Genting Malaysia - An attractive proxy for short term rebound as negatives mostly discounted

HLInvest

Publish date: Mon, 03 Dec 2018, 09:17 AM

GENM’s market capitalisation saw a massive RM9.7bn or RM1.63 collapse in Nov amid concerns over mid to long term earnings jeopardy (prompted our analyst to slash RM788m in FY18-20 core earnings) following a series of negative newsflow i.e. the Budget 2019 additional new casino taxes, its legal proceedings against Disney and Fox (seeking minimum US$1bn or RM4.2bn damages) and the RM1.8bn impairment related to the US tribal casino project investment (or Mashpee’s notes). Although share price could remain pressure due to 3Q18 headlines RM1.3bn loss and uncertainties until the fate of outdoor theme park is crystallized along with the gaming tax hike impact, we believe these risks have been largely priced in, given undemanding valuations at 0.84x P/B (48% below 10Y average of 1.6x) and 14.5x FY19 P/E (16% below 10Y average of 17.2x). We see good entry levels near RM2.76-2.86.

HLIB institutional research maintains a HOLD rating with RM3.23 target price.

Management was tight-lipped with no clear dateline and plan on the development of outdoor theme park following the legal proceedings with Disney. Management is now reviewing its cost structure, marketing and rebates to cushion the impact of gaming tax hike as announced during Budget 2019 without hurting the competitiveness of its gaming business. Meanwhile, Skytropolis Funland indoor theme park is set to be rolled out by mid Dec 2018. Overall, HLIB maintained a HOLD rating with lower target price of RM3.23 (previously RM3.41) after removing the Mashpee’s note from SOP valuation following the impairment.

Good entry levels near RM2.76-2.86 as values re-emerge after recent rout.

Despite prevailing risks, we opine that GENM’s massive market capitalisation erosion of RM9.7bn in Nov had basically more than discounted the concerns over mid to long term earnings jeopardy and potential undermining the growth expectation on the Genting Integrated Tourism Plan (GITP) expansion (RM788m cut in FY18-20 core earnings), a loss in legal proceedings against Disney and Fox (seeking RM4.2bn damages) and the RM1.8bn impairment related to the US tribal casino project investment (or Mashpee’s notes). Valuations are undemanding at 0.84x P/B (48% below 10Y average of 1.6x) and 14.5x FY19 P/E (16% below 10Y average of 17.2x).

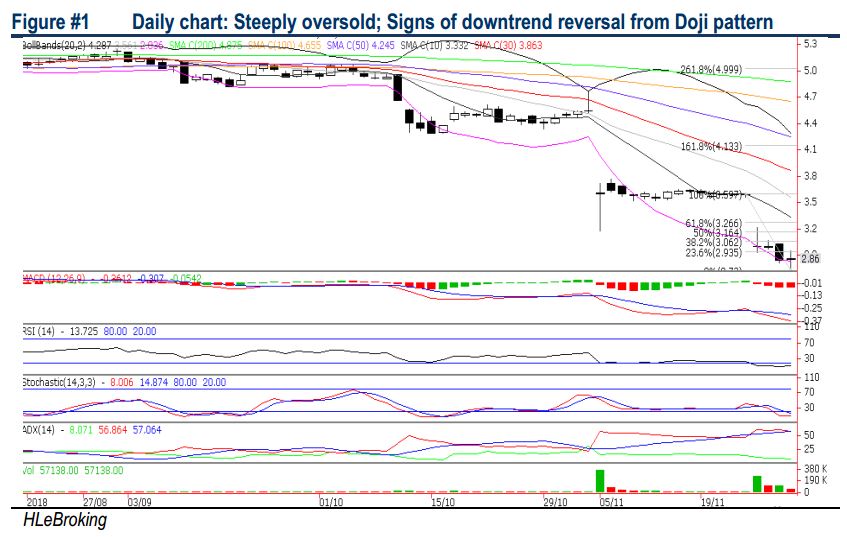

Potential downtrend reversal. Given the formation of Doji candle and signs of uptrend reversal in –DMI and ADX, GENM is ripe for a relief rebound in the near term. A decisive breakout above RM2.95 (30 Nov high) is likely to lift share prices higher towards RM3.06 (36.2% FR) and RM3.16 (50% FR) before heading towards our LT objective at RM3.27 (61.8% FR). On the flip side, key supports are RM2.76 (30 Nov low and RM2.62 (2 July 2010). Cut loss at RM2.58.

Source: Hong Leong Investment Bank Research - 3 Dec 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024