Traders Brief - Oversold Situation, KLCI Could be Due for Rebound

HLInvest

Publish date: Tue, 02 Apr 2019, 10:32 AM

MARKET REVIEW

Asia’s stock market ended in a positive note on the back of stronger-than-expected factory activity in China, where Caixin Manufacturing PMI stood at 50.8, while official PMI rose to 50.5 in March. The Shanghai Composite Index and Hang Seng Index advanced 2.58% and 1.76%, respectively, while Nikkei 225 rose 1.43%.

Despite the strong regional performances, the FBM KLCI ended in the negative zone led by banking heavyweights such as Public Bank, Ambank and CIMB amid concerns over a potential OPR cut by BNM moving forward. Market breadth was however slightly positive with 445 gainers vs. 411 losers. Meanwhile, market traded volumes stood at 2.63bn, worth RM1.97bn. Construction sub-indices added 1.05% on the back of comments from Finance Minister on continuation of BN-era projects (worth RM14bn).

Wall Street ended on a bullish tone with the healthy recovery of China factory data, in tandem with the expansion in US factory activity; ISM commented that national factory activity rose to 55.3 in March vs. 54.2 in February. Meanwhile, construction spending rose 1.1% in February has also boosted the market sentiment. The Dow and S&P500 rose 1.27% and 1.16%, respectively, while Nasdaq gained 1.29%.

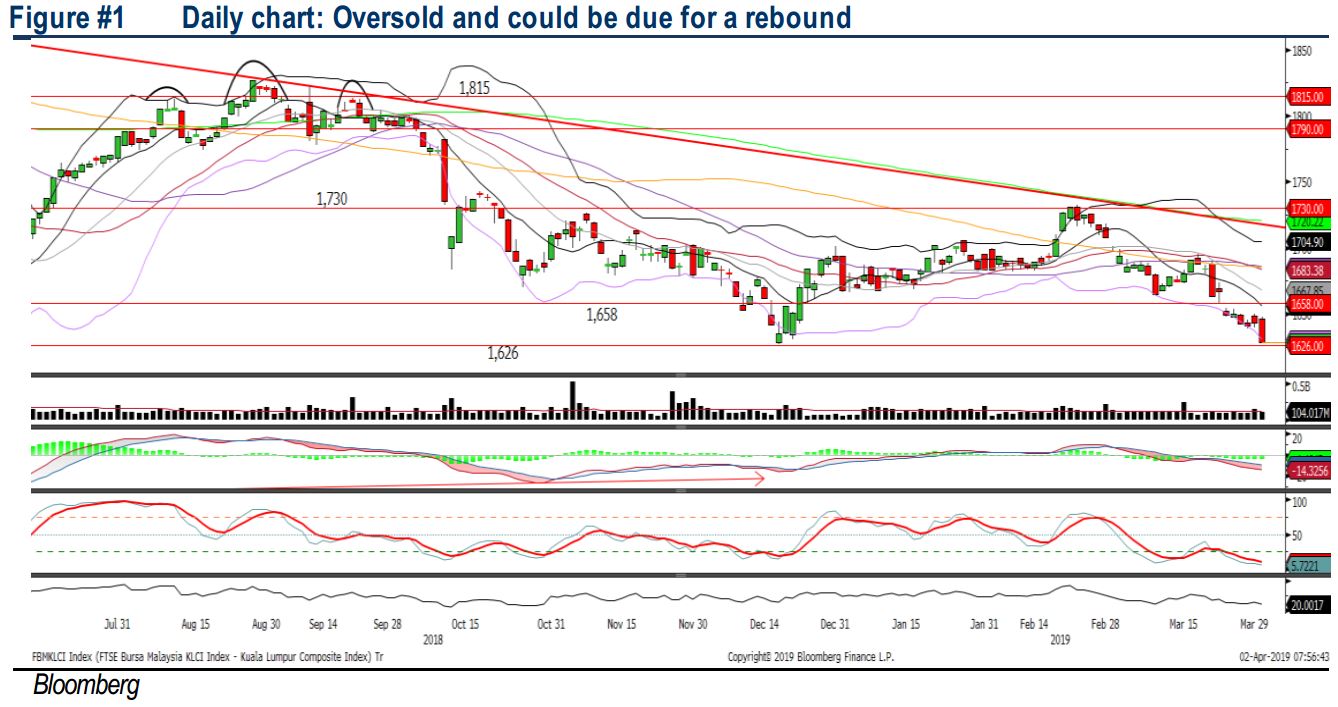

TECHNICAL OUTLOOK: KLCI

The FBM KLCI declined sharply yesterday below 1,640 and the MACD indicator expanded negatively below zero. However, both the RSI and Stochastic oscillators are suggesting that the key index is oversold and could be due for a technical rebound. Hence, we opine that the key index could find support near the 1,626 level (Dec-18 low). Meanwhile, the resistance is envisaged around 1,666-1,680.

With the traders still speculating a potential OPR cut by BNM, we believe the sentiment will continue to drag on banking stocks, eventually limiting upside potential on KLCI. However, with the oversold momentum oscillators, the key index may be due for a technical rebound. Also, traders may focus on construction stocks amid recovering sentiment on construction projects moving forward.

TECHNICAL OUTLOOK: DOW JONES

The Dow surged strongly after breaching above the short term trendline and the MACD indicator has flashed a golden cross; suggesting the truth of the uptrend. The RSI and Stochastic oscillators are improving above 50. We believe the Dow could break above the 26,300 level, targeting the previous all-time high zone around 26,951. Meanwhile, support will be anchored around 26,000.

We believe the trading tone could stay positive over the near term with both the US and China manufacturing data suggesting some improvements in March. Nevertheless, as Chinese officials will be heading to Washington for the trade discussions, should there be any positive surprises; the Dow could even surge towards the previous all-time high zone around 26,951- 27,000.

Source: Hong Leong Investment Bank Research - 2 Apr 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024