Traders Brief - Positive Bias on KLCI, Mild Pullback in Small Cap

HLInvest

Publish date: Tue, 19 Mar 2019, 04:53 PM

MARKET REVIEW

Asia’s stock markets ended positively as investors were focusing on the US-China trade developments, where both the US and Chinese officials have commented that the trade discussions have been going on well despite the Trump-Xi summit being postponed. Also, traders were slightly bullish ahead of the FOMC meeting, expecting a dovish stance from the Fed’s officials. The Shanghai Composite Index and Hang Seng Index rose 2.47% and 1.37%, respectively, while Nikkei rose 0.62%.

In tandem with the regional performances, the FBM KLCI further rebounded as expected, adding 0.62% to 1,690.94 pts. Market breadth was slightly negative with 455 decliners vs. 440 gainers, while overall traded volumes fell to 3.26bn, worth RM1.92bn (vs. 4.67bn valued at RM3.67bn last Friday). Mild profit taking activities were seen emerging within small caps and lower liners and FBM Small Cap slipped marginally by 0.16% to 13,080.98 pts.

Wall Street ended on a higher note, posting the 4th day of winning streak led by banks and tech. Also, sentiment was lifted as investors anticipate that the Fed will reinforce its dovish approach on the interest rate outlook. The Dow and S&P500 rose 0.25% and 0.37%, respectively, while Nasdaq added 0.34%.

TECHNICAL OUTLOOK: KLCI

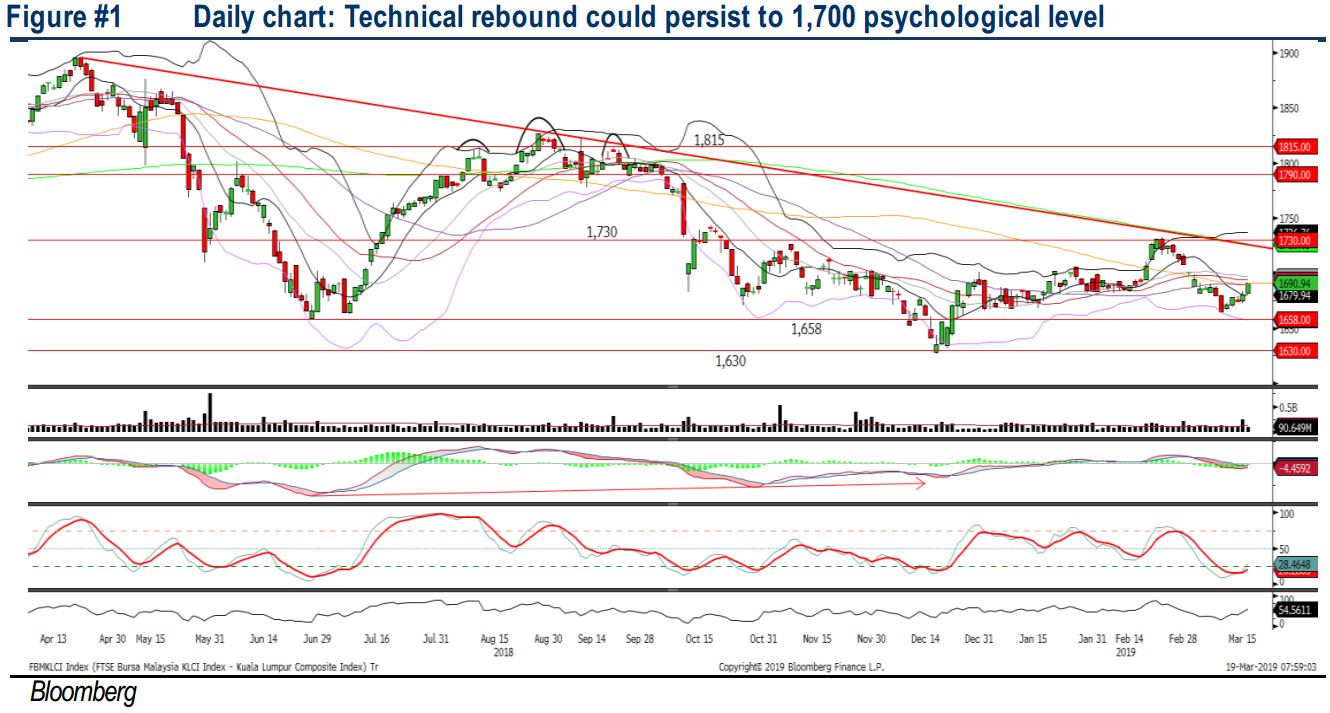

The FBM KLCI advanced further after surging above the resistance of 1,680. Most of the technical indicators (MACD Line and Histogram hooking upwards, while RSI and Stochastic oscillators are trending higher above the oversold region) are suggesting that the short term momentum is positive and may rebound further over the near term. Next resistance will be envisaged around 1,700, followed by 1,730, while support will be anchored around 1,680, followed by 1,666.

Broader market could turn sideways with the emergence of profit taking activities across the small cap stocks and FBM Small Cap has pulled back marginally. Nevertheless, we opine that this retracement phase would be mild given that the upward rally has started since early March and will be view as healthy profit taking mode. Meanwhile, the KLCI is likely to retest 1,700 with the positive short term technical indicators, coupled with inflow of foreign participation over the past two trading days.

TECHNICAL OUTLOOK: DOW JONES

The Dow managed to recover further for another session and could be revisiting the psychological level of 26,000. The MACD Histogram is recovering, in tandem with the MACD Line and both the RSI and Stochastic oscillators are trending higher above 50. Should the Dow surge above 26,000, next resistance will be pegged around 26,343. Support will be located around 25,158 (SMA200), followed by 25,000

With the Dow heading towards the psychological level of 26,000 on the back of easing trade tensions, investors will be looking for more clues in the upcoming FOMC for affirmation of the Fed’s commitment towards a “patient” monetary policy. Should there be any negative surprises from the interest rate outlook and the potential slowdown in the economy, we anticipate the selling pressure may emerge on Wall Street.

Source: Hong Leong Investment Bank Research -19 Mar 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024