Traders Brief 14 Jan 2019 - Upside Bias to Retest 1700 Levels

HLInvest

Publish date: Mon, 14 Jan 2019, 10:52 AM

MARKET REVIEW

Led by a 5th straight rally on Dow and 0.7% jump in the SHCOMP, Asian markets continue to tick higher amid positive optimism of the US-China recent trade talks in Beijing (despite sparse details from the meetings). Sentiment was also boosted by dovish Fed’s stance, given the mixed signals of an upbeat view on the US economy but crosswinds from growth prospects in other countries and overall financial conditions that have tightened materially.

Tracking regional markets gains and higher crude oil prices, KLCI stepped up 4.3 pts or 0.26% at 1683.2 (+13.4 pts WoW), accompanied by 2.89bn shares valued at RM2.17bn against 3.45bn shares valued at RM2.66bn on Thursday. Market breadth was bullish with 569 gainers vs 294 decliners, mainly attributed to stronger performances by FBM MID70 (+1.05%), FBMSCAP (+0.95%) and FBM ACE (+0.69%) stocks.

After registering a 5-day winning streak, the Dow slipped as much as 203 pts on profit taking and reset positions ahead of the 4Q18 results reporting season. Sentiment was also dampened by the ongoing US government shutdown (for a record 23rd day) and worries about an economic slowdown in China. Nevertheless, promises of patience from the Fed and cautious optimism over the concluded US-China trade talks pared losses to 6 pts at 23996, ending the week 2.4% higher.

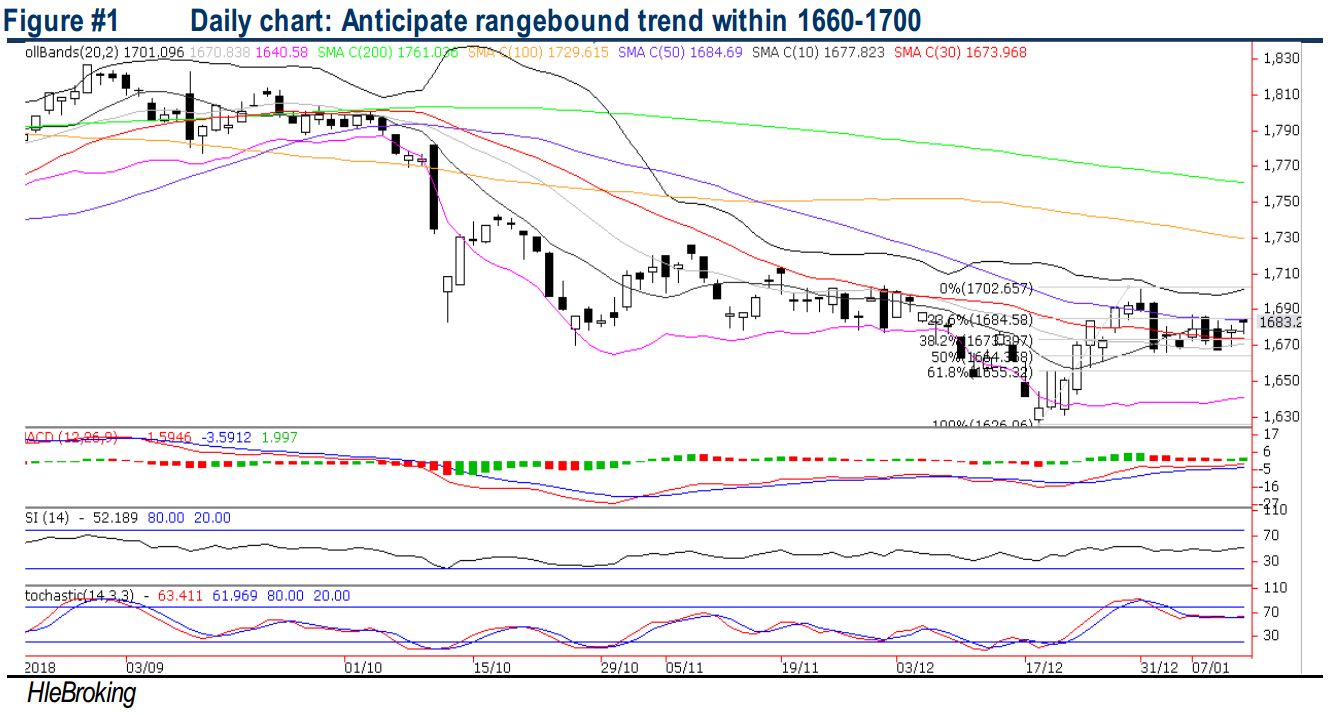

TECHNICAL OUTLOOK: KLCI

Last week, KLCI has trended sideways between the 1667-1,687 in tandem with the rally on Dow and regional bourses. As most of the indicators like MACD Histogram, RSI and Stochastic oscillators readings are flashing mildly improving signals, the key index may retest 1687-1700 levels this week. The support will be situated at 1660-1666.

While we expect positive sentiment driven by progress in US-China trade talks, a dovish Fed stronger RM and steadier oil prices and FCPO would continue to drive KLCI higher to retest 1700 this week, profit taking activities are likely to emerge, especially on the lower liners and penny stocks. Nevertheless, traders may continue to lookout for rotational trading plays within the O&G, construction, property, automotive, industrial and airlines sectors amid strengthening ringgit and steady oil prices.

TECHNICAL OUTLOOK: DOW JONES

After rallying 1314 pts 5 days, the Dow fell as much as 203 pts intraday to 23798 paring the losses to 6 pts at 23996, extending its V-shape rebound after hitting 52W low of 21712 on 26 Dec. Although the MACD Histogram and RSI readings are still flashing positive signals, the Stochastic oscillator is approaching steeply overbought levels, indicating Dow will experience a pullback soon. Retracement supports are anchored around 23500-23800 while resistances fall on 24000-24300

In the US, we believe the current rebound in stock markets could be due for volatility ahead of the upcoming reporting season this week. Also, market participants could be eyeing on the federal government partial shutdown (dragged on into the 23rd day), stoking fears the shutdown could drag on for a long time as consensus estimates that every two weeks of a shutdown trims 0.1 percentage points from growth due to delays in spending and investment. Meanwhile, Trump also said he will probably declare a national emergency if the White House and Congress cannot reach a deal to end the shutdown.

Source: Hong Leong Investment Bank Research - 14 Jan 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024