Traders Brief - Upside Could be Capped Near 1,640-1,650

HLInvest

Publish date: Fri, 31 May 2019, 09:54 AM

MARKET REVIEW

Tracking the overnight losses in Wall Street, coupled with some threatening statements from China as well as inverted yield curve phenomenon between the 3-month and 10-year bond, Asia’s stock markets ended lower; the Shanghai Composite Index and Hang Seng Index fell 0.31% and 0.44%, respectively, while Nikkei 225 lost 0.29%.

Meanwhile, most of the stocks on the local front continue to surge higher after a few international banks (HSBC and UBS) upgraded Malaysia’s equities as well as positive foreign inflows (+RM150.8m) yesterday. Market breadth was positive with 513 gainers vs. 366 losers, accompanied by 2.47bn, valued at RM2.67bn. Meanwhile, selected O&G stocks such as DAYANG, PERDANA and CARIMIN were topping the actives list.

The protracted trade dispute between the US and China, coupled with the 10-year bond yield that has declined significantly in May (causing an inverted yield curve between the 3-month and 10-year bond yield) have raise concerns over a potential slowdown in economic activities moving forward. However, the revised 1Q19 US GDP stood at 3.1%, (slightly higher than consensus of 3%) has led to a minor recovery on Wall Street; the Dow and S&P500 added 0.17% and 0.21%, respectively.

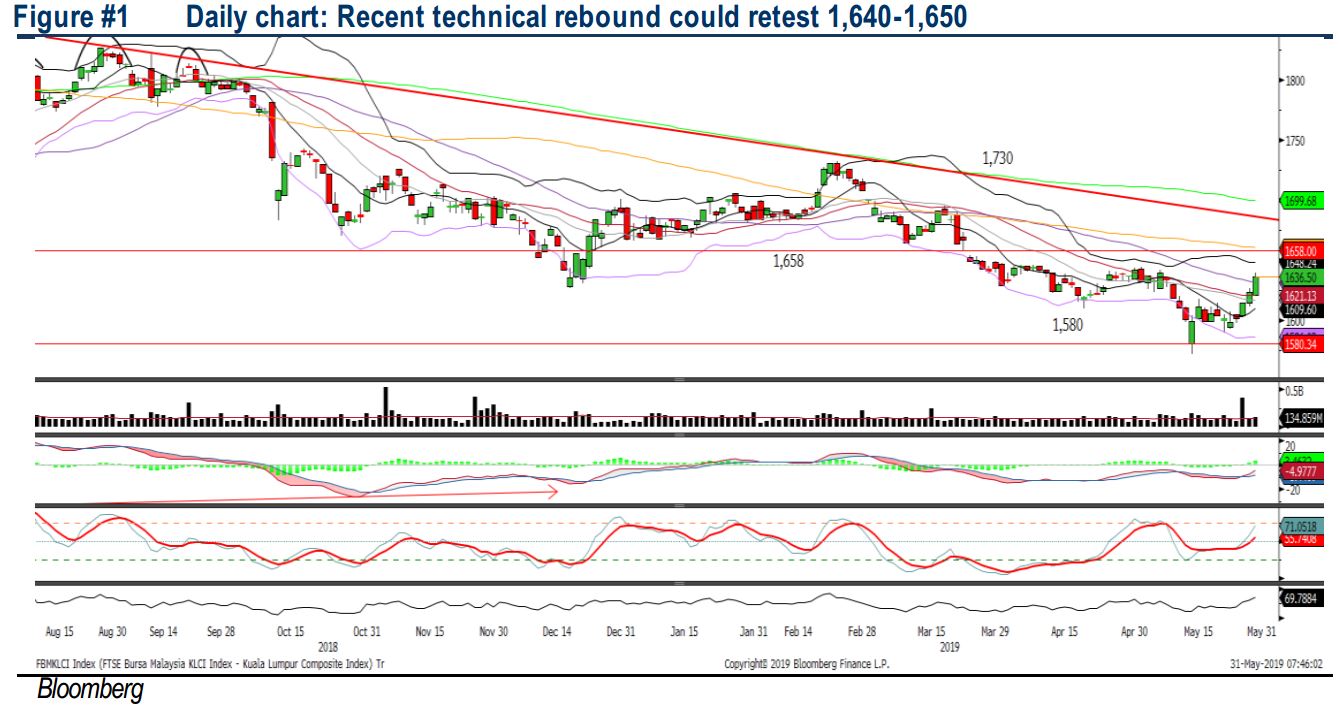

TECHNICAL OUTLOOK: KLCI

The FBM KLCI managed to recover fairly well above the 1,600 psychological level. Also, most of the indicators are slightly positive at this juncture. The MACD Line is recovering towards zero, while both the RSI and Stochastic oscillators are trending above 50; indicating that the momentum is positive. Hence, it could revisit the resistance along 1,640-1,650, while support will be pegged around 1,600.

Despite the mildly positive Wall Street, coupled with the recent upgrade on Malaysia’s equities by the foreign banks, we believe the technical rebound on KLCI may be limited around 1,640- 1,650 as tweet from President Trump regarding the 5% tariffs on Mexico products may dampen the market sentiment regionally, eventually leading to profit taking activities on KLCI. Nevertheless, traders may focus on export-oriented segment on the back of weaker ringgit tone around RM4.20/USD.

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded mildly yesterday, but still hovering below the SMA200 at 25,430. The MACD Line is threading below zero, while the Stochastic oscillator is oversold. Hence, we believe the Dow could be due for a short term technical rebound, but upside likely to be capped around 25,430, followed by 26,000. Support will be set along 24,500.

Meanwhile, we believe sentiment on Wall Street will remain weak as China has put a pause to buy American soy amid the escalated trade tensions between the US and China. Also, traders would trade on a cautious tone ahead of several major events such as June Fed meeting and the G20 summit, where traders could monitor the interest rate outlook and progress between President Trump and President Xi on the trade front, respectively. Hence, the Dow could range between the 24,500-26,000 levels in the near term.

TECHNICAL TRACKER: DRB-HICOM

Riding on the Proton’s revival. We expect DRB to continue report earnings improvement, where recovering trend was observed in its 2HFY19 results, leveraging on Proton’s turnaround momentum following the participation of Geely as Proton’s Foreign Strategic Partner. Following X70 launch, Proton has been reporting strong sales growth and the positive momentum is likely to continue ahead of the exciting models lined up in 2019-2020. Moreover, Proton’s new plant commencement by Sep 2019 will allow it to manufacture “next Generation” Proton models and further improving its cost structure. Technically, the stock is poised for a downtrend resistance breakout soon, to lift prices towards RM2.09-2.29 in the short to mid term.

Source: Hong Leong Investment Bank Research - 31 May 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024