Traders Brief - Upside Bias Near 1700 in a Holiday-shortened Week

HLInvest

Publish date: Thu, 07 Feb 2019, 05:03 PM

MARKET REVIEW

Asian bourses ended in muted trades as markets in Hong Kong, China and most of Southeast Asia closed for lunar new year holidays. Major markets in the Nikkei 225 and ASX 200 rose 0.1% and 0.3%, respectively following overnight rally in Dow as investors traded cautiously following President Trump’s State of the Union address as he said a trade deal was possible with China if Beijing agrees to “real structural change” and claimed that Democratic attempts at “ridiculous partisan investigations” could damage US prosperity.

In a half-day trading session on 4 Feb and ahead of the 2-day CNY breaks, KLCI ended with a meagre 0.08-pt gain (from as much as +16 pts) to 1683.6 at the 11th hour due to selldown in heavyweights such as MAXIS (-19 sen to RM5.56), PETGAS (-42 sen to RM17.66), PETDAG (-44 sen to RM25.94), MISC (-8 sen to RM6.70) and KLK (-24 sen to RM24.44). Overall, the Year of the Dog ended negatively for KLCI with the benchmark index tumbled 9.35% or 173.7 pts from 1857.3 on 19 Feb 2018.

The Dow eased 21 pts to 25390, snapping a 4-day winning streak, after President Trump’s State of the Union address offered few details on his economic agenda. The president, however, insisted China commit to real, structural economic reforms before a trade deal can be reached. Meanwhile, Treasury Secretary Steven Mnuchin confirmed that he and US trade representative Robert Lighthizer will travel to Beijing next week to continue negotiations over the longstanding trade dispute before the 1 March deadline.

TECHNICAL OUTLOOK: KLCI

Following a 4-day 11.9 pts decline, KLCI rose as much as 16 pts intraday to a high of 1699.7 amid Wall St rally on 1 Feb but the gains were pared down to a +0.08-pt at 1683.6. In wake of the long black candlestick and weakening technical readings, KLCI is likely to engage in an extended consolidation in this holiday-shortened week with key supports near 1676 (38.2% FR) followed by 1666 (50% FR). On the flip side, a decisive breakout above 1700 will spur index higher towards 1705 (28 Jan high) and 1713 (100D SMA) resistances.

Potential trade deal between the US and China before the March dateline and dovish shift in Fed’s monetary stance would help risk-on sentiment on KLCI to recapture the 1700-1705 levels over the near term. However, we see stiff resistances near 1713-1726 (8 Nov high) as we are likely to experience a tepid Feb reporting season.

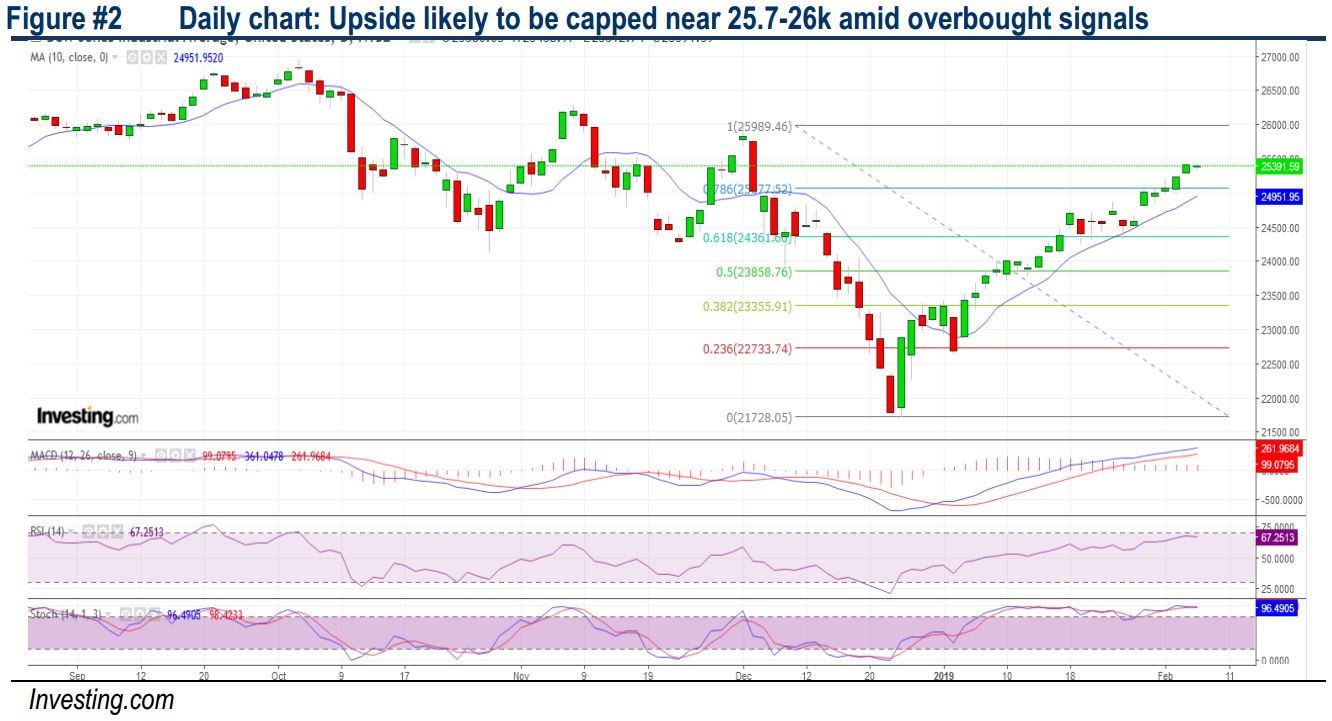

TECHNICAL OUTLOOK: DOW JONES

The Dow continued its uptrend above the 10D SMA but the momentum is likely to taper off after moving in tight range bound within 25312-25439 levels before falling 21 pts at 25390 overnight. Although the MACD indicator continues to stay firmly above the zero, RSI and stochastic reading are flashing moderating signals from overbought regions. Given the small Doji candlestick and weakening technical reading, we believe the upside could be limited after the V-shape rebound (+16.9% since hitting a trough of 21712 on 26 Dec). The immediate resistance will be set around 25720/ 26000. Meanwhile, supports will be situated near 24950/ 24580.

Near term Dow’s prospects remain sanguine following strong US economic data and positive comments out of Washington on the trade talks coupled with a dovish Fed. However, investors are likely to stay mildly cautious, pending further trade talks agreement, with key focus are likely to include intellectual property rights and protection, as well as opening up of markets for US exports of non-financial goods and services. Meanwhile, despite over 65% of the S&P 500 companies that reported so far managed to beat a sharp markdown in earnings and revenue expectations, 1Q19 earnings projections remain tepid and are likely to cap further strong gains ahead, with stiff resistances at 25700-26000.

Source: Hong Leong Investment Bank Research - 7 Feb 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024