Traders Brief - Still in the Pullback Mode, Support at 1,658

HLInvest

Publish date: Wed, 17 Jul 2019, 04:52 PM

MARKET REVIEW

Asia’s stock markets ended mixed as minutes from the Reserve Bank of Australia’s monetary policy meeting in July showed that the central bank was ready to adjust interest rates if required. The Shanghai Composite Index and Nikkei 225 declined 0.18% and 0.69%, respectively but Hang Seng Index added 0.23%.

On our local front, the FBM KLCI traded lower for the session led by Petronas Chemical, Tenaga and DIGI; the key index dropped 0.21% to 1,668.94 pts. Market sentiment was negative with 450 decliners vs. 407 gainers, accompanied by 3.32bn, worth RM2.09bn. We noticed O&G companies such as KNM, Velesto and Reach Energy were traded actively higher.

Wall Street slipped from record highs after President Trump briefly commented to the reporters that both US and China have a “long way to go” on trade. In addition, President Trump reiterated that the US can slap tariffs on an additional USD325bn worth of Chinese goods “if US wants”. These statements kept the upside capped for the session and the Dow and S&P500 declined 0.09% and 0.34%, respectively, while Nasdaq fell 0.43%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continues to hover within the flag formation, staying below the SMA200 (1,681). The MACD Line extended lower, but still above zero. Meanwhile, both the RSI and Stochastic oscillators trended below 50; suggesting that the near term upside could be limited. Resistance is pegged around 1,700, while support is located around 1,658.

Given the subdued sentiment on Wall Street amid the protracted trade war, we think the FBM KLCI may stay within the retracement phase over the near term, with the upside being capped along 1,700. However, we anticipate trading activities within O&G stocks to remain robust on the back of volatile oil prices.

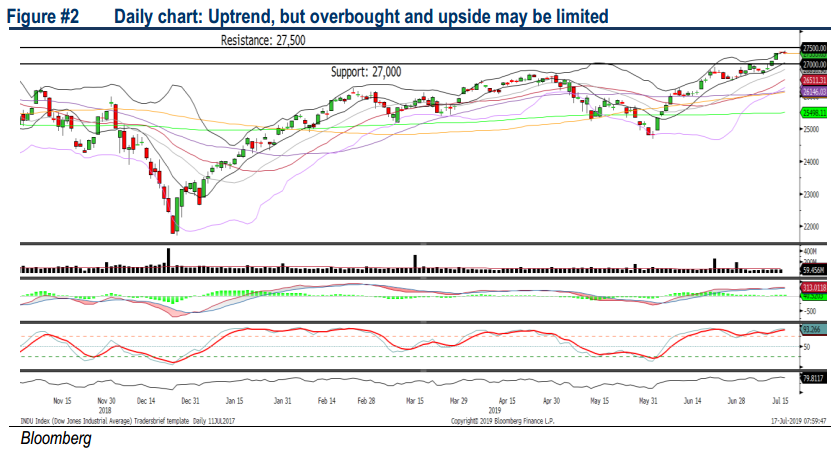

TECHNICAL OUTLOOK: DOW JONES

After marking several new highs on the Dow, the MACD indicator continues to stay above zero. However, we believe the near term upside could be limited, given the momentum oscillators are indicating that the Dow is overbought. Resistance will be envisaged around 27,300-27,500, support will be set around 26,500-27,000.

On Wall Street, trading sentiment is likely to be affected by the uncertain trade progress following President Trump’s statements. In addition, investors will be monitoring closely on the upcoming FOMC meeting to form their investment thesis moving forward based on the interest rates outlook guidance. Hence, we opine that the Dow will stay neutral ahead of the meeting.

TECHNICAL OUTLOOK: CLOSED POSITION

We Had Squared Off Our Technical Tracker-SUPERLON (5.1% Loss) on 16 July.

Source: Hong Leong Investment Bank Research - 17 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024