QES Group - Cheaper Entry to Automation, Test and Equipment (ATE) Segment With Solid Balance Sheet and Earnings Growth

HLInvest

Publish date: Wed, 20 Mar 2019, 05:27 PM

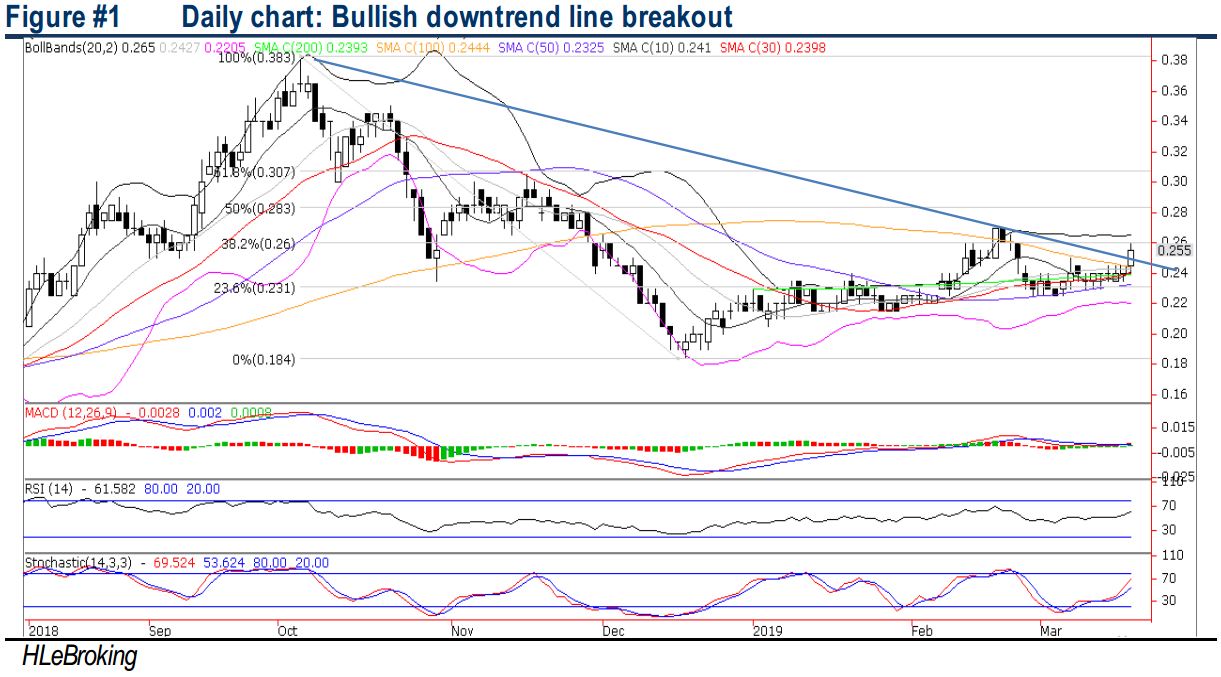

Despite rising 18.6% YTD, we expect QES to advance further towards RM0.27- 0.305 in the medium to long term after staging a bullish downtrend line breakout yesterday, premised on its (i) cheap valuations at 11.8x FY19 P/E (37% discount to peers’ of 18.8x P/E), supported by a strong 22% FY18-20 EPS CAGR and RM53m net cash (28% of market cap); (ii) three new high margins automated products in the pipeline i.e. Fully Automated Vision Inspection System (FAVIS), Automated Wafer Packing System (AWPS) and Automatic Wafer Identification (AWID) to drive its manufacturing segment post FY20; (iii) strong recurring income from its distribution and maintenance businesses (averaging c60-70% to sales); (iv) well-diversified clientele with more than 2400 customers (Malaysia and Asia markets) mainly in the semiconductor, E&E and automotive industries and (v) relatively insensitive to forex fluctuations, as 55-60% of its revenues are quoted in USD with natural hedging from its USD-denominated purchases (c.60%).

Small but commendable. Since its inception in 1991, QES (listed in Mar 2018) has secured over 2,400 customers with over 11,000 units of equipment sold. The group has been established as a distributor for many reputable brands of inspection, test and measurement equipment. The majority of its customers are multinational corporations in the semiconductor, E&E as well as automotive industries. QES started distributing equipment locally and eventually expanded its regional footprint by setting up satellite offices and teaming up with local partners in Singapore, Thailand, Hong Kong (to penetrate China markets), Vietnam and the Philippines. In FY18, Malaysia contributed about 29% to revenue while the rest were exported to the Philippines (17%), Singapore (14%) , Vietnam (12%), Thailand (9%), Indonesia (8%), China (4%) and others (7%).

Stable recurring income stream. Meamwhile, QES also provides after sales service such as training programmes, on-call services that are available around the clock, and periodical maintenance services. With a scheduled maintenance and servicing model which covers the entire life span of the equipment, the company is able to enlarge its recurring income stream.

Markets’ expansion. Besides the 3 core industries (namely semiconductor, E&E and automotive), QES has been activtily penetrating into new market segments, potentially within the higher education institutions, petrochemical, and pharmaceutical industries.

Poised for a triangle breakout. QES has been holding up well above the lower Bollinger band. A successful breakout above the downtrend line yesterday with robust volume of 27.16m shares (4x higher than 3M average) is likely to spur prices towards RM0.27 (21 & 22 Feb high) and RM0.285 (50% FR) levels before reaching our LT objective of RM0.31 (38.2% FR). Meanwhile, key supports are situated at RM0.24 (30D SMA) and RM0.23 (23.6% FR). Cut loss at RM0.225.

Source: Hong Leong Investment Bank Research - 20 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024