Traders Brief - Market May Stay Tepid Awaiting Fresh Catalyst

HLInvest

Publish date: Mon, 08 Jul 2019, 09:37 AM

MARKET REVIEW

Still, Asia’s stock market ended on a mixed note as investors were waiting for more economic data, which may provide more clues on the interest rate outlook in the upcoming July FOMC meeting by the Fed. The Shanghai Composite Index and Nikkei 225 rose 0.19% and 0.20%, respectively, but Hang Seng Index slipped 0.07%.

Meanwhile, the FBM KLCI lost 0.29% to 1,682.53 pts and market breadth was negative; there were 4 decliners for every 3 advancers in the broader market. Market traded volumes stood at 2.58bn, worth RM1.83bn. Nevertheless, selected consumer related stocks such as Power Root and Hai-O were traded actively higher.

Despite the stronger-than-expected jobs data, where the US economy has added 224k jobs in June (vs. consensus forecast of 165k), Wall Street declined as strong jobs data has dampened the expectations of a Fed rate cut. The Dow and S&P500 fell 0.16% and 0.18%, respectively, while Nasdaq slipped 0.10%.

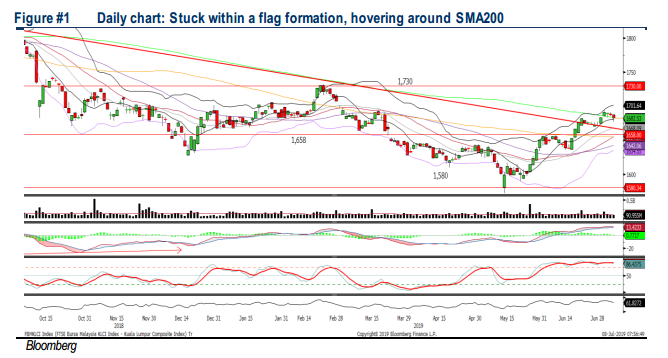

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has pulled back after staying above the SMA200 last week and formed a flag formation, the MACD Histogram has started to turn weaker last Friday, while both the RSI and Stochastic oscillators are trending mildly lower after hovering in the overbought region. The resistance will be located around 1,700, while support will be set along 1,666.

On the local bourse, we expect further consolidation on the broader market, tracking the negative Wall Street performance last Friday. With the slight recovering Brent oil prices, O&G segment is likely to trade actively this coming session. Nevertheless, without any fresh positive catalyst, we opine that the FBM KLCI could stay in a range bound mode between the 1,666- 1,700 level this week.

TECHNICAL OUTLOOK: DOW JONES

The Dow pulled back marginally last Friday after hitting an all-time-high on Wednesday. The MACD indicator is still trending above zero; while both the RSI and Stochastic oscillators are overbought. We believe that the upside could be limited on the Dow with the resistance located around 27,000-27,500. Meanwhile, support will be set along 26,500.

Now the market participants are pricing in strong jobs data, softer expectations of an interest rate cut by the Fed moving forward, Wall Street may be taking a short breather in the near term. Meanwhile, investors may be shifting their focus on the trade developments between the US and China to reaffirm their trading decisions.

Source: Hong Leong Investment Bank Research - 8 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024