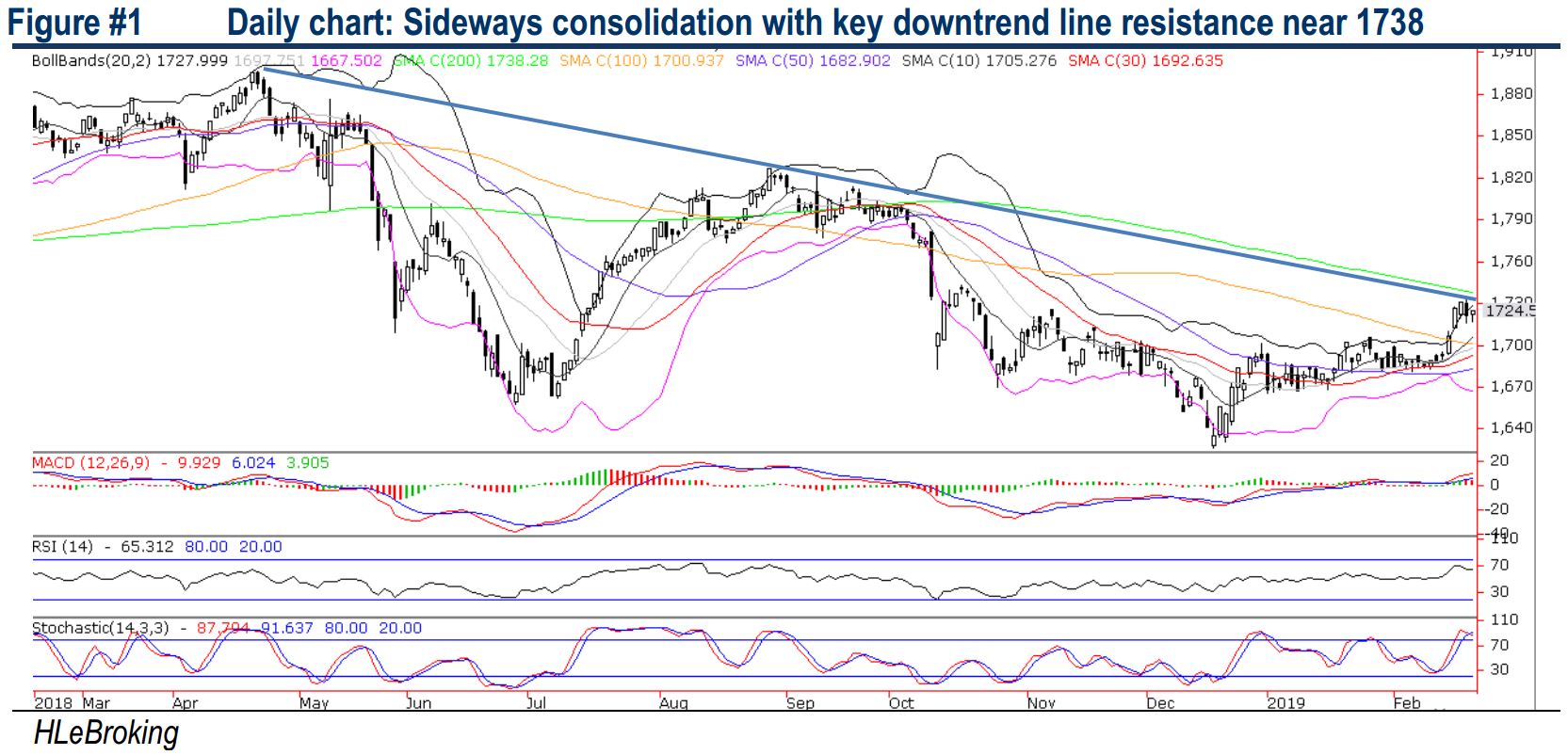

Traders Brief - Upside Bias But Facing Stiff 200D SMA Resistance Near 1738

HLInvest

Publish date: Tue, 26 Feb 2019, 05:11 PM

MARKET REVIEW

Asia’s stock markets ended higher, led by a 157-pt or 5.6% rally in Shanghai composite (SHCOMP) to 2,961 levels (18.7% YTD) after President Trump announced in a series of posts on Twitter Sunday evening that America is planning to delay a set of additional tariffs on Chinese goods post 1 March dateline. Given the rally, the SHCOMP has traded into bull market territory, surging 21.3% from 52W low of 2441 (2 Jan).

In tandem with higher regional markets, KLCI gained 3.2 pts to 1,724.6 after traded within a range of 7.17 pts between an intra-day high of 1,724.6 and a low of 1,717.4. Trading volume decreased to 2.61bn shares worth RM2.15bn as compared to last Friday’s 2.67bn shares worth RM2.34bn. Market breadth was negative with 386 gainers against 480 losers as broader markets continued its healthy profit taking following recent relief rally from Dec 2018 lows. Besides, sentiment was cautious amid ongoing tepid Feb reporting season.

The Dow rallied as much as 209 pts to 26,241 after President Trump tweeted that he would delay the 1st of March dateline for increasing tariffs on Chinese products. He also cited “substantial progress” across key topics such as intellectual property, technology transfers, agriculture and currency and may meet with President Xi at Mar-a-Lago to wrap up a deal. However, after surging 20.9% from 52W low of 21712 (26 Dec), partly due to trade optimism and dovish Fed monetary stance, the early gains were reduced to 60 pts at 26,092.

TECHNICAL OUTLOOK: KLCI

We believe the overall outlook remains positive given that the index has decisively broken multiple key SMAs. Continued buying momentum could see the index testing the long-term downtrend line near 1738 (200D SMA). A strong close above the trendline would be positive for the local market towards 1766 (100W SMA). Nevertheless, we opine that the recent rally is slightly stretched following the technical rebound from 52W low at 1627 (18 Dec) to YTD high of 1732 (22 Feb) and could be due for a mild retracement amid overbought slow Stochastic oscillators. Immediate supports are pegged at 1705 (10D SMA), followed by 1692 (30D SMA).

Dow’s bullish outlook (+11.9% YTD) amid the US-China trade optimism as well as a dovish Fed, coupled with the recovery in commodity prices and news on the potential resumption in domestic mega projects should act as supporting catalysts for KLCI to retest the long term downtrend resistance near 1,738 levels. However, sentiment would remain cautious amid the peak of 4Q18 results season this week and the recent net foreign outflows might limit further upside potential.

TECHNICAL OUTLOOK: DOW JONES

The small inverted hammer as well as grossly overbought indicators are signalling potential retracement may happen soon as the index has not retraced since hitting the trough of 21,712 (26 Dec). Should that happen, we expect the index to find near term support at 10D SMA or 25,720 (S1). A decisive breakdown below S1 will trigger further selldown towards crucial long term 200D SMA support at 25,080 (S2). Conversely, a strong buying momentum would spur the index to 26,300 (R1) and all-time high at 26,952 (R2).

Taking cues from the progressive US-China trade talks and increasingly dovish Fed, further gains on Dow remain bright, but growing worries over the global economy coincide with a deteriorating US 1Q19 earnings outlook (as consensus S&P 500’s EPS growth have shrunk to -0.9% from around +5% at the start of the year) might cap further strong gains. Moreover, the Dow had enjoyed a pretty extraordinary 20.9% rally since Dec low with a lot of the good news had been priced in.

Source: Hong Leong Investment Bank Research - 26 Feb 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024