Traders Brief - Market Sentiment to Stay Tepid Over Near Term

HLInvest

Publish date: Wed, 31 Jul 2019, 10:58 AM

MARKET REVIEW

Asia’s stock markets ended mildly higher ahead of the US-China trade discussion, which is happening in Shanghai this week as well as prior to the FOMC meeting outcome. Shanghai Composite Index and Hang Seng Index rose 0.39% and 0.14%, respectively. Meanwhile, Bank of Japan kept its monetary policy unchanged, but commented in its statement that it “will not hesitate to take additional easing measures” if the economy slows down; the Nikkei 225 added 0.43%.

On Monday, the FBM KLCI ended on a negative tone amid the resumption US trade talks as well as ahead of the FOMC meeting. Market breadth was also negative with 586 decliners, outpacing 298 advancers for the session. Market traded volumes stood at 2.64bn, worth RM1.72bn. Nevertheless, we noticed selected stocks such as Airasia, Ekovest and Green Packet traded actively higher. The local stock exchange was closed for a national holiday on Tuesday.

Wall Street closed lower following renewed statements from President Trump, stating that China is not keeping its promise to buy more agricultural products from the US. Also, traders are waiting for any new developments after US trade delegation has flew in to China on Monday as well as the monetary policies decision in the upcoming FOMC meeting. The Dow and S&P500 fell 0.09% and 0.26%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI extended its pullback phase and flirted around the downward trendline on Monday. The MACD Line expanded negatively over the past 5 trading days, while the Histogram is still weakening on Monday. The RSI and Stochastic, however are suggesting that the FBM KLCI could be oversold and could be due for a technical rebound. Resistance is set around 1,650-1,666, while support is located around 1,635, followed by 1,610.

On the local front, we expect the trading tone to remain tepid throughout the trade discussion between the US and China until there is a clearer picture on the trade deal. Meanwhile, traders may stay cautious prior to the FOMC meeting outcome as well. Thus, the FBM KLCI could trade within a range between 1,635-1,650 for the session.

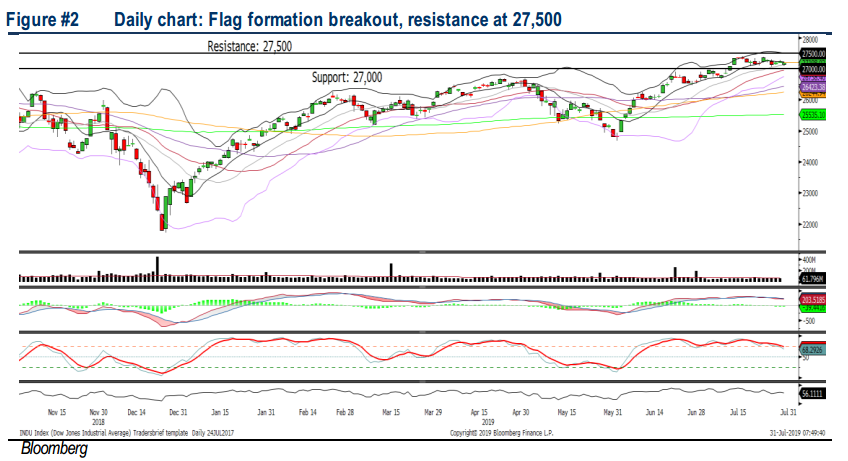

TECHNICAL OUTLOOK: DOW JONES

The Dow trended sideways between the 27,000-27,400 region over the past 3 weeks. The MACD indicator is trending lower but above zero; suggesting that the Dow could be taking a healthy breather. Meanwhile, both the RSI and Stochastic oscillators have been weakening (but above 50) over the past two weeks. Hence, with the negative technical readings, we expect the Dow’s upside to be capped over the near term around 27,400, while support is set around 27,000.

In the US, all eyes will be on the resumption of trade talks as the US trade delegation is in China at this juncture. In addition, market sentiment is likely to stay cautious ahead of the interest rate decision and the statements from the Federal Reserve. The Dow could trend around 27,000-27,400.

Source: Hong Leong Investment Bank Research - 31 Jul 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024