Traders Brief - Eyeing on FOMC Meeting and US-China Trade Talks

HLInvest

Publish date: Fri, 26 Jul 2019, 09:04 AM

MARKET REVIEW

Lifted by semiconductor stocks following record close on Nasdaq overnight and dovish comments by The Reserve Bank of Australia Governor Philip Lowe coupled with expectations of more dovish policy guidance by ECB meeting in the evening, Asian markets were mostly higher. Sentiment was also bolstered by news that Washington and Beijing will restart face-to face talks next week in Shanghai.

Tracking higher peers in ASEAN markets, KLCI climbed 4.2 pts to end at intraday high of 1656.6 during the final minutes active buying on index-linked stocks such as PCHEM, PMETAL, MAXIS, IOI and SIMEPLNT. However, market breadth was negative as losers 500 thumped gainers 301, accompanied by lower volume of 2.76bn shares valued at RM2.00bn as compared to Wednesday’s 3.22bn shares worth RM2.29bn.

Wall Street fell from record closings as the Dow lost 129 pts to 27141 after ECB’s chief Mario Draghi’s comments disappointed investors hoping for a more dovish monetary policy stance as there was not a significant risk of a recession in the region, raising fears that the Fed would not be as aggressive in its easing measures when it meets on 30-31 July. Sentiment was also dampened by downbeat earnings and forecasts from Tesla, Ford and Facebook.

TECHNICAL OUTLOOK: KLCI

After a tight range bound pattern in the last 4 trading sessions within 1647-1660, KLCI staged a 4.2-pt technical bounce to 1656.6, comfortably above the LT downtrend line support near 1648. We think the KLCI may still undergo an extended consolidation unless it is able to convincingly stage a successful breakout above key resistances at 1665 (50% FR) and the 200D SMA (now at 1674) zones. On the flip side, should the index break below 1648, the outlook could turn bearish and KLCI could slip further towards 1633 (50% FR) territory.

Given the weak Wall Street and European markets overnight as well as ahead of the two major events next week focusing on the resumption of trade talks in Shanghai and FOMC meeting (30-31 July), sentiment on the broader market could turn more cautious. Technically, we see an extended sideways pattern near the LT down trendline support of 1648, with key barriers near 1675-1674 levels.

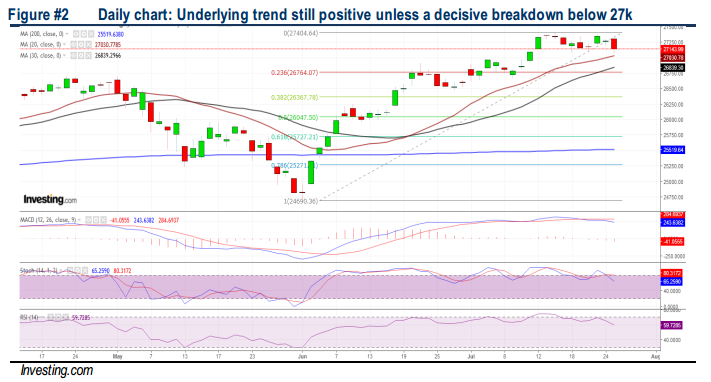

TECHNICAL OUTLOOK: DOW JONES

The Dow’s underlying trend still remains firm as long as the index is able to stay above the 20D SMA and 30D SMA levels, with major resistance at all-time high of 27398 (15 July), followed by 27500-27800 zones. On the flip side, a decisive break down below 27000 will trigger more selloff towards 26400-26800 levels.

In the near term, all eyes remain focus on the ongoing reporting season and the resumption of US-China trade negotiations next week coupled with the crucial 30-31 July FOMC meeting. While most companies are beating revised-down estimates, the tone and substance of management commentary is on the cautious side, with uncertainty about global trade as notable headwind. We opine that the Dow to range bound within 26800-27400 zones.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our technical tracker positions on DKSH (2.0% return amid expiry) and DESTINI (0.0% return amid weakening technical).

Source: Hong Leong Investment Bank Research - 26 Jul 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024