Traders Brief - KLCI to Trend Higher, Taking Cues From Wall Street

HLInvest

Publish date: Wed, 24 Jul 2019, 09:47 AM

MARKET REVIEW

Stocks markets in Asia ended mostly higher, in-line with sentiment on Wall Street overnight. Also, trading tone was more positive ahead of the widely anticipated FOMC meeting, where consensus (Bloomberg: 82.5% is anticipating 25 basis points cut, while 17.5% is looking for a 50 basis points reduction) is expecting an interest rate cut. The Shanghai Composite Index and Hang Seng Index rose 0.45% and 0.34%, respectively, while Nikkei 225 added 0.95%.

Meanwhile, FBM KLCI ended marginally higher after fluctuating around the positive and negative territories throughout the session; the FBM KLCI closed at 1,655.67 pts (+0.02%). Market breadth was positive with 462 advancers vs. 359 decliners, accompanied by 2.77bn, valued at RM2.02bn. We also noticed selected O&G and technology stocks topping the gainers list.

Wall Street gained momentum throughout the session as trade-related news resurfaced, stating that trade discussions between the US and China will have a face-to-face session next week where the US delegation will be led by Trade Representative Robert Lighthizer and will be in China by Wednesday. In addition, strong set of results were announced by Coca Cola and United Technologies, which have lifted the overall trading sentiment on Wall Street. The Dow and S&p500 advanced 0.65% and 0.68%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continues to trend sideways within a tiny range between 1,647-1,658 levels over the past four trading days. The MACD Line has crossed below zero, while the MACD Histogram continues to weaken further over the past few sessions. However, the Stochastic oscillator is oversold; hence we believe the FBM KLCI could be due for a technical rebound, potentially retesting the 1,680 level over the near term. Support will be set around 1,630-1,647.

Taking cues from the US as well as positive trade-related news flow that both the US and China will be resuming trade talks, we expect buying interest to pick up on the local front and could lift the KLCI higher to potentially retest the 1,680 level. At the same time, traders will be looking out for trading opportunities within the technology sector as volumes were picking up strongly over the weeks.

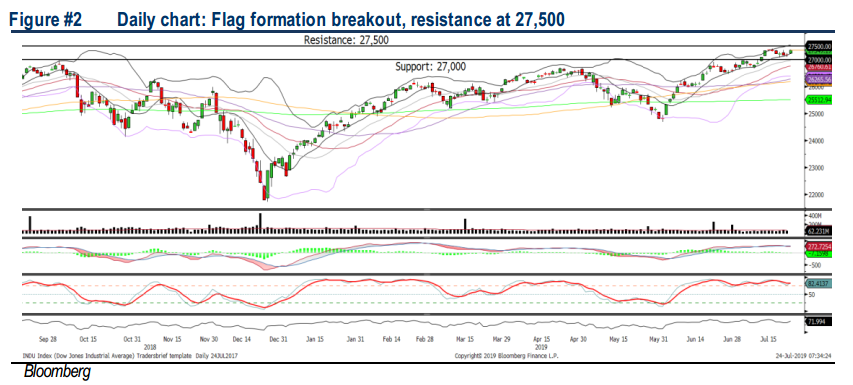

TECHNICAL OUTLOOK: DOW JONES

The Dow has experienced a flag formation breakout yesterday and the MACD Line is hovering above zero. However, both the RSI and Stochastic oscillators are hovering within the overbought region; suggesting that the upside could be limited. Nevertheless, should the key index surge above 27,500, next resistance will be at 27,800-28,000. Support will be anchored around 27,000

We believe the ongoing reporting season in the US is likely to provide sustainable upward momentum for Wall Street; given several Dow Jones members have registered better-than expected results. In addition, the resumption of trade talks between US and China may provide some optimism towards trading sentiment, at least in the near term.

TECHNICAL TRACKER: PESONA

Strong RM2bn order book and decent concession income. Despite the sluggish construction sector news flow post-GE14, PESONA bucked the sluggish trend by securing sizeable new jobs amounted to c.RM920m in the past 12 months, bringing the outstanding order book to RM2.0bn as of end-March 2019. Following the 33% correction from 52-week high of RM0.365 to RM0.245 yesterday, PESONA provides a positive risk-reward profile at 7.8x FY19E P/E (24% lower against peers) with 4.1% dividend yield, underpinned by a healthy outstanding order book of RM2.0bn (a 3.6x cover on FY18 construction revenue and provided earnings visibility until 2021) and a stable recurring concession income for UNIMAP (until 2035). Technically, the stock is poised to retest RM0.265-0.30 zones following the bullish triangle breakout.

Source: Hong Leong Investment Bank Research - 24 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024