WTI - Downside bias ahead of the OPEC meeting (25-26 June) and G20 summit (28-29 June)

HLInvest

Publish date: Thu, 13 Jun 2019, 11:36 AM

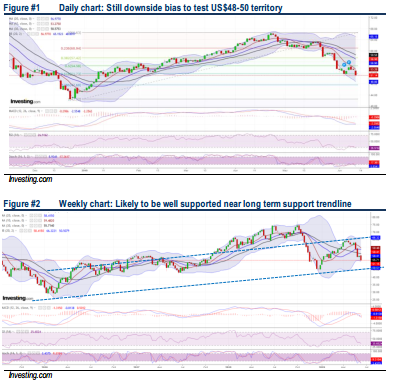

WTI sank 4% to a 5M low at US$51.1 (-23.3% from YTD high of US$66.6 on 23 Apr) after U.S. crude stockpiles jumped for the 2nd week in a row, as the market continues to grapple with concerns about weakening fuel demand due to the escalating US-China trade war. The US commercial crude inventories rose by 2.2m/barrels in the week through 7 June (consensus: -480k barrels), according to the U.S. Energy Information Administration (EIA). Technically, WTI further selldown towards US$48-50 levels unless prices can swiftly reclaim above the US$53-54 trajectory.

US commercial crude inventories increased. Crude inventories rose by 2.2m/barrels in the week through 7 June (consensus: -480k barrels), according to the U.S. Energy Information Administration (EIA). The primary concerns are increasing crude supplies from U.S. and the U.S.-China trade dispute may lead to decelerating global growth and weigh on oil demand.

Choppiness prevails with key supports at US$48-50 levels. Following the 57% rally from Dec low of US42.4 (24 Dec) to a high of US$66.6, WTI has fallen 23% to end at US$51.2 yesterday. We see further near term downward consolidation amid negative technical and prices are hovering below 10D/20D/30D SMAs with key supports at US$48-50. More solid support is the long term support trend line at US$46. Stiff resistances are pegged at US$53.3-55 levels.

Source: Hong Leong Investment Bank Research - 13 Jun 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024