WTI Crude Oil - Eyeing the outcome of output cuts in OPEC meeting

HLInvest

Publish date: Wed, 21 Nov 2018, 10:08 AM

Following the bearish statement by IEA that oil markets are entering an unprecedented period of uncertainty, given concerns over rising supplies and slowing global growth, near term oil prices has turned decided bearish after sliding 30.4% from 4Y high of US$76.9 (3 Oct) to US$53.5 overnight. All eyes are on the upcoming OPEC meeting on 6 Dec amid growing expectations that the cartel will look to cut oil output (by roughly 1-1.4m bpd). However, any inaction by its major ally, Russia (who stated that they would want to take a wait-and-see approach recently) with regard to a potential supply cut would further dent sentiment.

WTI slumped 6% to US$53.5, snapping its 4th winning streak. OPEC lately warned demand for its crude is falling faster than expected, underlining why Saudi Arabia and some other members are signalling output cuts ahead of the 6 Dec meeting but Trump’s remarks that the group should not cut output is stoking concerns producers may not change course to prevent a glut.

Meanwhile, rising American output and inventories are pointing to an emerging glut and speculation is swirling over whether OPEC’s major ally Russia will corporate in stemming the price slump. Moreover, recent broad-based USD strength amid widespread risk-aversion on the back of a broader market sell-off, further weighed down on the USD-sensitive oil.

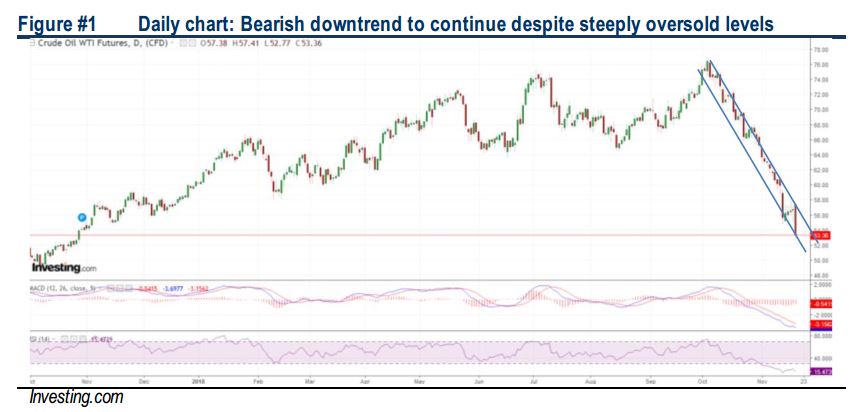

Despite potential technical rebound, LT view turns bearish after support trendline near US$60 is broken. Following the recent plunge, WTI’s near term outlook has tuned decidedly bearish after violating the LT support near US$60 to end at US$53.5 overnight. Given the bearish Marubozu candle, WTI could see further downtrend towards US$48-50 levels before a long-awaited technical rebound is taking place. A successful reclaim above R1 near US$55 will take prices higher back towards US$59-63 zones.

Source: Hong Leong Investment Bank Research - 21 Nov 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024