Traders Brief - Consolidation Phase, But Downside Limited for Now

HLInvest

Publish date: Thu, 11 Apr 2019, 05:49 PM

MARKET REVIEW

Asia’s markets edged down on Wednesday amid fresh concern over the outlook for the global economy, after IMF slashed its global economic growth forecast once again to 3.3% in 2019 from 3.6% previously and maintained the 2020 growth forecast of 3.6%. Besides, sentiment was dampened further by the US-EU trade tensions between the US and EU as Trump administration moved toward imposing tariffs on about USD11bn in imports from the EU, in response to the block's subsidies for aircraft maker Airbus.

Tracking lower closings on Dow overnight and regional markets, KLCI lost 2.4 pts after fluctuated between an intra-day high of 1645.6 and a low of 1639.2 while the FBMSCAP and FBMACE indices still closed positively with 1.4-pts and 0.4-pts gains, respectively. Market breadth was negative with 390 gainers as compared to 430 losers amid profit taking activities . Trading volume decreased to 3.47bn shares worth RM2.36bn as compared to Monday’s 3.84bn shares worth RM2.40bn.

The Dow continue to drop as much as 50 pts as investors braced for the start of a weak 1Q19 results season this week (widely expected to drop 3% YoY for the S&P 500 companies) and the increased trade tensions between the US-EU. However, the index managed to claw back to positive territory with a 6-pt gain at 26157 as the minutes from the Federal Reserve’s March meeting reassured investors that the central bank is in no hurry to resume raising interest rates.

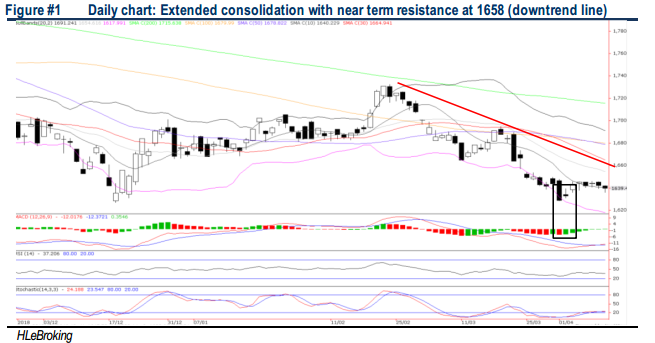

TECHNICAL OUTLOOK: KLCI

Given that the formation of Homing Pigeon candlestick last week, KLCI is still able to gain higher in the short term, barring any breakdown below 5D low of 1635, as a close below this level will trigger more downside towards 52W low of 1627. Conversely, a strong breakout above 1644 (100H SMA) will spur index higher towards 1650-1658 levels.

Consolidation Phase, But Downside Limited for Now

MARKET REVIEW

Asia’s markets edged down on Wednesday amid fresh concern over the outlook for the global economy, after IMF slashed its global economic growth forecast once again to 3.3% in 2019 from 3.6% previously and maintained the 2020 growth forecast of 3.6%. Besides, sentiment was dampened further by the US-EU trade tensions between the US and EU as Trump administration moved toward imposing tariffs on about USD11bn in imports from the EU, in response to the block's subsidies for aircraft maker Airbus. Tracking lower closings on Dow overnight and regional markets, KLCI lost 2.4 pts after fluctuated between an intra-day high of 1645.6 and a low of 1639.2 while the FBMSCAP and FBMACE indices still closed positively with 1.4-pts and 0.4-pts gains, respectively. Market breadth was negative with 390 gainers as compared to 430 losers amid profit taking activities . Trading volume decreased to 3.47bn shares worth RM2.36bn as compared to Monday’s 3.84bn shares worth RM2.40bn. The Dow continue to drop as much as 50 pts as investors braced for the start of a weak 1Q19 results season this week (widely expected to drop 3% YoY for the S&P 500 companies) and the increased trade tensions between the US-EU. However, the index managed to claw back to positive territory with a 6-pt gain at 26157 as the minutes from the Federal Reserve’s March meeting reassured investors that the central bank is in no hurry to resume raising interest rates.

TECHNICAL OUTLOOK: KLCI

Given that the formation of Homing Pigeon candlestick last week, KLCI is still able to gain higher in the short term, barring any breakdown below 5D low of 1635, as a close below this level will trigger more downside towards 52W low of 1627. Conversely, a strong breakout above 1644 (100H SMA) will spur index higher towards 1650-1658 levels.

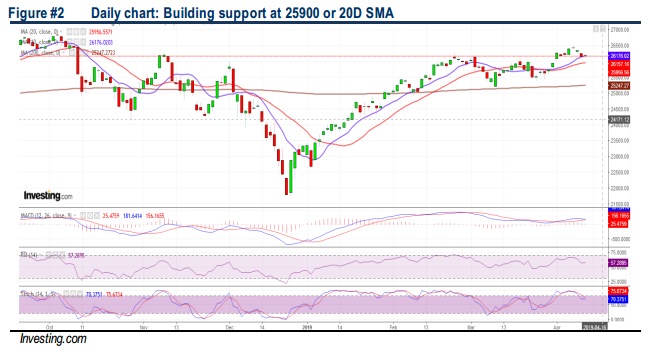

TECHNICAL OUTLOOK: DOW JONES

The Dow has retreated from the recent high of 26487 (5 Apr), and the MACD indicator is weakening over the past few sessions. Also, the RSI is trending lower (but above 50), while the Stochastic oscillator is trending lower after suggesting that the key index is overbought last week. The Dow’s upside will be capped along 26487 and all-time high at 26952 (3 Oct 2018). Support will be anchored around 26247 (SMA200), followed by 25000.

Market participants could be staying cautious ahead of the corporate earnings season this week, as consensus are expecting a 3% YoY drop in S&P 500 companies, the first since 2016. Moreover, fresh concerns over the US-EU trade tensions as well as the latest IMF’s downgrade of global economic growth could further dampen the sentiment on stock markets, capping the upside move after a decent rebound in the previous weeks on the back of fading worries on US-China trade disputes. The Dow’s resistance will be set along 26487-26952.

2Q19 RETAIL STRATEGY: Volatile and Newsflow-driven Quarter

The lingering worries on trade war uncertainties, slower economic growth potential and inverted yield curve may continue to dampen the market tone moving forward. However, we see potential catalysts such as (i) recovering firmer Brent oil prices, (ii) optimism in construction sector, (iii) export-oriented companies amid weakening bias USD/MYR trend and (iv) defensive (consumer) and high dividend yielding corporates. Hence, we believe retailers will need to cherry-pick stocks for potential winners under the abovementioned sectors. We like (i) O&G: SAPNRG, EATECH, (ii) construction: KIMLUN, KERJAYA, TRC, GFM, (iii) export-oriented: SUPERMAX and (iv) defensive: DKSH, UCHITEC.

Source: Hong Leong Investment Bank Research - 11 Apr 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024