Tradersbrief - May Take a Mild Breather After the Strong Surge

HLInvest

Publish date: Tue, 04 Dec 2018, 05:00 PM

MARKET REVIEW

Asia’s stock markets traded in the positive territory following the positive trade developments after the G20 summit, where President Trump and Chinese President Xi Jinping agreed to a temporary trade truce. The Nikkei 225 rose 1.00%, while Hang Seng Index and Shanghai Composite Index jumped 2.55% and 2.57%, respectively.

Tracking the regional benchmark indices, stocks on the local front trended mostly higher; the FBM KLCI rose 1.18% to 1,699.72 pts. On the broader market, there were 568 advancers and 338 decliners, while 327 traded unchanged. Market volumes stood at 2.52bn, worth RM2.29bn. Also, technology sector were one of the best performing sectors on Bursa Malaysia, rising 5.88% led by MPI, KESM, Inari, Globetronics and Pentamaster.

Wall Street trended on a bullish note following the fresh trade development as Trump agreed to remain the 10% tariffs on the USD200bn Chinese goods and willing to re-negotiate the terms within the 90-day window. The Dow and S&P500 jumped 1.13% and 1.09%, respectively, while Nasdaq rallied 1.51%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded yesterday, but closed slightly below the 1,700 psychological level. The MACD Line is still hovering below zero, but RSI (slightly above 50) and Stochastic (rebounded off the oversold region) have been trending higher. Hence, with the mixed technical readings, the FBM KLCI could remain sideways between the 1,680-1,713 zones over the near term. Next resistance will be envisaged around 1,730, while support will be located around 1,680, followed by 1,673.

Although overnight Wall Street was positive, we anticipate that the buying interest may fizzle off today as mild profit taking activities could emerge after an overheated relief rally yesterday on the local bourse. Nevertheless, traders may look into O&G stocks after Brent crude oil prices gained momentum above USD60.

TECHNICAL OUTLOOK: CLOSED POSITIONS

Yesterday, we had closed our daily technical tracker position on TALIWRK (3.5% loss) amid weakening technical.

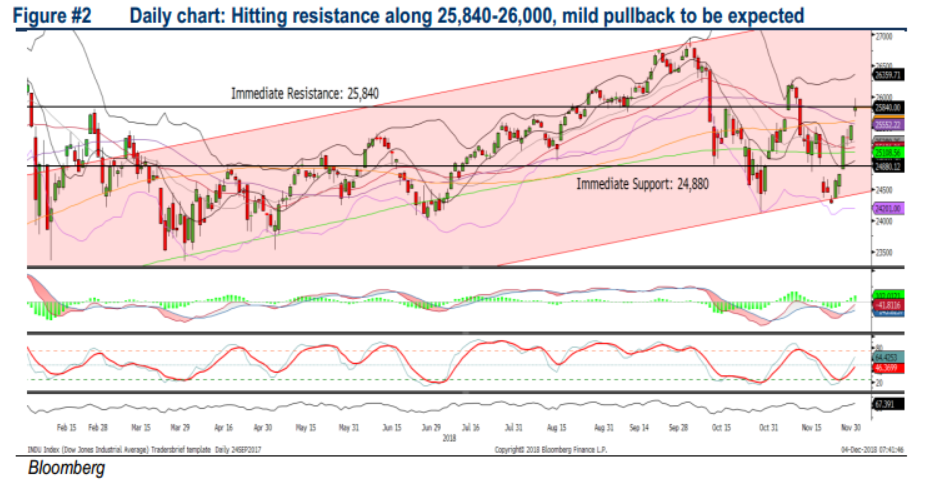

TECHNICAL OUTLOOK: DOW JONES

The Dow gapped up, hitting the resistance along 25,840-26,000 levels and formed a Doji candle. The MACD Line is recovering towards zero level, while both the RSI and Stochastic oscillators are trending above 50; suggesting that the positive momentum is intact. Nevertheless, we opine that the recent rally may take a mild breather before surging higher to retest the previous all-time-high zone near the 27,000. Meanwhile, support will be anchored around 25,108 (SMA200), followed by 24,880.

We think the relief rally may sustain at least over the near term as both Trump and Xi agreed to hold off on new tariffs during G20 summit over the weekend and China has made more than USD1.2 trillion (details will be negotiated) in additional trade commitments as part of a deal Beijing vowed to take immediate actions on those promises. The 90-day window is to resolve issues including intellectual property protection, non-tariff trade barriers and cyber theft.

Source: Hong Leong Investment Bank Research - 4 Dec 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024