Traders Brief - Small Cap and Lower Liners Likely in Focus

HLInvest

Publish date: Thu, 14 Feb 2019, 05:08 PM

MARKET REVIEW

Key regional benchmark indices ended on a positive tone following comments from President Trump to postpone the tariff deadline if both the US and China could agree on a trade deal over the near term. The Shanghai Composite Index and Hang Seng Index advanced 1.84% and 1.16%, respectively, while Nikkei 225 rose 1.34%.

Meanwhile, the FBM KLCI bucked the regional trend, closing marginally lower by 0.13% to 1,685.30 pts. Market breadth, however was positive with 468 advancers vs. 340 decliners. Generally, stocks that were traded were mostly small cap and lower liners as they were topping the top volumes list. Market traded volume stood at 2.63bn, worth RM1.88bn.

Sentiment on Wall Street remained positive on the back of comments by President Trump, stating that the high level trade talks were going “very well”. This has eased investors’ concerns that both the US and China would be unable to reach a trade agreement by end of the trade truce period on 1st of March. The Dow and S&P500 rose 0.46% and 0.30%, respectively, while Nasdaq inched up marginally by 0.08%.

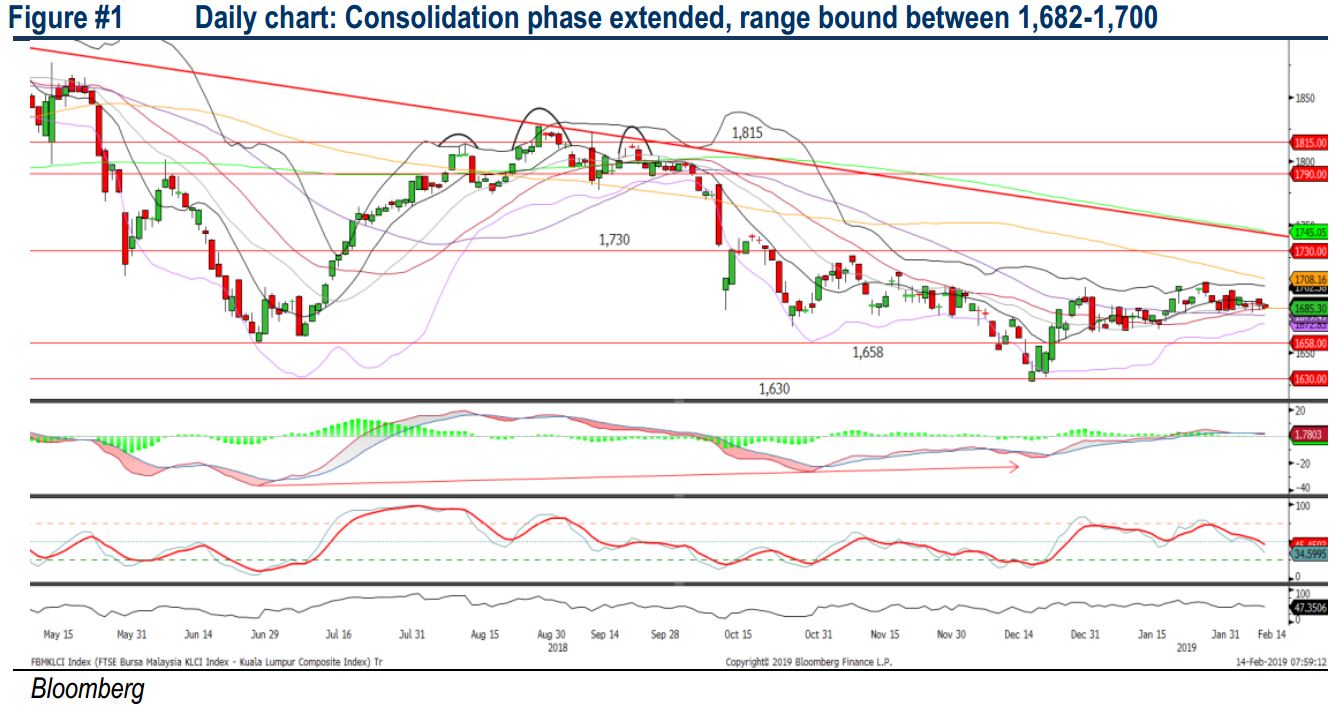

TECHNICAL OUTLOOK: KLCI

The FBM KLCI remains range bound between the 1,682-1,700 zone and the MACD indicator stayed flattish. Both the RSI and Stochastic oscillators are hovering below the 50 level; indicating that the key index could extend its retracement phase over the near term. Should the key index violates below the 1,682 level, next support will be located around 1,666. Resistance will be envisaged along 1,700.

Although the FBM KLCI extended its consolidation between the 1,682-1,700 levels, sentiment on the broader market could stay positive tracking the positive performances from regional stock markets and Wall Street. We believe traders may look into small cap and lower liner within the IT software related stocks such as PRESBHD, DNEX and DSONIC as they have surged in trading volumes yesterday.

TECHNICAL OUTLOOK: DOW JONES

The Dow closed higher for another session but formed an inverted hammer and smaller candlestick. The MACD Histogram has turned flattish; indicating that the positive momentum has been tapering off and upside could be limited. Also, both the RSI and Stochastic oscillators are suggesting that the Dow is overbought. Hence, based on the technical readings on the indicators, upside could be limited around the resistance of 26,000. Support will be anchored around 25,000 (SMA200).

Despite the fading worries on the trade front following positive comments by President Trump, which may boost the sentiment at least over the near term, traders are likely to be focusing on the trade discussions this week between US and China’s officials in order to gauge the tone of the trade developments moving forward. At this current juncture, both RSI and Stochastic oscillators are suggesting that the Dow is overbought with immediate resistance located around 26,000.

Source: Hong Leong Investment Bank Research - 14 Feb 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024