Traders Brief - Market Likely to Rebound Amid Positive Wall Street

HLInvest

Publish date: Mon, 07 Jan 2019, 10:01 AM

MARKET REVIEW

Asia’s stock markets mostly rebounded on the back of easing trade fears following the news from China’s commerce ministry, announcing that vice-ministerial level trade talk with the US would be held on 7-8 Jan. Also, China’s services PMI jumped to a six-month high in December at 53.9 (vs. 53.8 in the previous month), boosted the positive sentiment further on Shanghai Composite Index (+2.05%), while Hang Seng Index added 2.24%. However, Nikkei 225 declined 2.26%.

On the local front, stocks traded lower, after the negative performance on Wall Street overnight; FBM KLCI slipped 0.36%. Market breadth, however was positive with 492 gainers vs. 349 decliners as broader market sentiment was lifted by the positive trade news from China. Market traded volumes stood at 2.20bn, worth RM1.29bn. Some of the O&G (Carimin, Hibiscus) and plantation (FGV, Sime Darby Plantation) stocks traded higher amid recovering Brent oil and crude palm oil prices.

Wall Street rebounded sharply following the stronger-than-expected jobs data, where US economy added 312k jobs in December (vs. consensus of 176k). Also, Jerome Powell’s tone has turned slightly dovish, commenting that central bank will be patient in raising rates. Both the news has lifted the Dow and S&P500 by 3.29% and 3.43%, respectively.

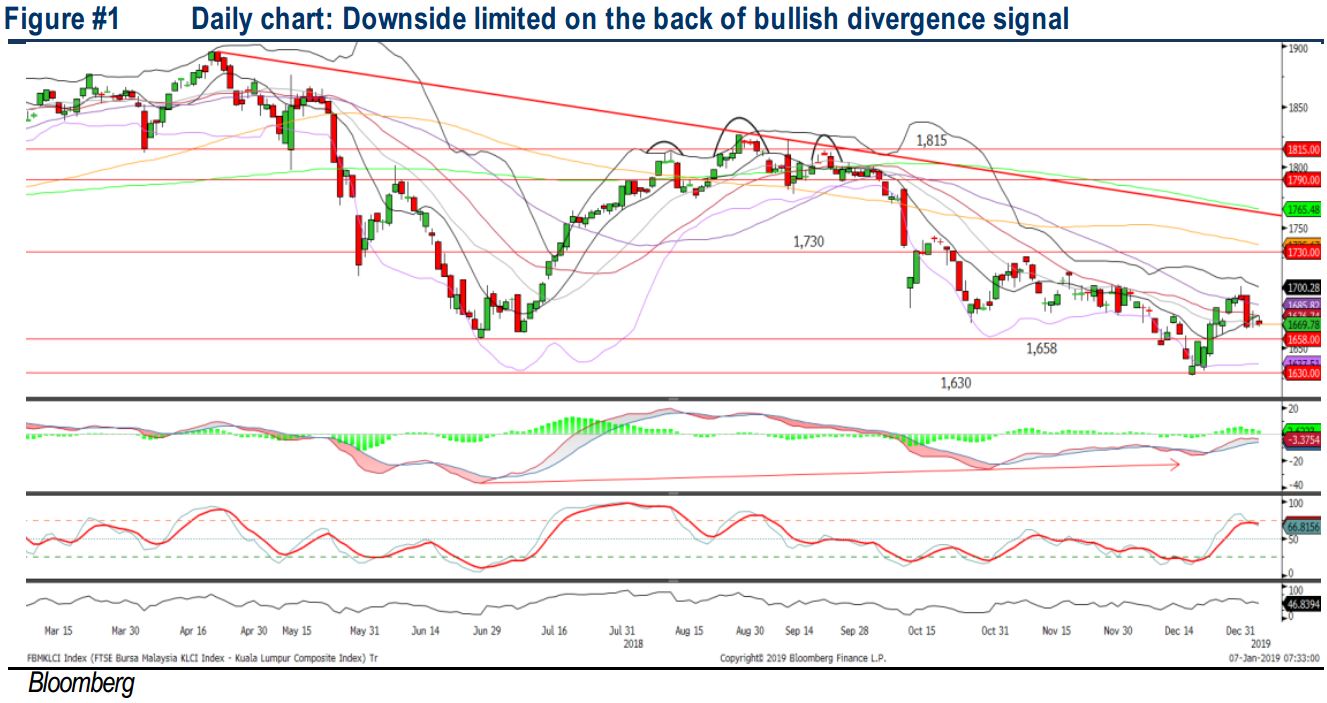

TECHNICAL OUTLOOK: KLCI

The FBM KLCI trended sideways over the past two trading days and the MACD Line stay ed flattish, while MACD Histogram continues to weaken last week. Nevertheless, as we mentioned that the bullish divergence (period from Jun-18 to Dec-18) was spotted between both the MACD and the key index, we opine that the downside could be limited around the support of 1,630-1,650. Meanwhile, the resistance will be envisaged around 1,695-1,700.

