Traders Brief - Await Trump-Xi Meeting at G20 Summit

HLInvest

Publish date: Fri, 28 Jun 2019, 09:40 AM

MARKET REVIEW

Led by gains in Hong Kong (+1.4%), Japan (+0.73%) and Shanghai (+0.69%) bourses, Asian markets ended higher as investors were boosted by the news from South China Morning Post that the US and China have “tentatively agreed” on a trade truce in the ongoing trade conflict ahead of the 28-29 June G20 summit in Japan. Earlier, Trump said a deal with President Xi was possible but that he was prepared to impose US tariffs on virtually all remaining Chinese imports if the two countries continue to disagree.

Bucking higher regional markets, KLCI eased 1.8 pts to 1672.7 due to last-minute selling in selected heavyweights e.g. PETGAS, TENAGA, MAYBANK, CIMB and PCHEM after trading within a tight range between intra-day high of 1676.7 and a low of 1670.7 as traders took a risk-averse mode ahead of the two-day G20 meeting. Market breadth was negative with 305 gainers as compared to 395 losers.

As investors eyed a scheduled President Trump-Xi meeting on 29 June for signs of progress in the long-running US-China trade spat, the Dow shed 10 pts after hovering within 26465-26607 levels. An agreement between Trump and Xi at the G-20 summit in Japan would avert the next round of tariffs on additional USD300bn worth of Chinese imports. Meanwhile, banks shares rose ahead of the Fed’s stress-test results release and after Fed officials tempered expectations for more aggressive monetary easing on Wednesday.

TECHNICAL OUTLOOK: KLCI

Following the 7% relief rally from 1572 (14 May) to 1682 (21 June), KLCI continued its profit taking pullback to end 1.8 pts lower at 1672.7, after oscillating between 1676.7 and low of 1670.7. Ahead of the G20 summit and US-Iran geopolitical uncertainties, KLCI is expected to engage in sideways consolidation amid weakening technical indicators. Resistanc e is pegged around 1682, 1687 (200D SMA) and 1700 psychological barrier while supports are near 1665 (10D SMA), 1655 (23.6% FR) and 1640 (38.2% FR) levels.

Bursa Malaysia should remain in consolidation mode given the lack of positive catalysts and a tepid performance on overnight Wall Street during the 28-29 June G20 summit. Meanwhile, on the final session in 1H19, window dressing activities on rotational index-linked stocks may give KLCI a boost. Resistance is pegged around 1687-1700 while supports are near 1655-1665 levels.

TECHNICAL OUTLOOK: DOW JONES

The Dow fell for the 3rd session amid uncertainty ahead of the G20 summit. The MACD Indicator has turned flattish, but still hovering above zero, while the Stochastic oscillator and RSI hooking down. Hence, we believe the Dow’s upside will be limited over the near term and the resistance is located around the all-time high at 26952 level. Meanwhile, support will be set along 26400 followed by 26100.

Wall Street struggled for direction throughout the session as market participants pondered whether a planned President Trump-Xi meeting at the G20 summit in Japan would yield any progress in the two country’s protracted tariff dispute. Overall, we expect the Dow to trend in range bound mode within 26100-26900 levels in the near term.

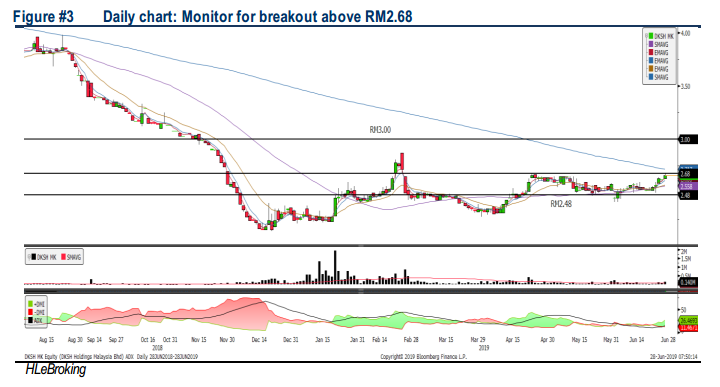

TECHNICAL TRACKER: DKSH

Synergies from Auric acquisition remains intact. Although we noticed share price have been trending sideways since the Auric acquisition, we think the synergies and efficiencies will be kicking in moving forward, which may reflect in bottom line and share prices. In addition, Auric’s distribution of chilled and frozen products and food services in Malaysia has been averagely garnering profit margins of c.7% compared to DKSH’s 1-2%, while we believe its in house butter and margarine brands SCS and Buttercup could contribute positively to the 2Q19 results on the back of higher sales during Hari Raya period. Technically, DKSH could trend higher as ADX has been suggesting that the momentum is picking. LT target price will be located around RM3.00, while cut loss is set around RM2.48.

Source: Hong Leong Investment Bank Research - 28 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-16

PCHEM2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

PCHEM2024-11-15

PETGAS2024-11-15

PETGAS2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-14

MAYBANK2024-11-14

MAYBANK2024-11-14

PCHEM2024-11-14

PETGAS2024-11-14

PETGAS2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

PCHEM2024-11-13

PETGAS2024-11-13

PETGAS2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-12

CIMB2024-11-12

CIMB2024-11-12

CIMB2024-11-12

MAYBANK2024-11-12

MAYBANK2024-11-12

MAYBANK2024-11-12

PCHEM2024-11-12

PETGAS2024-11-12

PETGAS2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-11

CIMB2024-11-11

CIMB2024-11-11

CIMB2024-11-11

MAYBANK2024-11-11

MAYBANK2024-11-11

PCHEM2024-11-11

PCHEM2024-11-11

PCHEM2024-11-11

PCHEM2024-11-11

PETGAS2024-11-11

PETGAS2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TENAGA2024-11-08

CIMB2024-11-08

CIMB2024-11-08

CIMB2024-11-08

MAYBANK2024-11-08

PCHEM2024-11-08

PETGAS2024-11-08

PETGAS2024-11-08

TENAGA2024-11-08

TENAGA2024-11-07

CIMB2024-11-07

CIMB2024-11-07

CIMB2024-11-07

CIMB2024-11-07

MAYBANK2024-11-07

PETGAS2024-11-07

PETGAS2024-11-07

TENAGA2024-11-07

TENAGA2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

MAYBANK2024-11-06

MAYBANK2024-11-06

MAYBANK2024-11-06

PCHEM2024-11-06

PCHEM2024-11-06

PCHEM2024-11-06

PCHEM2024-11-06

PETGAS2024-11-06

PETGAS2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TENAGA2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

PETGAS2024-11-05

PETGAS2024-11-05

TENAGA2024-11-05

TENAGA