Traders Brief - KLCI to Trend Higher, Taking Cues From Wall Street

HLInvest

Publish date: Tue, 23 Jul 2019, 09:24 AM

MARKET REVIEW

Key regional benchmark indices ended on a lower note, tracking the negative performances on Wall Street after the flip-flop statements from Fed’s officials; the Shanghai Composite Index and Hang Seng Index declined 1.27% and 1.37%, respectively, while Nasdaq slipped 0.23%. However, the STAR market (NASDAQ-style tech board for home-grown technology firms) started trading in Shanghai on Monday, with most of the stocks trading higher in their debut.

Similarly, the FBM KLCI closed in the negative territory, in tandem with the negative regional sentiment; the KLCI dropped 0.17% to 1,655.40 pts. Market breadth was negative with losers leading gainers by a ratio of 5-to-3, accompanied by 2.65bn shares traded for the session, valued at RM1.54bn. Nevertheless, we noticed front runners for the multi-billion immigration project such as HTPADU, SCICOM and IRIS traded actively higher.

Wall Street managed to end the session with some gains as traders were looking forward to corporate results that will be releasing by major tech companies such as Amazon and Facebook. Also, President Trump tweeted that the Fed should cut “deeper” in its upcoming July FOMC meeting. The S&P500 and Nasdaq gained 0.28% and 0.71%, respectively, while the Dow rose marginally by 0.07%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has retracted from the recent peak of 1,695 and stabilised around 1,647 level over the past three trading days. Also, the MACD Line has turned flat around the zero level, with the MACD Histogram recovering over the past two days. Meanwhile, both the RSI and Stochastic oscillators are oversold. Hence, we believe the KLCI could be due for a technical rebound. Resistance is pegged around 1,666, followed by 1,680, while support is located around 1,630-1,647.

On our local front, we believe the sentiment is likely to turn positive with the already-oversold FBM KLCI as well as taking cues from the overnight performance on Wall Street; the key index could perform a technical rebound to retest 1,680 in the near term. Also, we think O&G stocks may trade actively higher given the surge in crude oil prices yesterday.

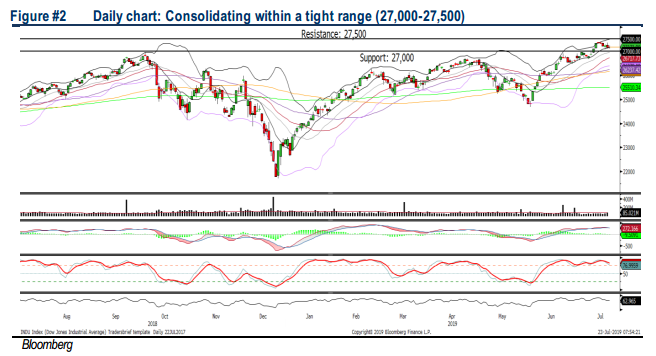

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trend within the flag formation. Meanwhile, the MACD indicator has issued a “sell signal”, with the MACD Line crossing below the Signal Line. However, both the RSI and Stochastic oscillators are still hovering above 50. Hence, we think with the mixed technical readings, the Dow’s upside could be limited around 27,400-27,500, while support is anchored around 26,500-27,000.

In the US, investors will be looking out for further strengthening or declining tone within the ongoing US corporate reporting season. Meanwhile, we expect that traders may take the opportunity to trade higher with President Trump’s tweet, commenting that the Fed should cut “deeper” in its upcoming FOMC meeting. However, should any negative surprises resurface on the trade front, it could limit the upside potential.

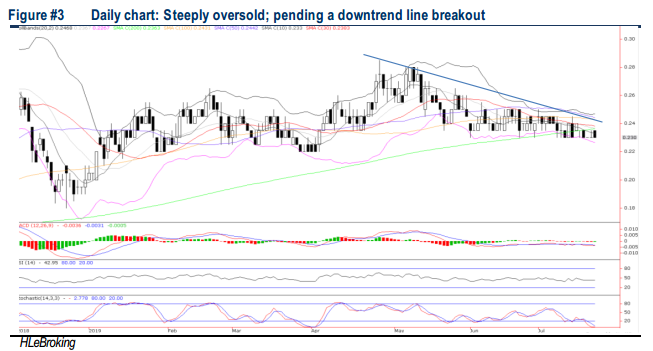

TECHNICAL TRACKER: K1

Diversification and solid net cash to thrive in rocky times. Management anticipates strong turnaround amid diversification into a more balanced product portfolio with the IoT, healthcare/medical and automotive markets, contributing improved margins and longer term stability due to longer product life cycles. Moreover, K1 is expected to capture higher loading from current clients as well as new products by new clients (benefiting from the US-China trade impasse). At RM0.23, the stock is trading at undemanding 16.8x FY19E P/E (36% lower than its peers), supported by a solid 51% EPS FY18-20 CAGR and net cash of RM51m or RM0.07/share, which will be useful for the anticipated impending sales growth and future acquisition of synergistic technology-based and the Industry 4.0 ecosystem businesses. Technically, the long term bullish rounding bottom formation is expected to drive K1 higher towards RM0.24-0.285 in the mid-to long term.

Source: Hong Leong Investment Bank Research - 23 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024