Traders brief - Lack of Fresh Impetus, Market Stay Sideways

HLInvest

Publish date: Wed, 10 Jul 2019, 04:53 PM

MARKET REVIEW

Asia’s stock markets ended mostly lower, tracking the negative performance on Wall Street. In addition, some of the Apple’s suppliers in Taiwan and Japan trended lower after Apple declined more than 2% in the previous session. The Hang Seng Index and Shanghai Composite declined 0.76% and 0.18%, respectively, but Nikkei 225 rose 0.14%.

Bucking the regional trend, the FBM KLCI closed marginally higher by 0.31% to 1,682.87 pts. Market breadth was fairly neutral with 401 advancers as compared to 402 decliners. Market traded volume stood at 2.41bn, worth RM1.72bn. Meanwhile, we noticed selected technology stocks such as Dufu and D&O were traded actively higher.

Wall Street trended mixed as investors were trading cautiously prior to the two-day testimony of the Fed’s chief before Congress to gauge the interest rate outlook in this upcoming July FOMC meeting. The S&P500 and Nasdaq added 0.12% and 0.54%, respectively, but the Dow slid 0.08%.

TECHNICAL OUTLOOK: KLCI

The KLCI snapped the 4-day losing streak and ended higher for the session. The MACD indicator is still falling over the past few trading days, while both the RSI and Stochastic oscillators are trending lower. Hence, with the negative technical readings, we believe the KLCI’s upside is likely to be limited around 1,700, while support is located at 1,666.

The lacklustre trading tone from the overnight Wall Street may extend towards stocks on the local front amid lacking of near term fresh leads. At this juncture, traders are watching closely on the interest rate path in the FOMC meeting and potential trade war news flow that may surface following the resumption of trade talks between the US and China after G20 summit. The KLCI could range bound between the 1,666-1,700 levels in the near term.

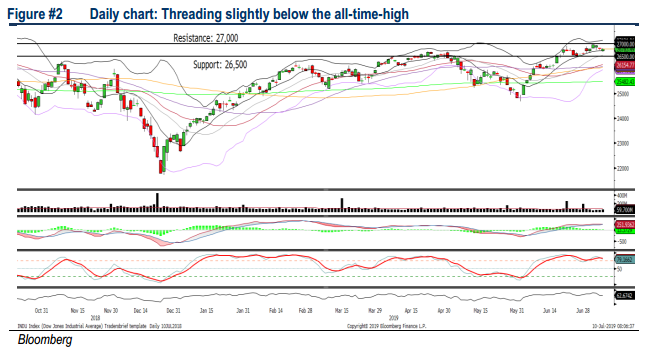

TECHNICAL OUTLOOK: DOW JONES

The Dow declined for the third consecutive day, forming a flag formation after hitting the peak last week. The MACD indicator (MACD Line and Histogram) continues to trend lower, while both the RSI and Stochastic oscillators are heading south after threading in the overbought region last week. The Dow’s resistance will be located around 27,000, while support is set along 26,500.

Aside from the Fed’s testimony to get some clues on the interest rate path moving forward, investors may look out for news related to the trade war as the top US trade officials have spoken to Chinese officials to continue negotiations in order to resolve the outstanding trade disputes and US officials commented that “both sides will continues these talks as appropriate”. Without any strong impetus in the market, we believe the trading tone could stay tepid over the near term with the Dow drifting sideways between 26,500-27,000 levels.

Source: Hong Leong Investment Bank Research - 10 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024