Traders Brief - Extended Consolidation After Falling Below the LT Downtrend Line Support

HLInvest

Publish date: Fri, 19 Jul 2019, 09:05 AM

MARKET REVIEW

Led by losses in NIKKEI (2%), SHCOMP (1%) and HANG SENG (0.7%), Asia’s markets ended lower as investors prepared for tepid results from the ongoing earnings season, as weak corporate earnings trends in the US underscored the impact of the trade standoff between Beijing and Washington and uncertainty over economic prospects. However, Indonesian JCI advanced on bets of dovish action from their central banks (benchmark rates reduced 0.25% to 5.75%).

Meanwhile, KLCI slipped 8.6 pts at 1648.9 to register its 3rd straight losses in tandem with the subdued ASEAN peers as renewed US-China trade concerns weighed on risk sentiment in the region. The WSJ reported that the trade talks between the US-China had halted awaiting Washington deciding how much trading leeway it would provide Huawei. Trading volume decreased to 2.83bn shares worth RM1.84bn as compared to Wednesday’s 3.83bn shares worth RM1.97bn. Market breadth was negative with 270 gainers as compared to 575 losers.

The Dow skidded as much as 151 pts to 27069 owing to a mixed bag of corporate earnings (eg Morgan Stanley, IBM, Netflix, United Health etc) and falling WTI prices on expectation that crude output would rise in the Gulf of Mexico following last week’s hurricane in the region. Nevertheless, the index rebounded sharply to end 3 pts higher at 27223 after New York Fed President John Williams said the central bank’s wisest strategy is to cut interest rates at the first sign of economic distress when interest rates are already low and it is better to take preventative measures than to wait for disaster to unfold.

TECHNICAL OUTLOOK: KLCI

Following the 7.8% relief rally from 1572 (14 May) to 1694 (2 July), KLCI continued its healthy profit taking pullback to end 8.6 pts lower at 1648.9, sliding below the 200D SMA (now at 1677) and marginally lower than the LT downtrend line support of 1650. Given the bearish MACD dead cross and the sliding RSI indicators, KLCI is expected to consolidate further towards 1633 (50% FR) and 1619 (38.2% FR) territory before staging a technical rebound targeting at 1677, 1694 and 1700 barriers.

Given the uncertain Wall Street performance, KLCI is likely to continue its healthy pullback consolidation below the SMA200. Moreover, the unresolved trade tensions, coupled with the slump in crude oil prices may put pressure amongst broader market on the local front. The FBM KLCI may trade within the range of 1630-1680.

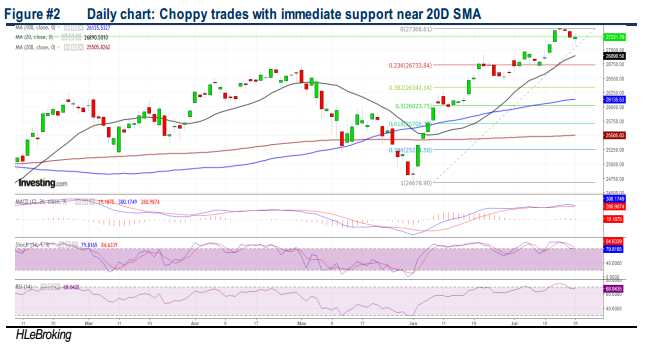

TECHNICAL OUTLOOK: DOW JONES

Due to overbought positions, the Dow has been making a healthy pullback after hitting all-time high of 27398 (15 July). As long as the index is not falling below the 20D SMA or 26890 support. However, the upside is likely to be capped at this juncture after forming several small bodies candle and the MACD indicator is declining. Meanwhile, both the RSI and Stochastic oscillators are turning sideways after threading along the overbought region recently. The resistance is pegged around 27500 while support will be set around 27000, followed by 26800.

In the near term, all eyes are still on the updates from the US-China trade war talks as US Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer will talk with Chinese counterparts today but cautioned that “complicated issues” remain. Meanwhile, the estimates for the ongoing 2Q19 results season remains negative, with analysts expect the S&P 500 earnings to fall by 1% (from -2.9% before the reporting season starts). Nevertheless, market undertone is firm in anticipation of a minimum 25 bps cut during the 30-31 July FOMC meeting. We see the Dow to continue to trend at range bound mode within 26800-27400 zones.

Source: Hong Leong Investment Bank Research - 19 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024