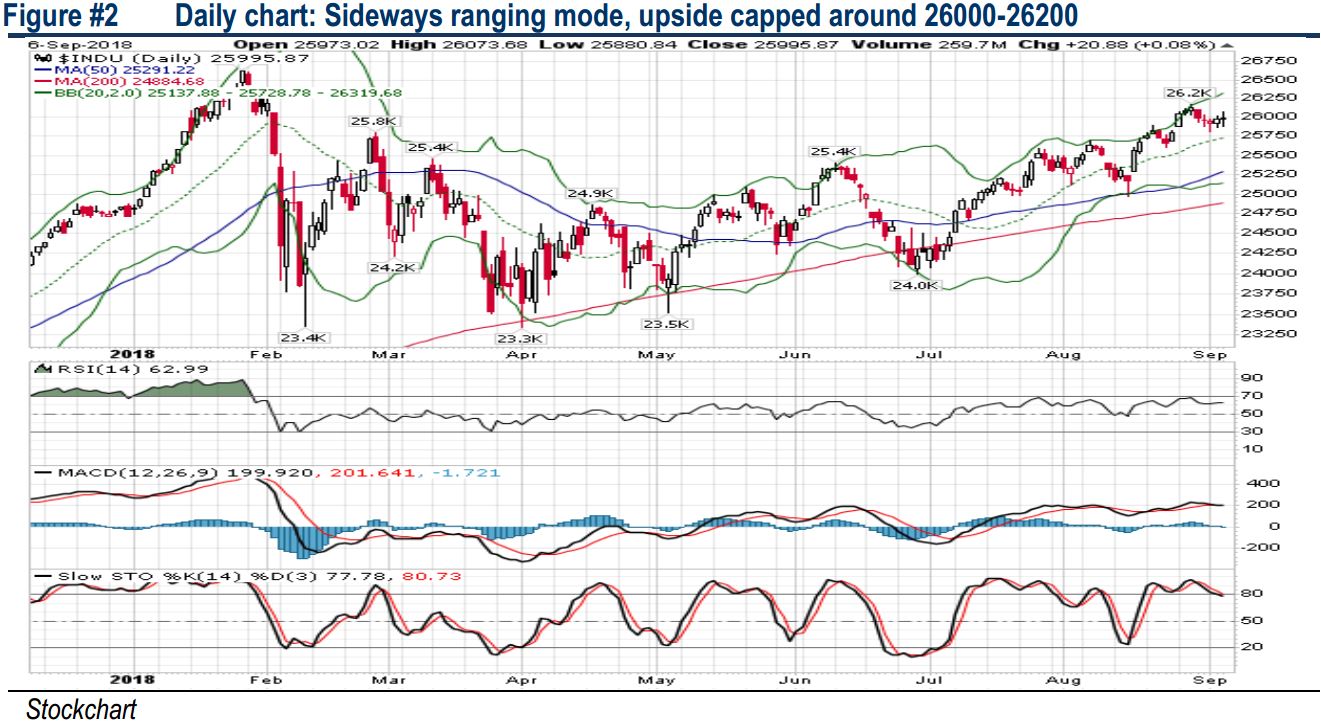

TECHNICAL OUTLOOK: DOW JONES

Although Dow turned sideways lately amid trade-related concerns, the uptrend is still intact as it is hovering above short and long term moving averages. However, in wake of the softening of technical indicators, we expect the upside to be restricted around 26000-26200 levels. Immediate support is set at 25728 (mid Bollinger band). A decisive fall below this level will trigger further selldown towards 25000-25200 zones.

Given the recent technology stock weakness amid the ongoing investigations on social media stocks and potential demand softness in chips stocks, trading sentiment could remain shaky over the near term. Also, uncertain trade developments and the fallout in the EMs may further dampen the optimism on stock markets.

Source: Hong Leong Investment Bank Research - 7 Sept 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024