Traders Brief 13 Sep 2018 - External Headwinds Will Continue to Take a Toll on Local Market

HLInvest

Publish date: Thu, 13 Sep 2018, 10:18 AM

MARKET REVIEW

Despite a 0.4% technical rebound overnight, Asia markets were broadly lower, weighed by the building of "perfect storm" for EMs currencies and intensifying trade war tension between US China after the latter prepare to meet with the WTO on 21 Sep to request for permission to impose sanctions on the U.S. over their trade dispute.

In tandem with the regional market routs, KLCI slid 13.9 pts in a choppy trade after reopened from an extended holidays. Given the resumption of selling spree by foreigners, trading volume soared 29% to RM2.23bn shares worth RM2.81bn. Market breadth was negative with 166 gainers as compared to 896 losers.

The Dow soared as much as 174 pts to 26146 in the early session on news that the U.S. has reached out to China for a new round of talk after negotiations last month concluded without results. However, the gains reduced to 28 pts as shares of chip makers sunk and the unveiling of Apple’s new product line-ups did not result in share pop for the world’s most-valued company.

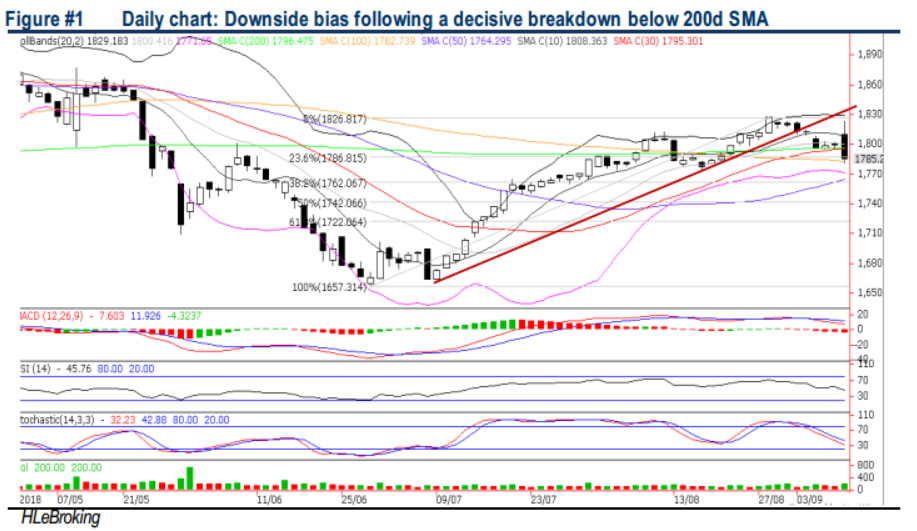

TECHNICAL OUTLOOK: KLCI

In wake of the decisive breakdowns below the support trend line (near 1810) and SMA200 (near 1796); KLCI near term outlook has weakened considerably, accompanied by the negative technical indicators. Unless KLCI can reclaim above 1796 successfully, the index is likely to drift lower towards 1762-1770 zones. Stiff resistances are located at 1796-1810.

After facing with huge selling pressure of RM1.03bn in the last 5 sessions, KLCI is prepared for some respite supported by the optimism in the resumption of trade talk. However, any rebound will be capped along 1796-1810 in this holiday-shortened week (Bursa will be closed on 17 Sep on Malaysia Day holiday), as investors will continue to adopt a ‘risk-off’ mode amid nagging fears of the contagion and spill over impacts from emerging markets (EMs), potential slowdown in Malaysia’s 2H18 economy coupled with global trade tensions.

TECHNICAL OUTLOOK: DOW JONES

Despite recent turbulence, the Dow managed to build its base above the mid Bollinger band near 25800 and the uptrend from 24000 is still very much intact, supported by positive readings in most indicators. Key supports are 25600-25800 whilst resistances fall on 26250- 26600.

Despite positive optimism from a new round of US-China talk, we see the trading sentiment could remain edgy ahead of the upcoming FOMC meeting on 26 Sep and the ongoing trade discussions and worries between the US and its trading partners. Hence, we anticipate that Wall Street may trend sideway.

Source: Hong Leong Investment Bank Research - 13 Sept 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024