Supermax Corporation - Beneficiary of Weaker Ringgit

HLInvest

Publish date: Thu, 30 May 2019, 10:03 AM

SUPERMAX is a glove manufacturer that has expanded its revenue stream, by diversifying towards contact lens business since 2016. In addition, the weaker ringgit may translate to better earnings moving forward for the company and trading activities could pick up on export-oriented stocks over the near term. Technically, SUPERMAX has surged above the downward trendline, coupled with positive ADX signal, targeting RM1.87-2.15, while support will be set around RM1.52-1.57, with a cut loss point located around RM1.50.

Gloves manufacturer with steady growth. SUPERMAX is a leading international manufacturer (export to over 160 countries, such as the US, EU, Middle East, Asia and South Pacific countries), distributor and marketer of high-quality medical gloves. It has 12 factories manufacturing various types of natural rubber and nitrile latex glove.

Diversified into contact lens business. Since 2016, SUPERMAX diversified and became Malaysia’s very first home-grown contact lens manufacturing company. It has successfully commissioned its manufacturing facility in Malaysia after carrying out extensive R&D activities in the UK. With its very own brand, AVEO and the global trade name AveoVision, it is exported to Europe, Japan, North America, Latin America, Middle-East, West Africa, South Korea, South Asia, Eastern Europe and Asia-Pacific Countries.

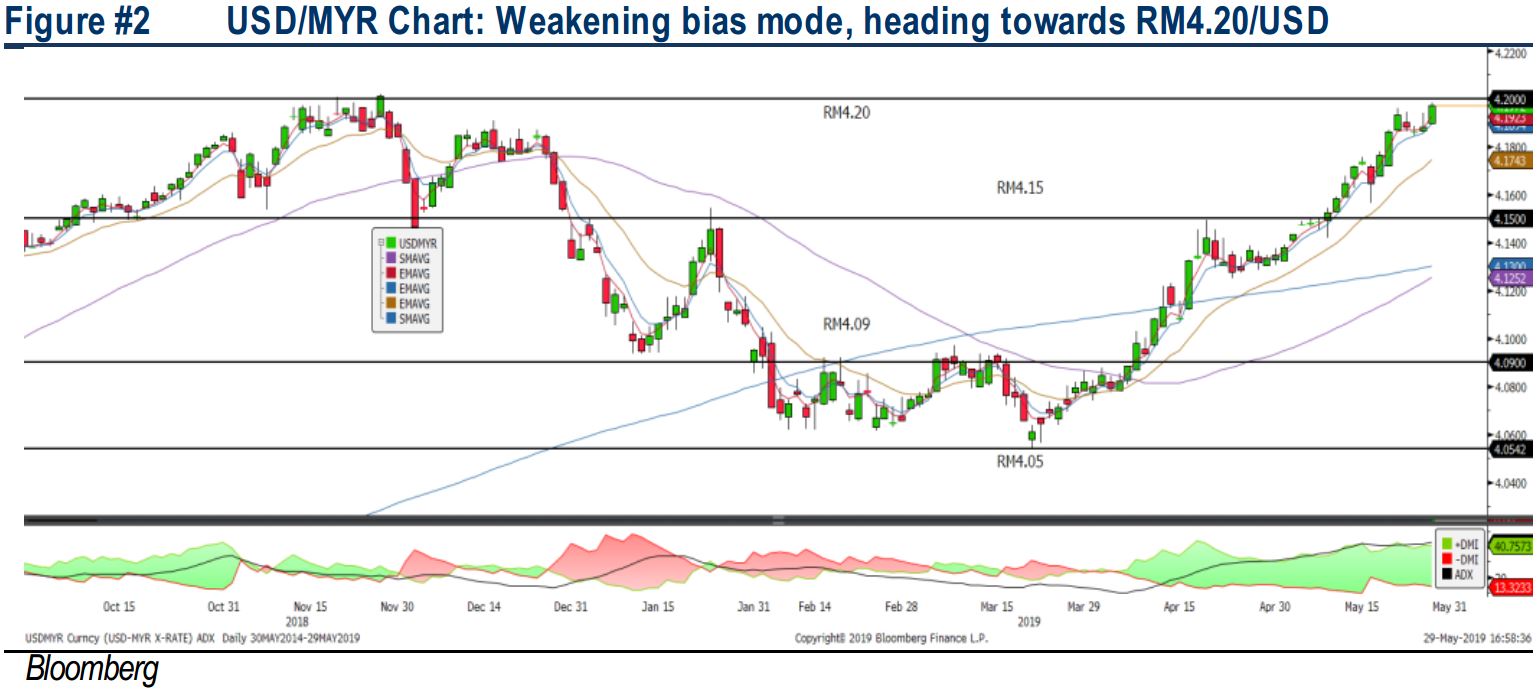

Beneficiary of weakening ringgit. With the ringgit trading near RM4.20/USD, we believe it may translate to better earnings for the company and investors are likely to take some exposure within the export-oriented sector such as gloves in the near term.

SUPERMAX formed a downtrend line breakout. After forming a breakout above the RM1.52 on 15th of May following the release of quarterly results, the trend has turned more positive surpassing the downward trendline. The –DMI has crossed below the ADX; suggesting that SUPERMAX may surge over the near term to retest the resistance around RM1.87-RM2.00, followed by a LT target at RM2.15. Support will be anchored around RM1.52-1.57 and cut loss will be set below RM1.50.

Source: Hong Leong Investment Bank Research - 30 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024

GTMS

shit analysis

2019-05-30 10:07