WTI Crude Oil - All Eyes on OPEC Meeting (6 Dec) to Discuss Output Cuts

HLInvest

Publish date: Thu, 10 Jan 2019, 04:49 PM

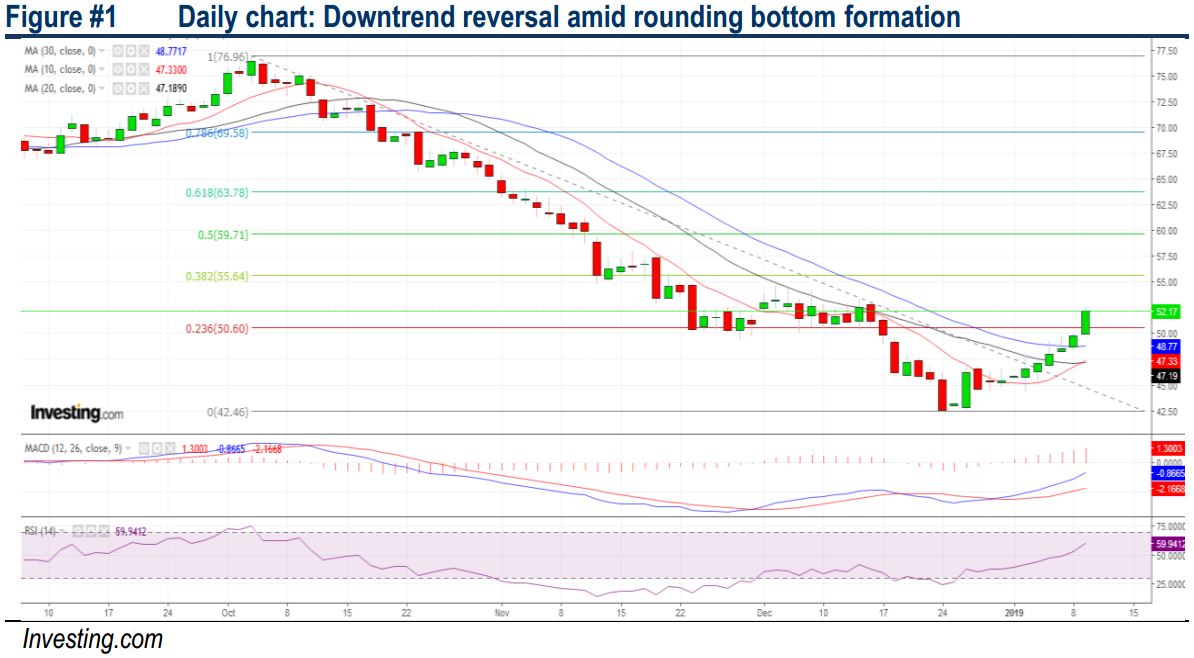

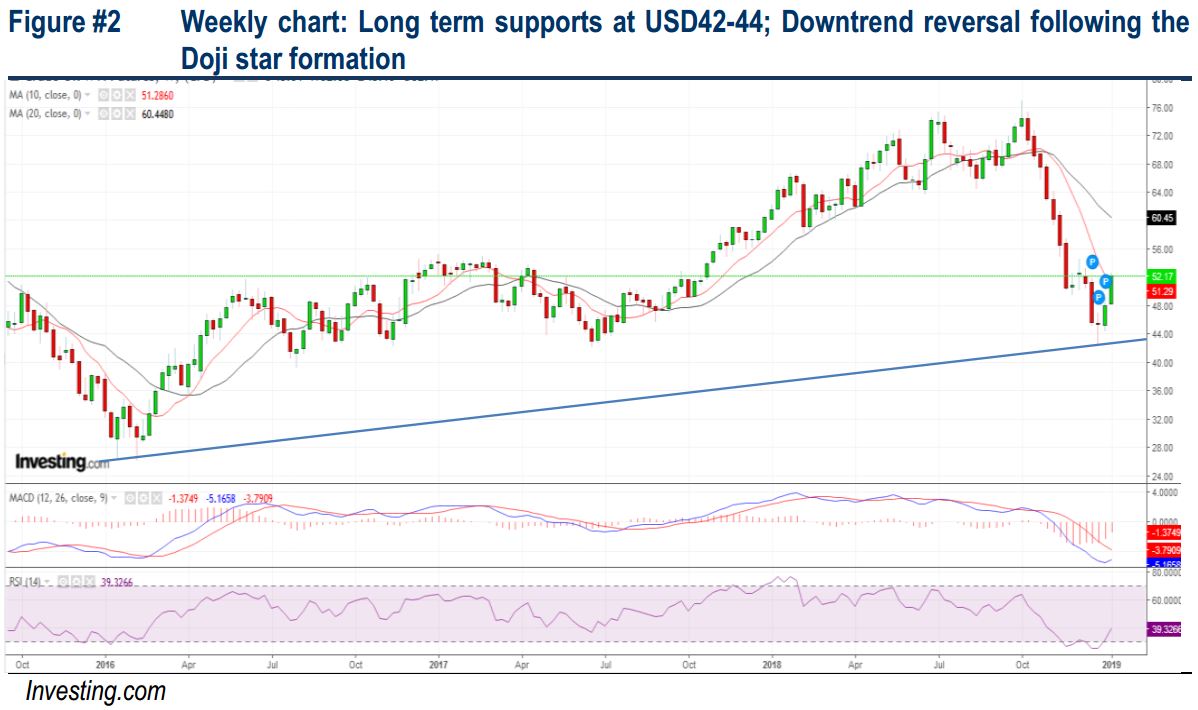

Concerns of slowing global economy and surging production supply from US & OPEC, coupled with a broad-based USD strength (weighed down on the USD sensitive commodity) witnessed WTI prices diving 45% from 52W high of USD76.9 (3 Oct) to a 52w low USD42.3 (24 Dec) before ending at USD45.4 on 31 Dec, tumbling 38% in 4Q18. However, oil prices staged a strong 15% rebound in Jan 2019, driven by favourable catalysts such as OPEC production cuts (including Russia) to keep 1.2m bpd off the market effective this month and positive optimism of the US-China trade talks China coupled with a pullback in the greenback. Technically, the bullish daily and weekly charts are showing the worst is over and WTI prices are firming up to retest USD55-60 in 1Q19.

Potential downtrend reversal from the daily and weekly charts. Following the recent strong price recovery, WTI’s near term outlook has turned decidedly positive after building a base from USD42 levels. Given the rounding bottom (daily chart) and Doji star (weekly chart) formations; WTI could see further uptrend towards USD55 levels, in anticipation of a long-awaited relief rebound. A successful reclaim above USD55 will spur prices higher back towards USD59-63 zones.

Source: Hong Leong Investment Bank Research - 10 Jan 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024