Traders Brief - Spill Over Buying Support May Lift KLCI

HLInvest

Publish date: Fri, 12 Jul 2019, 03:38 PM

MARKET REVIEW

With Wall Street (S&P500 briefly traded above 3,000 for the first time) ending on a positive note overnight, Asia’s stock markets followed suit to trade higher as investors digested a potential interest rate cut moving forward following the testimony by Fed’s chief Jerome Powell. The Hang Seng Index and Nikkei 225 added 0.81% and 0.51%, respectively, while Shanghai Composite Index inched higher by 0.08%.

Meanwhile, the KLCI closed in the positive territory region on the back of a last minute buying support; the key index rose 0.02% to 1,679.26 pts. Market breadth was positive with 501 gainers as compared to 329 decliners, accompanied by 3.18bn stocks traded, worth RM2.12bn for the session. Also, we noticed technology and O&G stocks trended positively for the session; the latter gained traction after a rally observed in crude oil prices.

Wall Street ended positively as Federal Reserve Chair Jerome Powell reiterated the similar view on the concerns over the strength of the global economy and the US economic outlook on Thursday and market is expecting a rate cut in the upcoming FOMC meeting. The Dow surged above 27,000 for the first time, while S&P500 added 0.23%.

TECHNICAL OUTLOOK: KLCI

Still, the FBM KLCI is hovering nearby the SMA200, the MACD indicator suggests that the key index may trend sideways for now. The RSI and Stochastic oscillators are trending around the 50 level. However, should the KLCI breach above 1,690, buying support could lift the index towards 1,700. Meanwhile, support will be located around 1,666, followed by 1,650.

On the local bourse, we expect buying interest to sustain given the positive Wall Street performance overnight. Also, the traders may lookout for technology-related stocks as volumes have picked up strongly in the past few days and O&G-related counters on the back of the recent rally in crude oil prices. The KLCI may retest 1,700 over the near term.

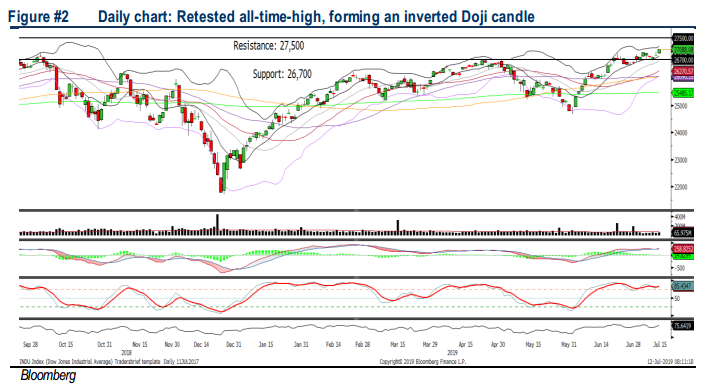

TECHNICAL OUTLOOK: DOW JONES

For the first time, the Dow has surged and closed above the 27,000 level and uptrend is intact. The MACD indicator has reversed higher, while both the RSI and Stochastic oscillators are still trending above 50. Resistance is now pegged around 27,500, while support is pegged around 26,700.

In the US market may continue to stay afloat with the investors pricing in a higher chance of the Federal Reserve to reduce the interest rate in the upcoming FOMC meeting. Hence, the Dow may be supported above 27,000. However, should any negative surprises in the trade developments between the US and China, it may cap the upside potential of the marke

Source: Hong Leong Investment Bank Research - 12 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024