Traders Brief 05 Apr 2019 - KLCI to Trend Higher Amid Optimistic Trade Talks

HLInvest

Publish date: Fri, 05 Apr 2019, 07:42 PM

MARKET REVIEW

Asia’s stock markets ended mixed as market participants are monitoring the ongoing trade negotiations between the US and China, which has resumed on Wednesday in Washington, while President Trump will be meeting Chinese Vice Premier Liu He this week. The Shanghai Composite Index rose 0.94%, but Hang Seng Index slipped 0.17%, while Nikkei 225 traded flat. Tracking the gains on overnight Wall Street, the FBM KLCI ended marginally higher by 0.11%. Market breadth was also positive with 435 advancers vs. 397 decliners, accompanied by 3.18bn shares traded for the day (worth RM2.13bn). Besides, we noticed selected IT solutions company like MYEG and HTPADU trended actively higher.

Wall Street traded mostly positive for the session amid optimism on trade discussions between the US and China, coupled with rebounding energy stocks after crude oil prices trended slightly higher yesterday. The Dow and S&P500 rose 0.64% and 0.21%, respectively; the latter marked a 6-day winning streak (longest streak since Feb 2018).

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded over the past three days and the MACD Histogram recovered as MACD Line hooked slightly higher over the few sessions. Meanwhile, the RSI and Stochastic oscillators are trending higher yesterday, suggesting a recovery in momentum. Hence, with the positive bias indicators, we anticipate KLCI to surpass the immediate resistance of 1,648, targeting 1,666, with the support set around 1,626-1,630.

With the still-optimistic progress in the US-China trade discussions, we believe the positive sentiment could spill over towards stocks on the local front. Also, traders may lookout for bashed down banking heavyweights earlier this week as we anticipate the KLCI to extend its technical rebound over the near term. Also, we believe O&G stocks will be focused on the back of firmer crude oil prices.

TECHNICAL OUTLOOK: DOW JONES

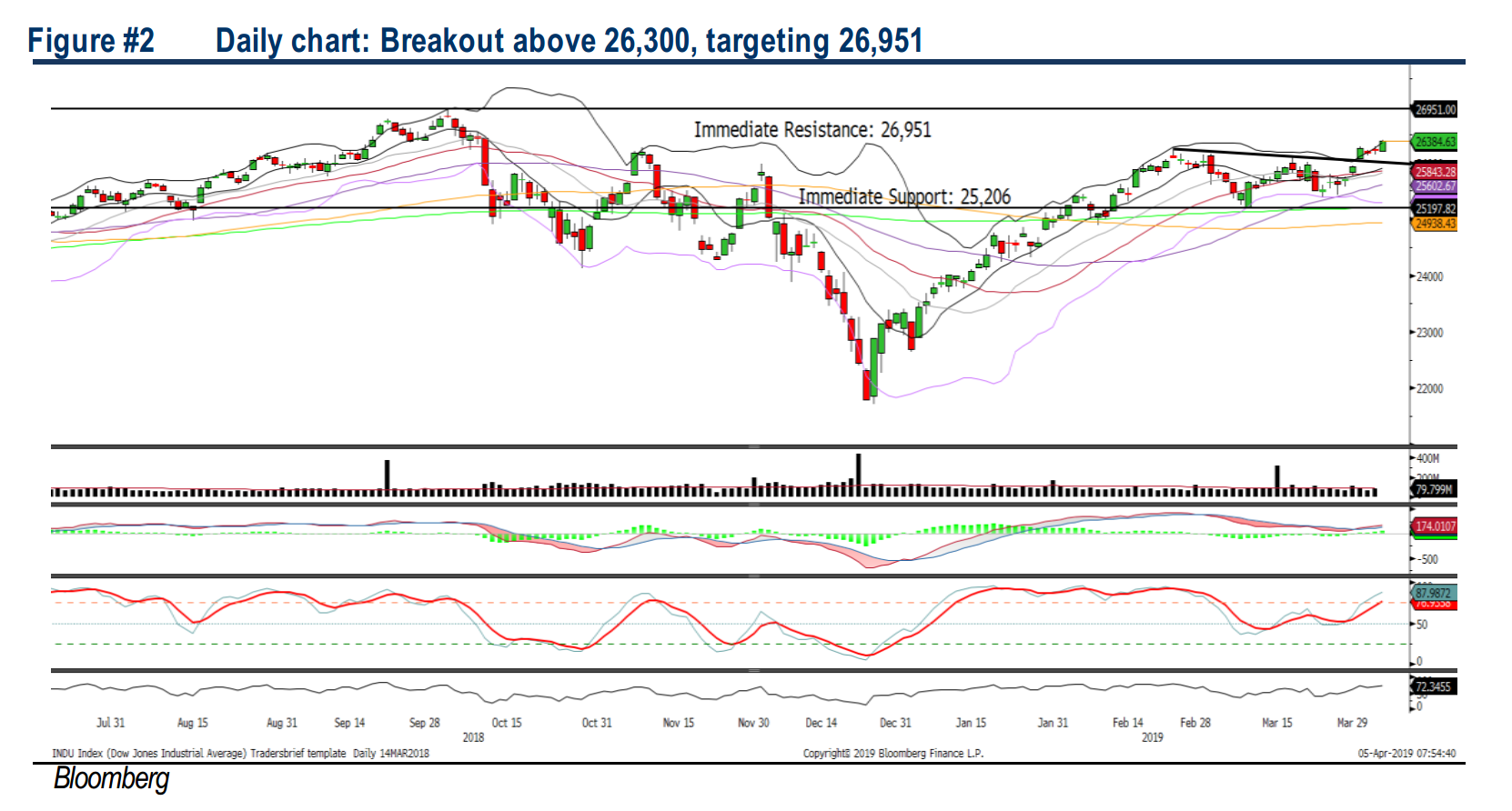

The Dow has surged above the 26,300 resistance yesterday, it could be viewed as a breakout of an inverted head and shoulders formation, which the target maybe located around 26,951 and 27,600, followed by a LT target at 30,900 (provided the support at 25,000 is not violated). The MACD indicator has expanded positively, while both the RSI and Stochastic oscillators are trending higher.

In the US, we opine that the upward move could persist on Wall Street as US and China is closer to strike a deal as President Trump says “we will know in the next four weeks”; providing a timeline to anticipate the summit (with President Xi) to happen. Based on technicals, the Dow could trend higher after surpassing above the 26,300 level, targeting 26,951.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we took profits on two technical trackers picks i.e ECONBHD (20% gain after hitting R2) and HARTA (4.5% return after hitting R1)

TECHNICAL TRACKER: FITTERS

Turning around within the pipes division. FITTERS may perform better in 2019, as its pipes division is on track to receive larger orders, giving rise to economies of scale as Malaysia’s water and waste water infrastructure undergo upgrades, coupled with the central purchase contract from PAAB and commitment of RM50m sales from Unitrade to drive pipes segment’s performance. Meanwhile, the property development & construction division will remain a major contributor due to the construction progress of Azalea@TamanPutra II (RM82m). At RM0.475, valuation at 0.59x P/B is cheap against 10Y 0.7x. With the double bottom formation, we expect FITTERS to advance further towards RM0.50-0.575 after a brief pullback.

Source: Hong Leong Investment Bank Research - 5 Apr 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024