Traders Brief - Overnight Slump on Dow Could Check Further Gains

HLInvest

Publish date: Thu, 30 May 2019, 10:00 AM

MARKET REVIEW

Asian markets ended mostly lower, tracking overnight 0.9% fall on Dow amid heightened US China trade angst as Trump said the US was “not ready” to strike a deal with China and added that tariffs on Chinese imports could go up “substantially.” Sentiment was also jeopardized by the US Treasury’s statement that put China, Germany, Italy, Ireland, Japan, South Korea, Malaysia, Vietnam and Singapore as watch lists for potential currency manipulation.

Bucking lower regional markets, KLCI jumped 9.1 pts or 0.56% to 1623.67, powered by Tenaga, PMETAL, IHH, PETGAS and DIGI as BNM said there are no consequences for the Malaysian economy from the country’s inclusion the US Treasury’s monitoring list of potential currency manipulator as the central bank stated that Malaysia supports free and fair trade, and does not practise unfair currency practices. Sentiment was further boosted by the upgrades from UBS (from Neutral to overweight) and HSBC (to Neutral from Underweight) on Malaysian equities, saying its stock market displays “defensive” qualities that could withstand an escalation in the US-China trade war.

Dow slid 221 pts at 25126 (rebounded from -410 pts intraday) amid worries of a protracted US China trade war would crimp global growth and pushed investors into the safety of government bonds, which has led to an inversion of the yield curve between 3-month bills and 10-year Treasury notes, a precursor to a possible recession. Sentiment was also dampened by news that Beijing could use rare earth elements to strike back after Trump remarked on Monday. Rare earths are a group of 17 chemical elements used in everything from high-tech consumer electronics to military equipment.

TECHNICAL OUTLOOK: KLCI

After plunging 11.8% or 205 pts from YTD high of 1732.3 (22 Feb) to a low of 1572 (14 May), KLCI finally staged a 3.3% or 51 pts relief rally to end at 1623.7 on 29 May, and staying above the downtrend line resistance. This, together with the bottoming up indicators would bode well for further rebound towards 1633 (38.2% FR) levels, with stiffer resistance at 1652 (50% FR). Key supports are situated at 1610 (23.6% FR) and 1600 territory.

Despite escalating US-China trade tensions and relentless foreign selloff, Bursa Malaysia remains resilient as the benchmark KLCI still managed to stand firmly above the 1600 psychological support and breached above the downtrend line yesterday. Given an extended uncertainty, we opine that gloves sectors (on the back of weakening ringgit) and oil & gas stocks (amid firmer oil prices) coupled with the defensive pharmaceutical companies are likely to stay in focus.

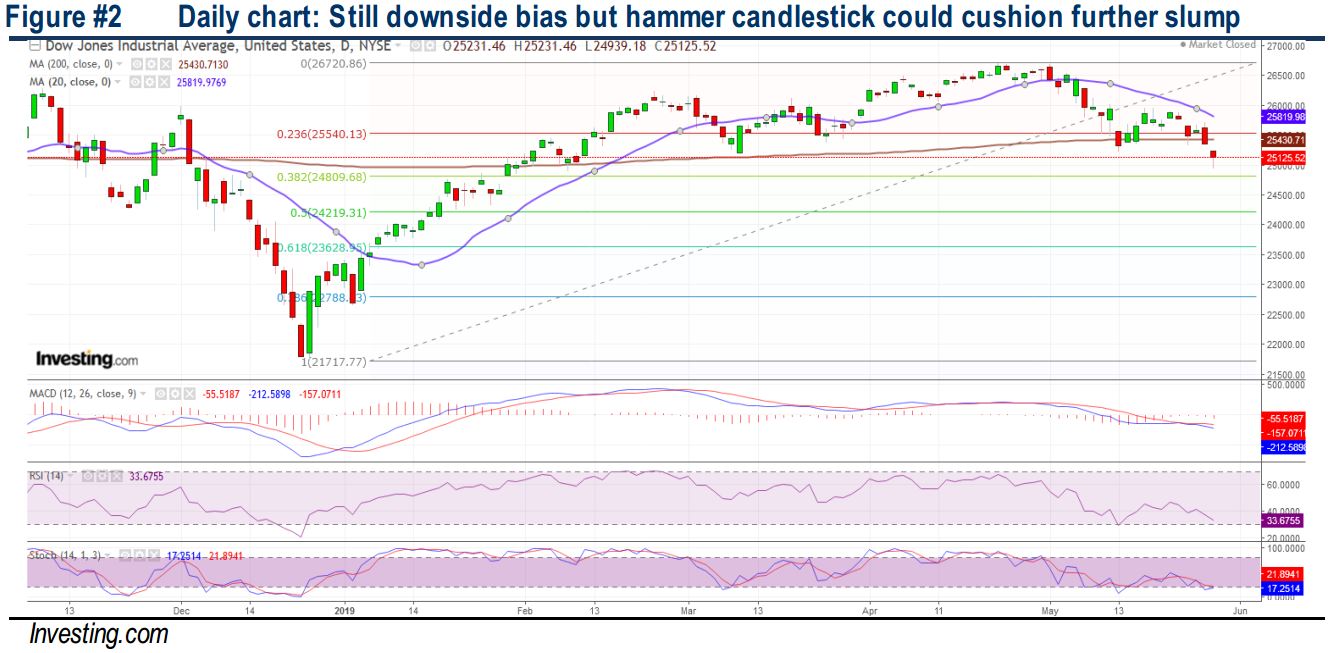

TECHNICAL OUTLOOK: DOW JONES

The Dow has declined below the SMA200 (near 25430) for another session but managed to rebound from intraday low of 24939 (-410 pts) to end at 25126 (-221 pts), forming a hammer candlestick that could signal potential downtrend reversal given the grossly oversold indicators. Nevertheless, most of the indicators remained weak, suggesting that the key index is still on downward bias before staging a technical rebound. Key supports are 24900/24500/24200 while resistances are pegged around 25500/25800/26000.

Overall, market volatility will prevail as the lengthy US-China trade war kept risk appetite in check, although on a less fierce magnitude after the recent rout (-5.9% from YTD high of 26696 on 23 Apr). Investors are monitoring closely any trade developments before the G20 summit on 28-29 June and are hoping for some form of trade progress to be struck soon. The Dow’s resistance is set around 25500-26000 level, while supports fall on 24500-24900 zones.

TECHNICAL TRACKER: SUPERMAX

Beneficiary of weaker ringgit. SUPERMAX is a gloves manufacturer that has expanded its revenue stream, by diversifying towards contact lens business since 2016. In addition, the weaker ringgit may translate to better earnings moving forward for the company and trading activities could pick up on export-oriented stocks over the near term. Technically, SUPERMAX has surged above the downward trendline, coupled with positive ADX signal, targeting RM1.87-2.15, while support will be set around RM1.52-1.57, with a cut loss point located around RM1.50.

Source: Hong Leong Investment Bank Research - 30 May 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024