Traders Brief - Awaiting Fresh Leads in the Market

HLInvest

Publish date: Fri, 17 May 2019, 10:45 AM

MARKET REVIEW

Asia’s stock markets ended mixed as President Trump declared a national emergency over threats against American technology and the Trump administration hit Chinese telecoms giant Huawei with severe sanctions on Wednesday. The Nikkei 225 fell 0.59%, but Shanghai Composite Index rose 0.58%, while Hang Seng Index traded flat for the day.

Meanwhile, the FBM KLCI ended lower for the session in view of the intensified trade tensions; the key index fell 0.76% to 1,599.19 pts. Market breadth was negative as decliners outpaced advancers by a ratio of 2-to-1, accompanied by softer volumes at 2.03bn, worth RM1.71bn as compared to 2.55bn (worth RM2.12bn) shares traded for Wednesday. Nevertheless, selected construction stocks such as HSS Engineers and Gadang traded higher.

Wall Street ended on a positive note, marking the third day of winning as upbeat results from Walmart and Cisco managed to offset the ongoing concerns on the uncertain trade developments. The Dow and S&P500 rose 0.84% and 0.89%, while Nasdaq added 0.97%. Meanwhile, WTI crude oil prices spiked 1.37% amid the Middle East tensions.

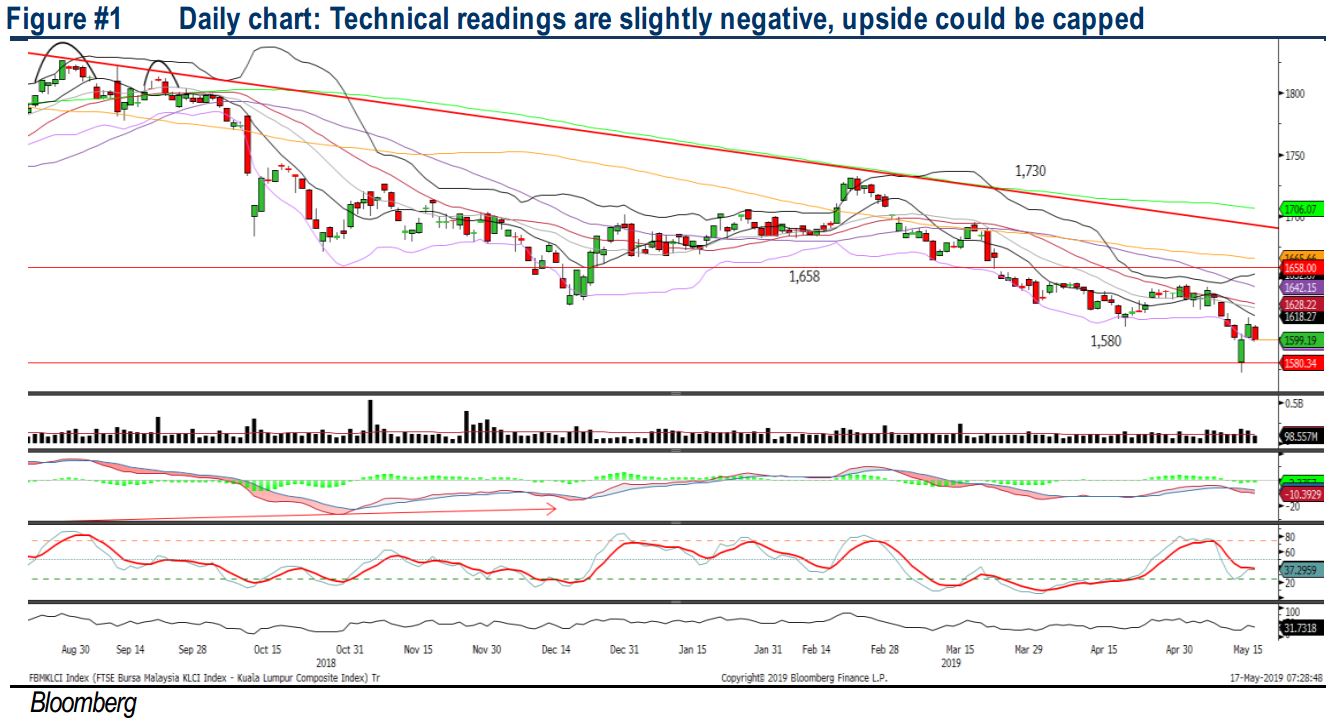

TECHNICAL OUTLOOK: KLCI

After a two-day rebound on KLCI, profit taking activities emerged and the key index ended below 1,600. The MACD Line is still hovering below zero and the MACD Histogram weakened mildly yesterday. Also, both of the RSI and Stochastic oscillators are still hovering below 50 (albeit slight rebound previously). Hence, with the negative technical readings on KLCI, resistance is envisaged around 1,630-1,640, while support will be located around 1,570-1,580.

With the escalating trade tension amid the unsettled disputes between the US and China, we believe it may suppress the buying interest on the local front. In addition, the foreign trade outflows remained persistent over the past few months, which YTD has accumulated around RM3.9bn of outflow and this may continue to weigh on the stock market. Hence, the FBM KLCI’s resistance could be located around 1,630-1,640.

TECHNICAL OUTLOOK: DOW JONES

The Dow has formed a 3-day winning streak after flirting along SMA200, but the MACD Line is still hovering below zero. Despite both RSI and Stochastic oscillators have recovered over the past two sessions, both the oscillators are still hovering below 50; suggesting that the upside may be limited. Next resistance will be pegged around 26,000, followed by 26,500. Meanwhile, support will be located around SMA200 (25,426), followed by 25,000.

Without any negative headlines on the trade progress, buying interest may sustain over the near term and market participants will be focusing on results and outlook guidance on corporates. However, President Trump has given a projection that the trade deal could be announced within the next 3-4 weeks and should there be any disappointment on this, the Dow’s upside could be capped around 26,000.

TECHNICAL TRACKER: CLOSED POSITION

Closed position: Yesterday, we had closed our technical tracker position - HSSEB (8.5% gain) after hitting R2.

Source: Hong Leong Investment Bank Research - 17 May 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024