Pecca Group - A Record Year in the Making

HLInvest

Publish date: Fri, 21 Jun 2019, 10:11 AM

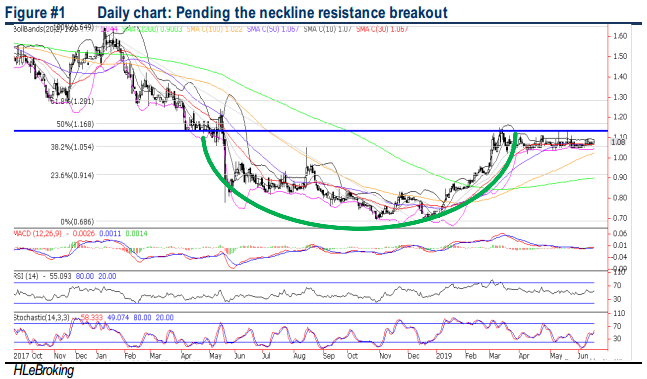

Pecca’s share prices rallied 47% YTD following a 65% surge in 9MFY19 earnings to RM13.8m, mainly attributed to higher sales volume and improved operational scale. HLIB maintains a BUY rating with a RM1.40 TP (+29.6% upside) based on 13x P/E on FY20 EPS, given its strong operational cash flow of RM17-25m per annum (FY19-21) with current net cash position of 51sen per share. Valuation is undemanding a 10.5x FY20E (35% lower than average 16.2x P/E since listed), supported attractive DY of 5.6-7.4% for FY19-21. Technically, the rounding bottom pattern signals potential long term downtrend reversal pattern, with upside targets at RM1.13-1.28 levels.

Decent earnings and net cash position. 9MFY19 earnings to RM13.8m, mainly attributed to higher sales volume (driven by higher Perodua demand) and improved operational scale. HLIB maintains a BUY rating with a RM1.40 TP (+29.6% upside) based on 13x P/E on FY20 EPS, given its strong operational cash flow of RM17-25m per annum (FY19-21) with current net cash position of RM94.0m (51sen/share).

Rounding bottom pattern signals potential cup and handle reversal pattern. The rounding bottom is a long-term reversal pattern, representing a long consolidation period that turns from a bearish bias to a bullish bias. After an extended sideways consolidation, PECCA is ripe for a neckline resistance breakout above RM1.13, supported by bottoming up indicators. A decisive close above RM1.13 will spur prices higher towards RM1.17 (50% FR) before reaching our LT objective at RM1.28 (61.8% FR). Key supports are situated at RM1.00-1.04. Cut loss at RM0.99.

Source: Hong Leong Investment Bank Research - 21 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024