Traders Brief - Heading Towards 1810-1818 Levels Amid Overnight Record Close in Dow

HLInvest

Publish date: Fri, 21 Sep 2018, 09:20 AM

MARKET REVIEW

Asian markets ended mixed on profit taking after two sessions of gains since late Tuesday, as sentiment turned cautious following remarks by Chinese Premier Li Keqiang said his country was currently facing "greater difficulties" in keeping its economy stable. Li, however, insisted that China was comfortable with its economic situation and that Beijing has prepared sufficient policy tools to boost the country's resilience in coping with various difficulties.

On the back of relief that the fresh US-China tariffs were less damaging than feared and surging crude oil prices, KLCI jumped as much as 9.5pts to intraday high of 1810.2, before narrowing the gains to 3 pts at 1803.7. Trading volume decreased to 1.94bn shares worth RM2.02bn as compared to Wednesday’s 2.01bn shares worth RM1.90bn. Market breadth was negative with 404 gainers as compared to 412 losers.

Led by rallies in materials, consumer staples and technology stocks, the Dow surged as much as 291 pts to all-time high of 26697 before narrowing the gains to 256 pts to 26662. Sentiment was boosted by improving signs of improving economic fundamentals and robust corporate earnings coupled with subsiding fears as the latest fresh levies imposed by both count ries were seen as less than previously expected.

TECHNICAL OUTLOOK: KLCI

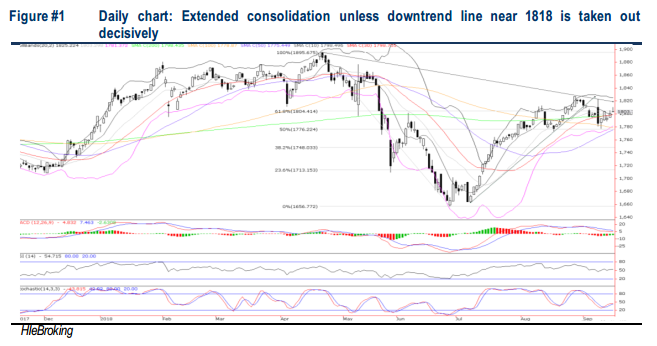

As expected, KLCI tested our envisaged immediate resistance near 1810 (the support-turned resistance trend line from 1657) yesterday before closing lower at 1803.7. Taking cue from a fresh record close at Dow, KLCI is expected to retest 1810, 1818 (downtrend line from 1897) and 1827 (30 Aug high) levels in the short term, as prices are still above all the SMAs and supported by positive indicators. Conversely, a breakdown below SMA200 near 1798 will see retracements towards 1776 (50% FR) levels.

The fresh record close in Dow overnight and expectations of potential end 3Q window dressing should bode well for KLCI to grind higher towards 1810/1818/1827 territory in the short term. However, the relief rally from post GE14 low at 1657 (28 Jun) is likely to be capped near 1840 (76.4% FR), due to the lack of domestic rerating catalysts, given the prospects of protracted US-China trade war, EM contagion risks, tightening financial conditions and expectations of further “belt-tightening budget 2019” to be tabled on 2 Nov.

TECHNICAL OUTLOOK: DOW JONES

As expected, the Dow finally broke its previous record of 26616 set in Jan 2018 yesterday to a fresh new high of 26697. Given the bullish indicators, the Dow could grind higher towards 26800 (upper channel) before profit taking emerging. On the flip side, only a decisive fall below SMA20 near 26000 will trigger further retracement towards 25600-25800 territory.

Taking cues from recent stern and bold statements from the US-China leaders, the prospects for significant progress towards de-escalation in the short term are low. Nevertheless, investors remain sanguine that anxiety over an escalating US-China trade conflict would compromise to eventually quell fears of a growth-hindering trade war in the long term, thus providing support to the ongoing equities markets rally.

Source: Hong Leong Investment Bank Research - 21 Sept 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024