Traders Brief - Sentiment to Turn Positive Following Trump’s Tweet

HLInvest

Publish date: Wed, 19 Jun 2019, 10:44 AM

MARKET REVIEW

Without any significant progress on the trade front throughout Asian market trading hours, market participants were focusing on the FOMC meeting and ECB President Mario Draghi’s comments, stating that the European central bank may provide more stimulus, either via fresh rate cuts or asset purchases, if inflation does not pick up and it has contributed to some buying interest in selected Asian markets. The Nikkei 225 declined 0.72%, while Shanghai Composite Index and Hang Seng Index increased 0.09% and 1.00%.

On the local front, the FBM KLCI managed to rebound higher by 0.88% to 1,652.76 pts after the recent healthy retracement, tracking selected gains on the regional markets. Market breadth was however negative with 428 decliners vs. 357 gainers. Market traded volume stood at 2.03bn worth RM1.72bn. Meanwhile, we noticed selected export-oriented stocks such as Karex and VS Industry traded actively higher.

Wall Street surged strongly on Tuesday after President Trump commented that his meeting with President Xi will continue in the upcoming G20 summit and it has lifted the market sentiment. Moreover, investors were hoping that the Fed could ease the monetary policy later this year. The Dow and S&P500 jumped 1.35% and 0.97%, respectively, while Nasdaq advanced 1.39%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI experienced a flag formation breakout above 1,646 and may retest the immediate hurdle along 1,658. The MACD Histogram has recovered mildly in tandem with the MACD Line which is hovering above zero. The Stochastic oscillator, however is hovering in the overbought region. Next resistances are located around 1,666, followed by 1,680. Support will be set along 1,615-1,630.

With the new information regarding the trade front resurfacing in the media, where President Trump and President Xi will be having meeting in the upcoming G20 summit, coupled with ECB highlighting that they may provide further stimulus moving forward, we believe market may trend higher over the near term. Hence, the FBM KLCI could retest the 1,666-1,680.

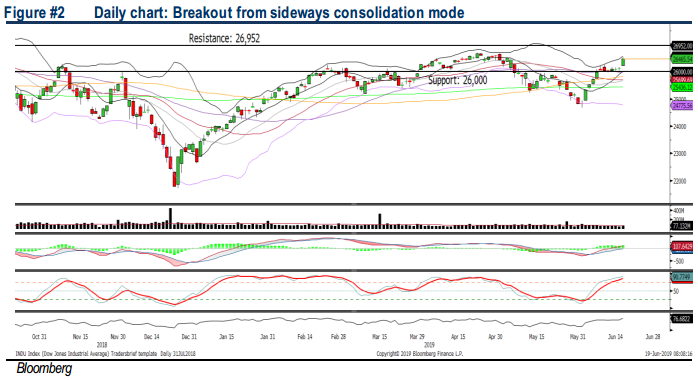

TECHNICAL OUTLOOK: DOW JONES

After a 6-day sideways consolidation phase, the Dow has successfully broken out above 26,250 and retested 26,500 resistance yesterday. The MACD indicator continues to trend higher above zero, suggesting that the positive momentum is intact. Meanwhile, the Stochastic oscillator is overbought. Resistance will be set around 26,700-26,952 (all-time-high), while support is pegged around 26,000.

Following the telephone conversation between President Trump and President Xi, providing some assurance that an extended discussion will take place in G20 summit next week, it has driven more some buying support on Wall Street. We think this recent rebound could sustain, at least over the near term and the Dow could retest the previous high along 26,952.

Source: Hong Leong Investment Bank Research - 19 Jun 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024