We expect the positive sentiment on Wall Street to extend regionally in Asia, eventually boosting stocks on the local front. Sectors that we may anticipate a rebound will be O&G (on the back of firmer recovery Brent crude oil price) and technology stocks as the latter were bashed down last week on Apple’s softer outlook guidance. Meanwhile, the FBM KLCI could trend within the range of 1,665-1,695.

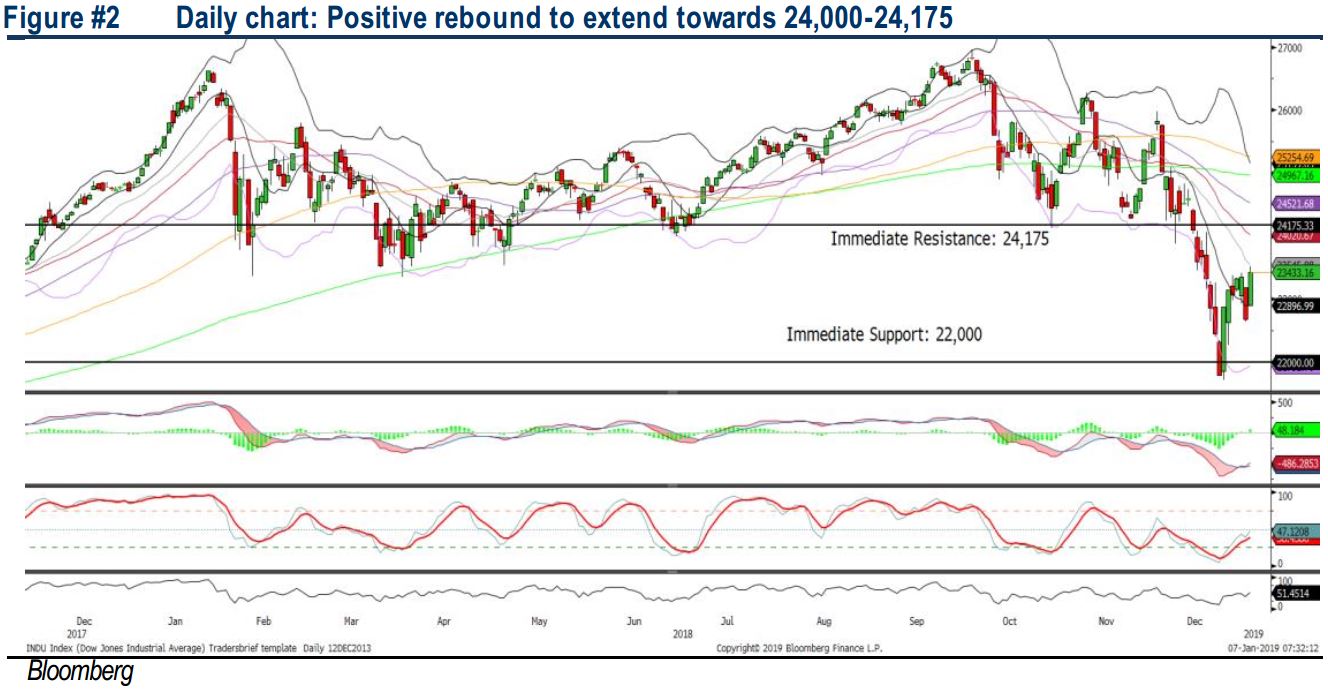

TECHNICAL OUTLOOK: DOW JONES

The Dow has trended higher, continuing the V-shape rebound formation. After declining below the support of 23,000, it reclaimed back the territory. With most of the technical indicators hooking upwards, we expect the Dow to further extend its rebound towards 24,000-24,175. Support will be at 22,000-22,500.

In the US, we expect the current feel good sentiment to persist for the near term as the economic data is improving, while the Fed’s tone are supporting market participation’s expectations. However, should there be any negative surprises surfacing from the US-China trade discussions (7-8 Jan) may affect markets’ sentiment.

Source: Hong Leong Investment Bank Research - 7 Jan 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024