Traders Brief - Short Term Uptrend May Revisit 1,666

HLInvest

Publish date: Fri, 07 Jun 2019, 11:09 AM

MARKET REVIEW

Although Wall Street ended on a strong note, Asia’s stock markets closed mixed as market participants were pricing in possibilities that the US Federal Reserve to slash interest rates this year on the back of the ongoing trade war and Jerome Powell said US central bank will monitor on domestic economy and do what it must to “sustain the economy”. The Shanghai Composite Index fell 1.17%, but Hang Seng Index added 0.26%.

The FBM KLCI ended lower by 0.68% to 1,644.09 pts on Tuesday on a shortened trading session. Market breadth was fairly neutral and was accompanied by 1.0bn shares traded for the session, worth RM1.01bn. Nevertheless, selected export-driven stocks such as SUPERMAX and LIIHEN traded higher on Tuesday. Meanwhile, local exchange was closed for Hari Raya break for the two days.

Wall Street continues to trend higher following the resumption of US-Mexico trade talks yesterday, after failing to reach an agreement on Wednesday. Also, the earlier surge was due to more accommodative stance by the Fed, signalling that the central bank was open to easing monetary policy to save the economy. The Dow and S&P500 climbed 0.71% and 0.61%, respectively, while Nasdaq rose 0.53%.

TECHNICAL OUTLOOK: KLCI

Although the FBM KLCI has taken a mild breather on Tuesday, the MACD Line is hovering above zero. However, both the RSI and Stochastic oscillators are within the overbought region; indicating that the upside could be limited. The resistance is located around 1,666, while support is pegged around 1,640.

Tracking the positive surge on Wall Street over the past two trading days, we opine that the buying support could spill over to local equities, especially KLCI members on the back of positive foreign trade inflows recently. Also, the recent bashed down small caps may head for a slight recovery amid the recovering sentiment and we believe export-oriented stocks will still be favourable on the back of weaker ringgit bias. The KLCI’s resistance is located around 1,666.

TECHNICAL OUTLOOK: DOW JONES

After the Dow formed a Doji candle on Monday, it has rebounded strongly for three days and surged above SMA200 (25,426). Meanwhile, the MACD indicator has issued a positive cross, while RSI and Stochastic oscillators are trending positively over the past few sessions. The next resistance is envisaged around 26,000-26,200. Support will be set around 25,000.

In the US, we believe the upside potential could be seen over the near term on the back of statements from the Fed to support the economy (market participants could be pricing a rate cut moving forward this year), accompanied by decent trade talks between the US and Mexico. In addition, traders will be monitoring closely on any developments ahead of the G20 summit, where President Trump and President Xi May meet and discuss on trade issues.

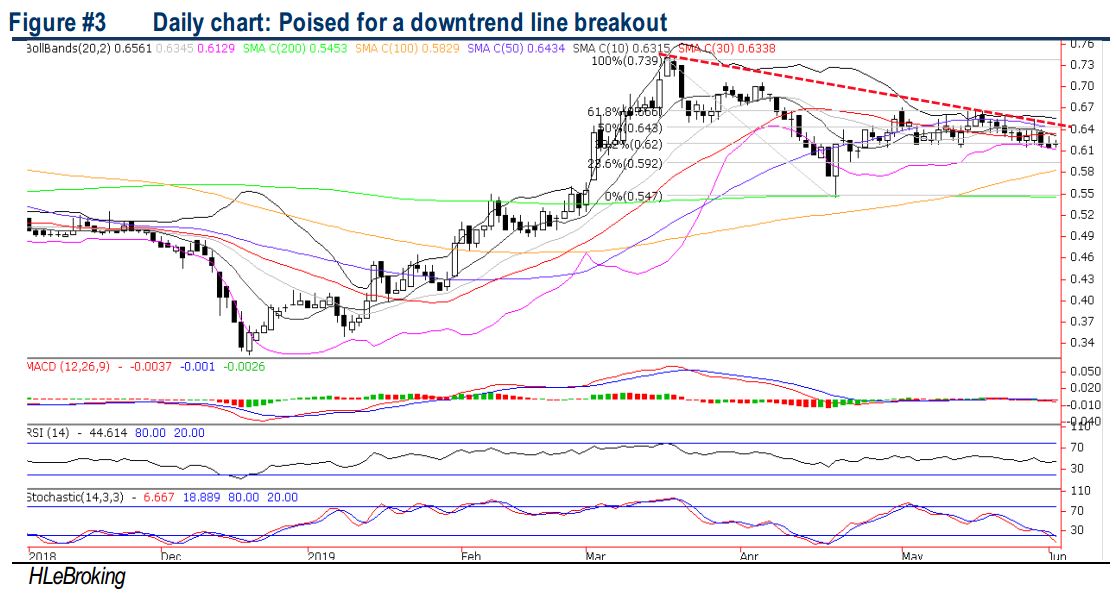

TECHNICAL TRACKER: BAHVEST

A direct proxy to the soaring gold prices. If executed well, Bahvest is expected to stage an explosive 359% FY19-21 EPS CAGR surge to consensus FY21 EPS of 6.4sen (FY19 0.3sen), mainly driven by the booming mining business (replacing the weakening aquaculture operations amid intense competitions from China producers). Moreover, Bahvest is a direct proxy to the more promising gold outlook as investors are now returning to the traditional safe haven, thanks to the protracted US-China trade war, rising geopolitical tensions, heightened fears of a global downturn coupled with sliding bond yields amid growing expectations for a Fed rate cut in 2H19. Valuation is undemanding at 15.9x FY3/20 P/E, 69.5% lower than 2Y average of 52.1x. Technically, the stock is ripe for a downtrend resistance breakout near RM0.645, before advancing further towards RM0.665-0.74 zones.

Source: Hong Leong Investment Bank Research - 7 Jun 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024