Traders Brief - Small Cap and Lower Liners Will be Focused

HLInvest

Publish date: Thu, 14 Mar 2019, 09:47 AM

MARKET REVIEW

Asia’s stock markets ended in the negative territories on the back of renewed concerns over PM Theresa May’s Brexit withdrawal deal, where UK lawmakers rejected another round on the terms of a deal for Britain to withdraw from the EU. The Shanghai Composite Index and Hang Seng Index fell 1.09% and 0.39%, respectively, while Nikkei 225 declined 0.99%.

Meanwhile, the FBM KLCI bucked the regional trend, closing higher by 0.42% to 1,678.24 pts. Market breadth was slightly negative with 459 decliners vs. 421 gainers. Market traded volumes surged to 4.00bn worth RM2.39bn as compared to 3.02bn worth RM2.10bn on Tuesday. Most of the O&G stocks were topping the active list following a firmer recovery on Brent crude oil prices.

Wall Street ended on a positive tone, extending its winning streak for the third consecutive day led by tech stocks. Also, several economic data has lifted the sentiment further; non defence durable goods rose 0.8% in January (largest increase in 6 months), while US construction spending added 1.3% in January (biggest increase in 9 months). The Dow and S&P 500 rose 0.58% and 0.69%, respectively, while Nasdaq advanced 0.69%.

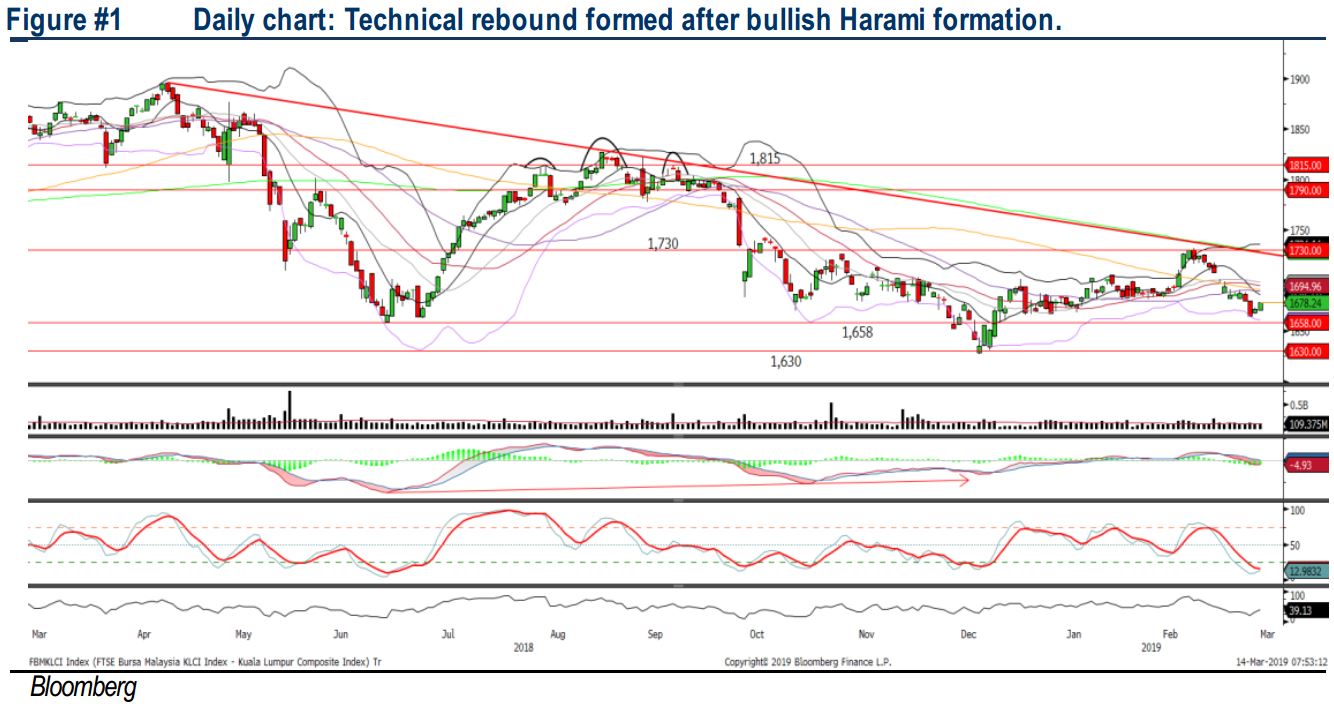

TECHNICAL OUTLOOK: KLCI

After the retracement phase from the recent peak of 1,732 level, it has formed a bullish Harami formation on FBM KLCI. The key index performed a technical rebound and the MACD Histogram has recovered mildly. Meanwhile, both the RSI and Stochastic oscillators have hooked higher in the oversold region. With the slight recovery in momentum, we may anticipate the key index to rebound and retest the near term resistance along 1,700, followed by 1,732. Support will be located around 1,666, followed by 1,650.

Taking cues from overnight positive Wall Street performance, coupled with the firmer crude oil prices on the back of a large US inventories drawdown amid sanctions of stalling exports from Venezuela, we opine that the buying support may spill over towards stocks on the local front amongst tech and O&G stocks.

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to rebound higher and the MACD Line is turning flat above zero. The RSI has crossed above 50, while Stochastic oscillator is trending towards 50. With the decent rebound on most of the technical indicators, we anticipate that the Dow could retes t the 26,000, followed by the 26,343 level over the near term. Meanwhile, support will be located around 25,000.

In view of a potential trade deal to be struck soon (President Trump and President Xi will be meeting face to face in order to iron out the trade details within these two months), coupled with several positive economic data recently, it has stabilized the trading tone at least for the near term. We may anticipate Wall Street to charge higher at least for the near term.

Source: Hong Leong Investment Bank Research - 14 Mar 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024