Traders Brief - KLCI May Trend Higher, But Upside Capped at 1,700

HLInvest

Publish date: Thu, 11 Jul 2019, 08:55 AM

MARKET REVIEW

Asia’s stock markets still ended mixed as investors were taking a sidelines approach prior to the scheduled testimony by the US Federal Reserve chairman in front of the House Financial Services Committee on Wednesday, looking out for clues on the upcoming interest rate path. The Shanghai Composite Index and Nikkei 225 fell 0.44% and 0.15%, respectively, while Hang Seng Index added 0.31%.

Meanwhile, the FBM KLCI slipped 0.23% to 1,678.97 pts. Market breadth was negative with decliners ahead of the advancers by a ratio of 4-to-3. Market traded volume stood at 2.24bn, worth RM2.02bn. Although broader market were seeing some profit taking activities, we noticed selected technology-related stocks such as DUFU, KESM and JCY trended higher for the session.

Wall Street closed higher following the testimony from Federal Reserve chairman Jerome Powell stating that the business environment across the US have slowed “notably” recently and concerns over the economic outlook still persist, signalling a potential support for easier monetary policy in the US moving forward. The Dow rose 0.29%, while S&P500 added 0.45%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has been flirting along the SMA200 over the past 7 trading days. With the potential emergence of buying interest today, the KLCI may surpass the SMA200. The MACD indicator however is trending lower after the negative crossover signal on Monday, while both the RSI and Stochastic oscillators are pointing downwards. Hence, we anticipate the upside might be limited around 1,700, support will be located around 1,666.

In view of the positive overnight Wall Street performance, we believe the buying interest could extend towards stocks on our local bourse. Investors may look out for stocks within the theme related to higher yielding stocks on the back of an interest rate down cycle environment. In addition, traders may monitor stocks within the O&G space as the Brent oil prices jumped 4.4% overnight.

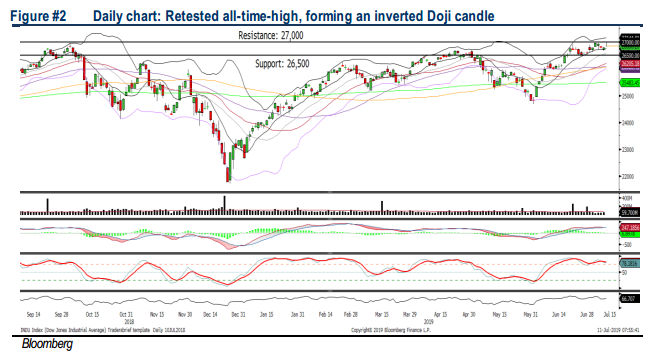

TECHNICAL OUTLOOK: DOW JONES

Despite the Dow trending higher, it retested the recent high of 26,983, forming an inverted Doji candle. The MACD indicator has flashed a negative crossover, but both the RSI and Stochastic oscillators are trending above 50. With the mixed technical readings, we believe the Dow’s upside may be capped along 27,000, while support will be set around 26,500.

On Wall Street, we expect the short term trading tone to stay positive, pricing in the easier monetary policy moving forward. At the same time, investors will need to monitor closely on the trade developments between the US and China after the resumption in trade talks. Should there be any negative surprises, further upside might be capped.

Source: Hong Leong Investment Bank Research - 11 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024